SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,800 of these meals using 1,400 direct labor-hours. The company paid its direct labor workers a total of $18,200 for this work, or $13.00 per hour. According to the standard cost card for this meal, it should require 0.30 direct labor-hours at a cost of $12.50 per hour. Required: What is the standard labor-hours allowed (SH) to prepare 4,800 meals? What is the standard labor cost allowed (SH × SR) to prepare 4,800 meals? What is the labor spending variance? What is the labor rate variance and the labor efficiency variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.

SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,800 of these meals using 1,400 direct labor-hours. The company paid its direct labor workers a total of $18,200 for this work, or $13.00 per hour. According to the standard cost card for this meal, it should require 0.30 direct labor-hours at a cost of $12.50 per hour. Required: What is the standard labor-hours allowed (SH) to prepare 4,800 meals? What is the standard labor cost allowed (SH × SR) to prepare 4,800 meals? What is the labor spending variance? What is the labor rate variance and the labor efficiency variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 5DQ: A. What are the two variances between the actual cost and the standard cost for direct labor? B. Who...

Related questions

Question

SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,800 of these meals using 1,400 direct labor-hours. The company paid its direct labor workers a total of $18,200 for this work, or $13.00 per hour.

According to the

Required:

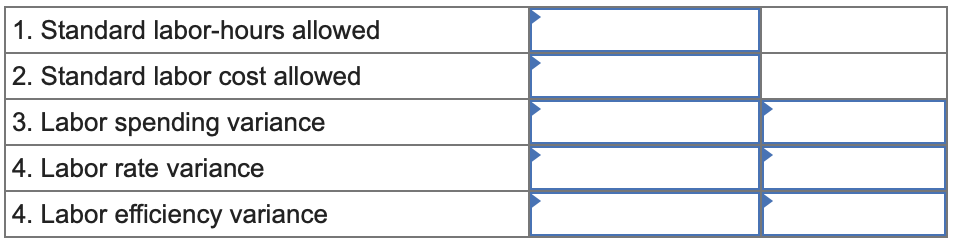

- What is the standard labor-hours allowed (SH) to prepare 4,800 meals?

- What is the standard labor cost allowed (SH × SR) to prepare 4,800 meals?

- What is the labor spending variance?

- What is the labor rate variance and the labor efficiency variance?

Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.

Transcribed Image Text:1. Standard labor-hours allowed

2. Standard labor cost allowed

3. Labor spending variance

4. Labor rate variance

4. Labor efficiency variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction

VIEWStep 2: the Standard labor-hours allowed is as follows-

VIEWStep 3: The Standard labor cost allowed is as follows-

VIEWStep 4: The Labor spending variance is as follows-

VIEWStep 5: Labor rate variance is as follows-

VIEWStep 6: The Labor efficiency variance is as follows-

VIEWSolution

VIEWStep by step

Solved in 7 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning