Smpany business rules. You will create a master budget for Williams Company, including their cash budget and the proforma financial statements.

Smpany business rules. You will create a master budget for Williams Company, including their cash budget and the proforma financial statements.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter22: Budgeting

Section: Chapter Questions

Problem 5TIF: Static budget for a service company A hank manager of City Savings Rank Inc, uses the managerial...

Related questions

Question

The problem is listed in the two images. Please help

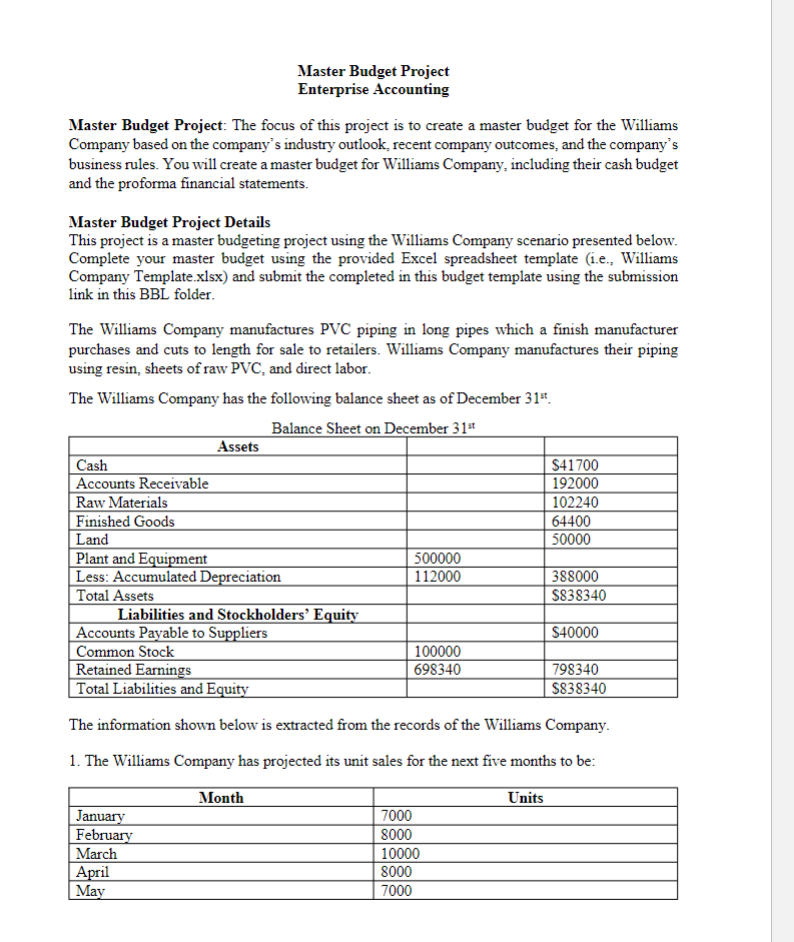

Transcribed Image Text:Master Budget Project

Enterprise Accounting

Master Budget Project: The focus of this project is to create a master budget for the Williams

Company based on the company's industry outlook, recent company outcomes, and the company's

business rules. You will create a master budget for Williams Company, including their cash budget

and the proforma financial statements.

Master Budget Project Details

This project is a master budgeting project using the Williams Company scenario presented below.

Complete your master budget using the provided Excel spreadsheet template (i.e., Williams

Company Template.xlsx) and submit the completed in this budget template using the submission

link in this BBL folder.

The Williams Company manufactures PVC piping in long pipes which a finish manufacturer

purchases and cuts to length for sale to retailers. Williams Company manufactures their piping

using resin, sheets of raw PVC, and direct labor.

The Williams Company has the following balance sheet as of December 31*.

Balance Sheet on December 31

Assets

Cash

$41700

Accounts Receivable

Raw Materials

Finished Goods

Land

Plant and Equipment

Less: Accumulated Depreciation

Total Assets

Liabilities and Stockholders’ Equity

Accounts Payable to Suppliers

Common Stock

Retained Earnings

Total Liabilities and Equity

192000

102240

64400

50000

500000

112000

388000

$838340

$40000

100000

698340

798340

S838340

The information shown below is extracted from the records of the Williams Company.

1. The Williams Company has projected its unit sales for the next five months to be:

Month

Units

January

February

March

April

May

7000

8000

10000

8000

7000

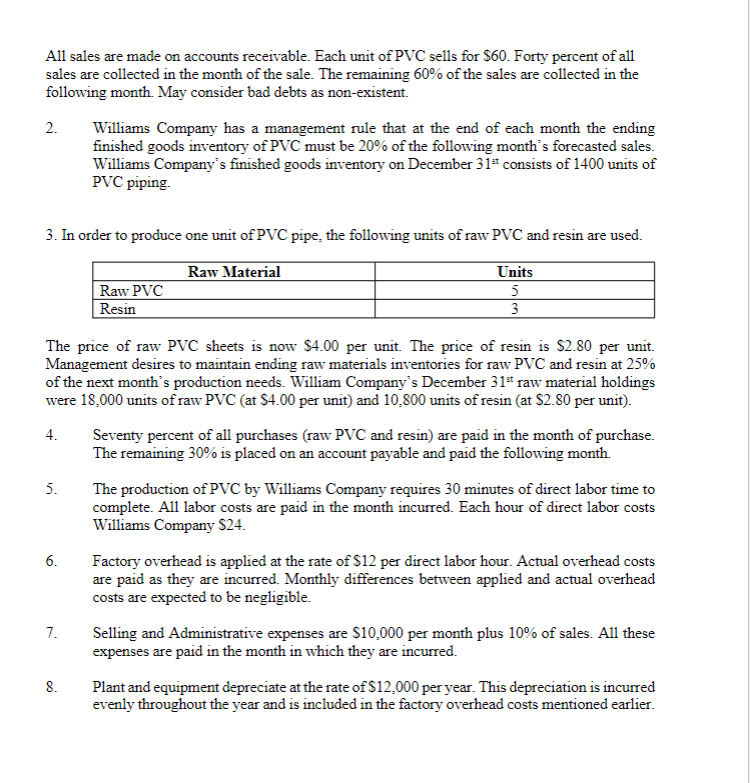

Transcribed Image Text:All sales are made on accounts receivable. Each unit of PVC sells for $60. Forty percent of all

sales are collected in the month of the sale. The remaining 60% of the sales are collected in the

following month. May consider bad debts as non-existent.

2.

Williams Company has a management rule that at the end of each month the ending

finished goods inventory of PVC must be 20% of the following month's forecasted sales.

Williams Company's finished goods inventory on December 31* consists of 1400 units of

PVC piping.

3. In order to produce one unit of PVC pipe, the following units of raw PVC and resin are used.

Raw Material

Units

Raw PVC

5

Resin

3

The price of raw PVC sheets is now $4.00 per unit. The price of resin is $2.80 per unit.

Management desires to maintain ending raw materials inventories for raw PVC and resin at 25%

of the next month's production needs. William Company's December 31 raw material holdings

were 18,000 units of raw PVC (at S4.00 per unit) and 10,800 units of resin (at S2.80 per unit).

4.

Seventy percent of all purchases (raw PVC and resin) are paid in the month of purchase.

The remaining 30% is placed on an account payable and paid the following month.

5.

The production of PVC by Williams Company requires 30 minutes of direct labor time to

complete. All labor costs are paid in the month incurred. Each hour of direct labor costs

Williams Company $24.

Factory overhead is applied at the rate of $12 per direct labor hour. Actual overhead costs

are paid as they are incurred. Monthly differences between applied and actual overhead

costs are expected to be negligible.

6.

7.

Selling and Administrative expenses are $10,000 per month plus 10% of sales. All these

expenses are paid in the month in which they are incurred.

8.

Plant and equipment depreciate at the rate of $12,000 per year. This depreciation is incurred

evenly throughout the year and is included in the factory overhead costs mentioned earlier.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning