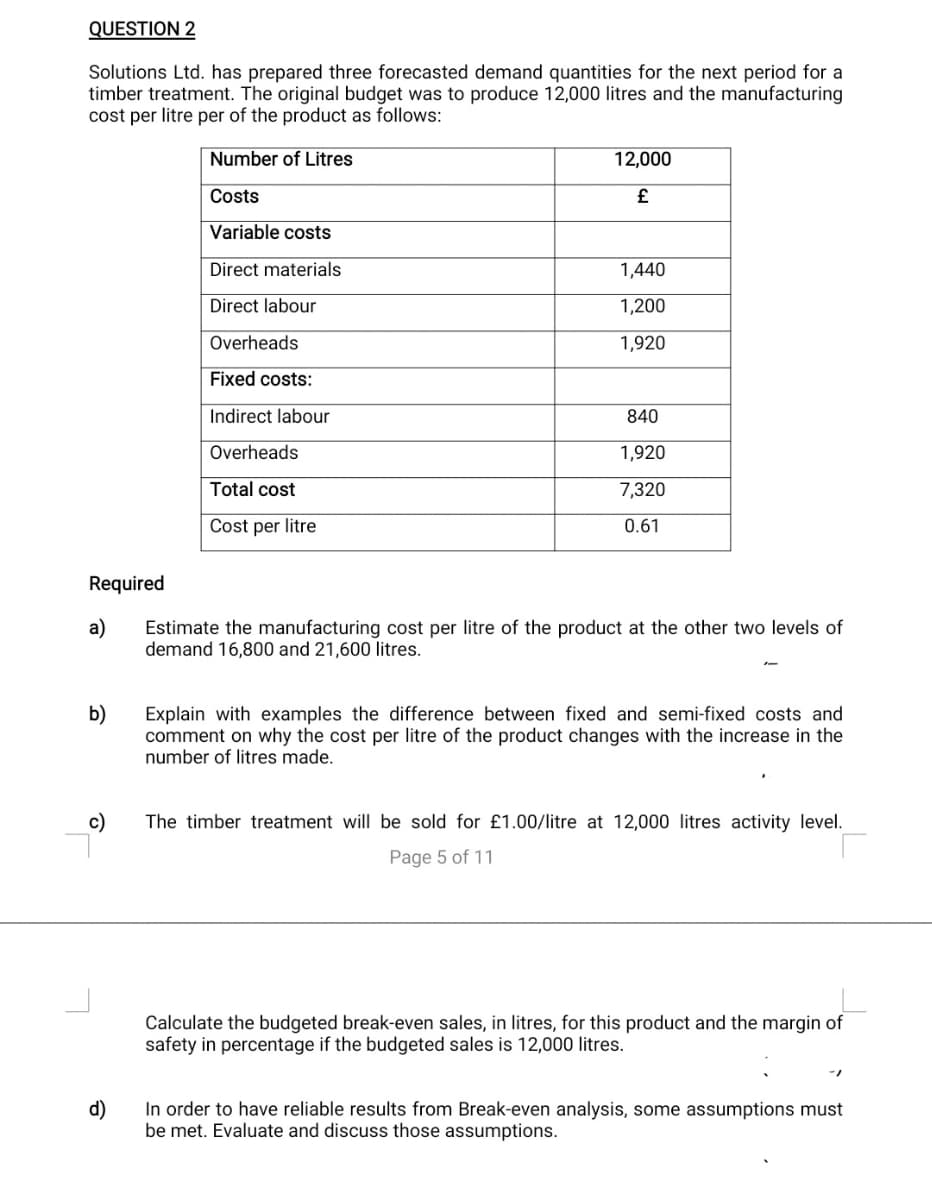

Solutions Ltd. has prepared three forecasted demand quantities for the next period for a timber treatment. The original budget was to produce 12,000 litres and the manufacturing cost per litre per of the product as follows: Number of Litres 12,000 Costs £ Variable costs Direct materials 1,440 Direct labour 1,200 Overheads 1,920 Fixed costs: Indirect labour 840 Overheads 1,920 Total cost 7,320 Cost per litre 0.61 Required a) Estimate the manufacturing cost per litre of the product at the other two levels of demand 16,800 and 21,600 litres. b) Explain with examples the difference between fixed and semi-fixed costs and comment on why the cost per litre of the product changes with the increase in the number of litres made. c) The timber treatment will be sold for £1.00/litre at 12,000 litres activity level. Page 5 of 11

Solutions Ltd. has prepared three forecasted demand quantities for the next period for a timber treatment. The original budget was to produce 12,000 litres and the manufacturing cost per litre per of the product as follows: Number of Litres 12,000 Costs £ Variable costs Direct materials 1,440 Direct labour 1,200 Overheads 1,920 Fixed costs: Indirect labour 840 Overheads 1,920 Total cost 7,320 Cost per litre 0.61 Required a) Estimate the manufacturing cost per litre of the product at the other two levels of demand 16,800 and 21,600 litres. b) Explain with examples the difference between fixed and semi-fixed costs and comment on why the cost per litre of the product changes with the increase in the number of litres made. c) The timber treatment will be sold for £1.00/litre at 12,000 litres activity level. Page 5 of 11

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 50E: Use the following information for Exercises 9-50 and 9-51: Assume that Stillwater Designs produces...

Related questions

Question

I need fast and correct I'll rate

Transcribed Image Text:QUESTION 2

Solutions Ltd. has prepared three forecasted demand quantities for the next period for a

timber treatment. The original budget was to produce 12,000 litres and the manufacturing

cost per litre per of the product as follows:

Number of Litres

12,000

£

Costs

Variable costs

Direct materials

1,440

Direct labour

1,200

Overheads

1,920

Fixed costs:

Indirect labour

840

Overheads

1,920

Total cost

7,320

Cost per litre

0.61

Required

a)

Estimate the manufacturing cost per litre of the product at the other two levels of

demand 16,800 and 21,600 litres.

b)

Explain with examples the difference between fixed and semi-fixed costs and

comment on why the cost per litre of the product changes with the increase in the

number of litres made.

c)

The timber treatment will be sold for £1.00/litre at 12,000 litres activity level.

Page 5 of 11

Calculate the budgeted break-even sales, in litres, for this product and the margin of

safety in percentage if the budgeted sales is 12,000 litres.

d)

In order to have reliable results from Break-even analysis, some assumptions must

be met. Evaluate and discuss those assumptions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub