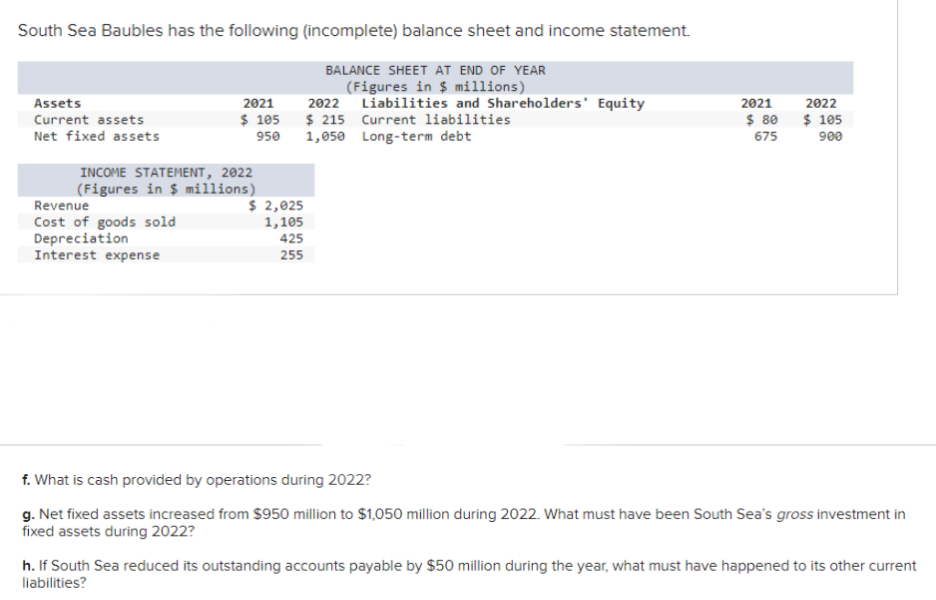

South Sea Baubles has the following (incomplete) balance sheet and income statement. Assets Current assets Net fixed assets 2021 $ 105 950 INCOME STATEMENT, 2022 (Figures in $ millions) Revenue Cost of goods sold Depreciation Interest expense $ 2,025 1,105 425 255 BALANCE SHEET AT END OF YEAR (Figures in $ millions) 2022 Liabilities and Shareholders' Equity $215 Current liabilities 1,050 Long-term debt 2021 $ 80 675 2022 $ 105 900 f. What is cash provided by operations during 2022? g. Net fixed assets increased from $950 million to $1,050 million during 2022. What must have been South Sea's gross investment in fixed assets during 2022? h. If South Sea reduced its outstanding accounts payable by $50 million during the year, what must have happened to its other current liabilities?

South Sea Baubles has the following (incomplete) balance sheet and income statement. Assets Current assets Net fixed assets 2021 $ 105 950 INCOME STATEMENT, 2022 (Figures in $ millions) Revenue Cost of goods sold Depreciation Interest expense $ 2,025 1,105 425 255 BALANCE SHEET AT END OF YEAR (Figures in $ millions) 2022 Liabilities and Shareholders' Equity $215 Current liabilities 1,050 Long-term debt 2021 $ 80 675 2022 $ 105 900 f. What is cash provided by operations during 2022? g. Net fixed assets increased from $950 million to $1,050 million during 2022. What must have been South Sea's gross investment in fixed assets during 2022? h. If South Sea reduced its outstanding accounts payable by $50 million during the year, what must have happened to its other current liabilities?

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

A 174.

Subject:- accounting

Transcribed Image Text:South Sea Baubles has the following (incomplete) balance sheet and income statement.

Assets

Current assets

Net fixed assets

2021

$ 105

950

INCOME STATEMENT, 2022

(Figures in $ millions)

Revenue

Cost of goods sold

Depreciation

Interest expense

$ 2,025

1,105

BALANCE SHEET AT END OF YEAR

(Figures in $ millions)

2022

$ 215

1,050

425

255

Liabilities and Shareholders' Equity

Current liabilities

Long-term debt

2021

$ 80

675

2022

$ 105

900

f. What is cash provided by operations during 2022?

g. Net fixed assets increased from $950 million to $1,050 million during 2022. What must have been South Sea's gross investment in

fixed assets during 2022?

h. If South Sea reduced its outstanding accounts payable by $50 million during the year, what must have happened to its other current

liabilities?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning