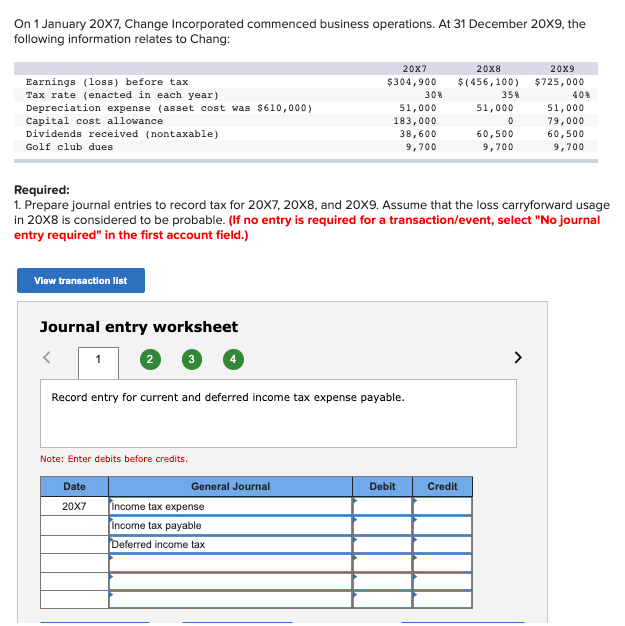

January 20X7, Change Incorporated commenced business operations. At 31 December 20X9, the following information relates to Chang: Earnings (loss) before tax Tax rate (enacted in each year) Depreciation expense (asset cost was $610,000) Capital cost allowance Dividends received (nontaxable) Golf club dues 20x7 $304,900 30% 51,000 183,000 38,600 9,700 20x8 $(456,100) 358 51,000 0 60,500 9,700 20x9 $725,000 40% 51,000 79,000 60,500 9,700 Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20X8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

January 20X7, Change Incorporated commenced business operations. At 31 December 20X9, the following information relates to Chang: Earnings (loss) before tax Tax rate (enacted in each year) Depreciation expense (asset cost was $610,000) Capital cost allowance Dividends received (nontaxable) Golf club dues 20x7 $304,900 30% 51,000 183,000 38,600 9,700 20x8 $(456,100) 358 51,000 0 60,500 9,700 20x9 $725,000 40% 51,000 79,000 60,500 9,700 Required: 1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20X8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:On 1 January 20X7, Change Incorporated commenced business operations. At 31 December 20X9, the

following information relates to Chang:

Earnings (loss) before tax

Tax rate (enacted in each year)

Depreciation expense (asset cost was $610,000)

Capital cost allowance.

Dividends received (nontaxable)

Golf club dues

View transaction list

Journal entry worksheet

1

2

Date

20X7

Note: Enter debits before credits.

Record entry for current and deferred income tax expense payable.

20x8

20X7

$304,900 $(456,100)

General Journal

Required:

1. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage

in 20X8 is considered to be probable. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field.)

Income tax expense

Income tax payable

Deferred income tax

51,000

183,000

38,600

9,700

30%

Debit

35%

Credit

51,000

0

60,500

9,700

20x9

$725,000

40%

51,000

79,000

60,500

9,700

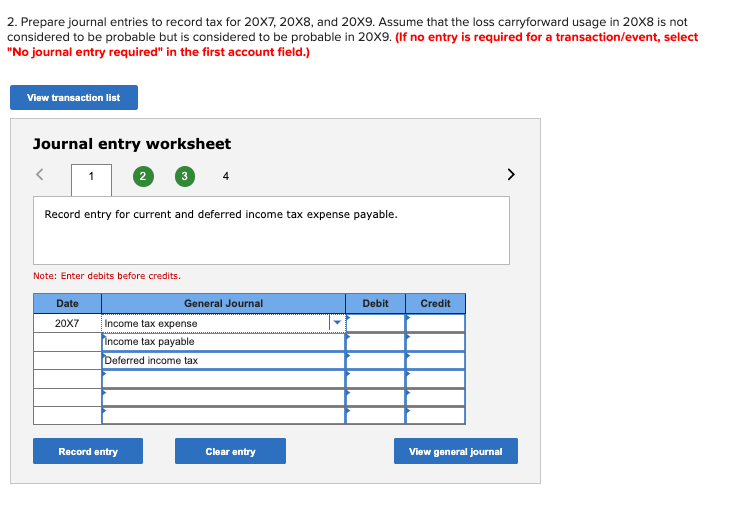

Transcribed Image Text:2. Prepare journal entries to record tax for 20X7, 20X8, and 20X9. Assume that the loss carryforward usage in 20X8 is not

considered to be probable but is considered to be probable in 20X9. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1 2 3

Record entry for current and deferred income tax expense payable.

Note: Enter debits before credits.

Date

20X7

General Journal

Income tax expense

Income tax payable

Deferred income tax

Record entry

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning