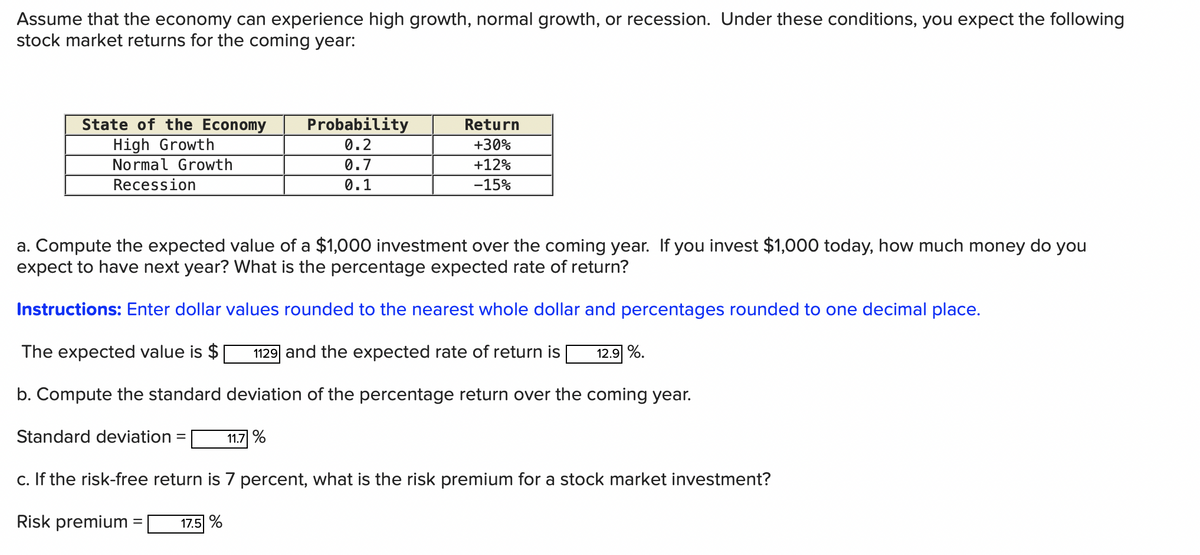

State of the Economy High Growth Normal Growth Recession Probability Return 0.2 +30% 0.7 +12% 0.1 -15% Compute the expected value of a $1,000 investment over the coming year. If you invest $1,000 today, how much money do you xpect to have next year? What is the percentage expected rate of return? structions: Enter dollar values rounded to the nearest whole dollar and percentages rounded to one decimal place. The expected value is $ 1129 and the expected rate of return is 12.9 %. . Compute the standard deviation of the percentage return over the coming year. tandard deviation = 11.7 % If the risk-free return is 7 percent, what is the risk premium for a stock market investment? isk premium = | 17.5 %

State of the Economy High Growth Normal Growth Recession Probability Return 0.2 +30% 0.7 +12% 0.1 -15% Compute the expected value of a $1,000 investment over the coming year. If you invest $1,000 today, how much money do you xpect to have next year? What is the percentage expected rate of return? structions: Enter dollar values rounded to the nearest whole dollar and percentages rounded to one decimal place. The expected value is $ 1129 and the expected rate of return is 12.9 %. . Compute the standard deviation of the percentage return over the coming year. tandard deviation = 11.7 % If the risk-free return is 7 percent, what is the risk premium for a stock market investment? isk premium = | 17.5 %

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.2P

Related questions

Question

Transcribed Image Text:Assume that the economy can experience high growth, normal growth, or recession. Under these conditions, you expect the following

stock market returns for the coming year:

Probability

State of the Economy

High Growth

Return

0.2

+30%

Normal Growth

0.7

+12%

Recession

0.1

-15%

a. Compute the expected value of a $1,000 investment over the coming year. If you invest $1,000 today, how much money do you

expect to have next year? What is the percentage expected rate of return?

Instructions: Enter dollar values rounded to the nearest whole dollar and percentages rounded to one decimal place.

The expected value is $

1129 and the expected rate of return is

12.9 %.

b. Compute the standard deviation of the percentage return over the coming year.

Standard deviation

11.7 %

c. If the risk-free return is 7 percent, what is the risk premium for a stock market investment?

Risk premium

17.5 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you