Stenback Company sells flags with team logos. Stenback has fixed costs of $1,260,000 per year plus variable costs of $4.50 per flag. Each flag sells for $15.00. Read the requirements Requirement 1. Use the equation approach to compute the number of flags Stenback must sell each year to break even. First, select the formula to compute the required sales in units to break even. Target profit Rearrange the formula you determined above and compute the required number of flags to break even. The number of flags Stenback must sell each year to break even is . Requirement 2. Use the contribution margin ratio approach to compute the dollar sales Stenback needs to earn $63,000 in operating income for 2018. (Round the contribution margin ratio to two decimal places.) Begin by showing the formula and then entering the amounts to calculate the required sales dollars to earn $63,000 in operating income. (Round the required sales in dollars up to the nearest whole dollar. For example, $10.25 would be rounded to $11. Abbreviation used: CM = contribution margin.) -- Required sales in dollars | + Requirement 3. Prepare Stenback's contribution margin income statement for the year ended December 31, 2018, for sales of 110,000 flags. (Round your final answers up to the next whole number.) (Use parentheses or a minus sign for an operating loss.) Stenback Company Contribution Margin Income Statement Year Ended December 31, 2018 Operating Income (Loss)

Stenback Company sells flags with team logos. Stenback has fixed costs of $1,260,000 per year plus variable costs of $4.50 per flag. Each flag sells for $15.00. Read the requirements Requirement 1. Use the equation approach to compute the number of flags Stenback must sell each year to break even. First, select the formula to compute the required sales in units to break even. Target profit Rearrange the formula you determined above and compute the required number of flags to break even. The number of flags Stenback must sell each year to break even is . Requirement 2. Use the contribution margin ratio approach to compute the dollar sales Stenback needs to earn $63,000 in operating income for 2018. (Round the contribution margin ratio to two decimal places.) Begin by showing the formula and then entering the amounts to calculate the required sales dollars to earn $63,000 in operating income. (Round the required sales in dollars up to the nearest whole dollar. For example, $10.25 would be rounded to $11. Abbreviation used: CM = contribution margin.) -- Required sales in dollars | + Requirement 3. Prepare Stenback's contribution margin income statement for the year ended December 31, 2018, for sales of 110,000 flags. (Round your final answers up to the next whole number.) (Use parentheses or a minus sign for an operating loss.) Stenback Company Contribution Margin Income Statement Year Ended December 31, 2018 Operating Income (Loss)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 47E: Klamath Company produces a single product. The projected income statement for the coming year is as...

Related questions

Question

Hello,

I need help answering this question.

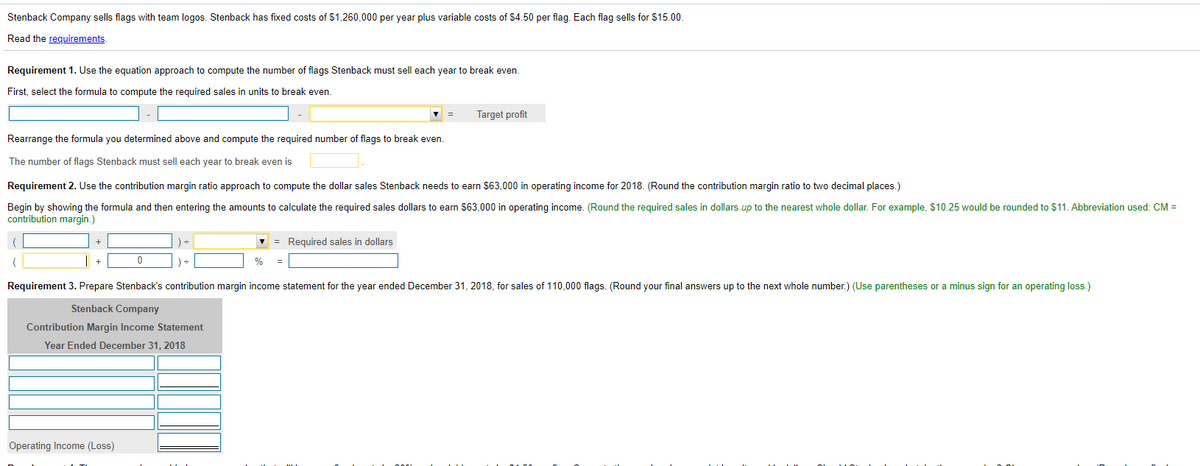

Transcribed Image Text:Stenback Company sells flags with team logos. Stenback has fixed costs of $1,260,000 per year plus variable costs of $4.50 per flag. Each flag sells for $15.00.

Read the reguirements.

Requirement 1. Use the equation approach to compute the number of flags Stenback must sell each year to break even.

First, select the formula to compute the required sales in units to break even.

Target profit

Rearrange the formula you determined above and compute the required number of flags to break even.

The number of flags Stenback must sell each year to break even is

Requirement 2. Use the contribution margin ratio approach to compute the dollar sales Stenback needs to earn $63,000 in operating income for 2018. (Round the contribution margin ratio to two decimal places.)

Begin by showing the formula and then entering the amounts to calculate the required sales dollars to earn $63,000 in operating income. (Round the required sales in dollars up to the nearest whole dollar. For example, $10.25 would be rounded to $11. Abbreviation used: CM =

contribution margin.)

v = Required sales in dollars

+

%

Requirement 3. Prepare Stenback's contribution margin income statement for the year ended December 31, 2018, for sales of 110,000 flags. (Round your final answers up to the next whole number.) (Use parentheses or a minus sign for an operating loss.)

Stenback Company

Contribution Margin Income Statement

Year Ended December 31, 2018

Operating Income (Loss)

Expert Solution

Step 1

CVP analysis is considered as a decision-making tool that helps management to make strategies and take wise decisions. It includes an analysis of contribution margin, Break-even point, Margin of safety, etc.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT