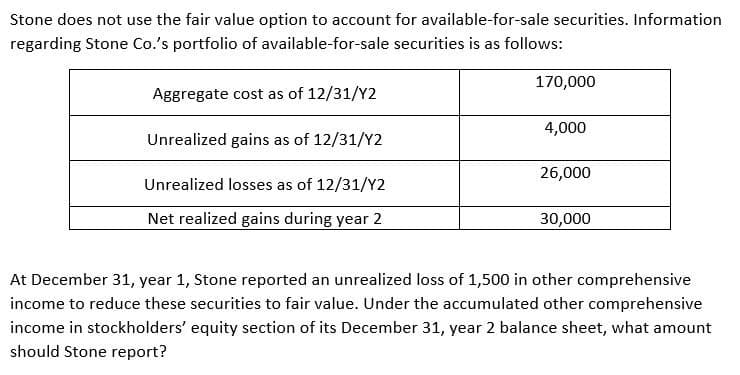

Stone does not use the fair value option to account for available-for-sale securities. Information regarding Stone Co.'s portfolio of available-for-sale securities is as follows: 170,000 Aggregate cost as of 12/31/Y2 4,000 Unrealized gains as of 12/31/Y2 26,000 Unrealized losses as of 12/31/Y2 Net realized gains during year 2 30,000 At December 31, year 1, Stone reported an unrealized loss of 1,500 in other comprehensive income to reduce these securities to fair value. Under the accumulated other comprehensive income in stockholders' equity section of its December 31, year 2 balance sheet, what amount should Stone report?

Stone does not use the fair value option to account for available-for-sale securities. Information regarding Stone Co.'s portfolio of available-for-sale securities is as follows: 170,000 Aggregate cost as of 12/31/Y2 4,000 Unrealized gains as of 12/31/Y2 26,000 Unrealized losses as of 12/31/Y2 Net realized gains during year 2 30,000 At December 31, year 1, Stone reported an unrealized loss of 1,500 in other comprehensive income to reduce these securities to fair value. Under the accumulated other comprehensive income in stockholders' equity section of its December 31, year 2 balance sheet, what amount should Stone report?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 15E

Related questions

Question

Under the accumulated other comprehensive income in

Transcribed Image Text:Stone does not use the fair value option to account for available-for-sale securities. Information

regarding Stone Co.'s portfolio of available-for-sale securities is as follows:

170,000

Aggregate cost as of 12/31/Y2

4,000

Unrealized gains as of 12/31/Y2

26,000

Unrealized losses as of 12/31/Y2

Net realized gains during year 2

30,000

At December 31, year 1, Stone reported an unrealized loss of 1,500 in other comprehensive

income to reduce these securities to fair value. Under the accumulated other comprehensive

income in stockholders' equity section of its December 31, year 2 balance sheet, what amount

should Stone report?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning