Student Services Incorporated ("SSI") acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. It supplies clothing, records, and confectionary items. The company has a $150,000 line of credit available with a local bank, and it draws on its account in amounts of $10,000 at a time. SSI has not drawn on the credit line yet. As at December 31, 2020, the firm had a cash balance of $14,000, which is the minimum balance that it wants to maintain. Any excess cash is used to repay the line of credit. [lgnore interest on the line of credit.] The following additional information is available. Actual Sales Forecasted sales October 2020 November 2020 $150,000 December 2020 $80,000 January 2021 February 2021 March 2021 $100,000 $200,000 $100,000 $60,000 $200,000 $140,000 $140,000 April 2021 May 2021 June 2021 Sales/Accounts Receivable: 80% of sales are on credit and terms are net 30 days (1 month). From past experience 60 percent of the accounts are collected 1 month after the sale, 30 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale Bad debts are negligible. Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month prior to sale. Purchases are equal to 80% of next month's sales and the gross profit margin is 40%.

Student Services Incorporated ("SSI") acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. It supplies clothing, records, and confectionary items. The company has a $150,000 line of credit available with a local bank, and it draws on its account in amounts of $10,000 at a time. SSI has not drawn on the credit line yet. As at December 31, 2020, the firm had a cash balance of $14,000, which is the minimum balance that it wants to maintain. Any excess cash is used to repay the line of credit. [lgnore interest on the line of credit.] The following additional information is available. Actual Sales Forecasted sales October 2020 November 2020 $150,000 December 2020 $80,000 January 2021 February 2021 March 2021 $100,000 $200,000 $100,000 $60,000 $200,000 $140,000 $140,000 April 2021 May 2021 June 2021 Sales/Accounts Receivable: 80% of sales are on credit and terms are net 30 days (1 month). From past experience 60 percent of the accounts are collected 1 month after the sale, 30 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale Bad debts are negligible. Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month prior to sale. Purchases are equal to 80% of next month's sales and the gross profit margin is 40%.

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 13P

Related questions

Question

![Student Services Incorporated (“SSI") acts as a wholesaler to the various student retail shops that

operate on campuses throughout Canada. It supplies clothing, records, and confectionary items.

The company has a $150,000 line of credit available with a local bank, and it draws on its account

in amounts of $10,000 at a time. SSI has not drawn on the credit line yet. As at December 31,

2020, the firm had a cash balance of $14,000, which is the minimum balance that it wants to

maintain. Any excess cash is used to repay the line of credit. [lgnore interest on the line of

credit.] The following additional information is available.

Forecasted sales

$200,000

$100,000

$60,000

$200,000

$140,000

$140,000

Actual Sales

$100,000

November 2020 $150,000

$80,000

January 2021

February 2021

March 2021

October 2020

December 2020

April 2021

May 2021

June 2021

Sales/Accounts Receivable: 80% of sales are on credit and terms are net 30 days (1 month).

From past experience 60 percent of the accounts are collected 1 month after the sale,

30 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale.

Bad debts are negligible.

Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month

prior to sale. Purchases are equal to 80% of next month's sales and the gross profit margin is

40%.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F04655fa1-8a14-4287-9748-c095e4183a84%2F13d3acc7-3172-4c7b-aeb0-bd496c905d83%2F8eadjcr_processed.png&w=3840&q=75)

Transcribed Image Text:Student Services Incorporated (“SSI") acts as a wholesaler to the various student retail shops that

operate on campuses throughout Canada. It supplies clothing, records, and confectionary items.

The company has a $150,000 line of credit available with a local bank, and it draws on its account

in amounts of $10,000 at a time. SSI has not drawn on the credit line yet. As at December 31,

2020, the firm had a cash balance of $14,000, which is the minimum balance that it wants to

maintain. Any excess cash is used to repay the line of credit. [lgnore interest on the line of

credit.] The following additional information is available.

Forecasted sales

$200,000

$100,000

$60,000

$200,000

$140,000

$140,000

Actual Sales

$100,000

November 2020 $150,000

$80,000

January 2021

February 2021

March 2021

October 2020

December 2020

April 2021

May 2021

June 2021

Sales/Accounts Receivable: 80% of sales are on credit and terms are net 30 days (1 month).

From past experience 60 percent of the accounts are collected 1 month after the sale,

30 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale.

Bad debts are negligible.

Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month

prior to sale. Purchases are equal to 80% of next month's sales and the gross profit margin is

40%.

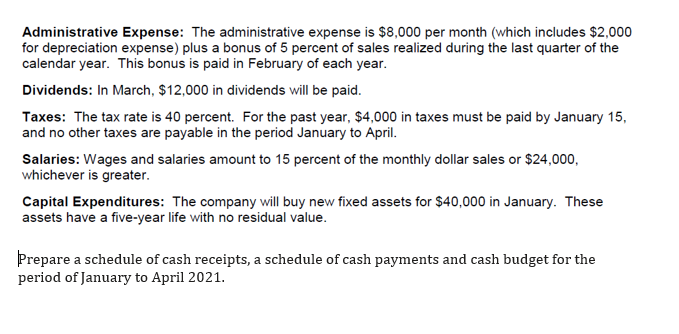

Transcribed Image Text:Administrative Expense: The administrative expense is $8,000 per month (which includes $2,000

for depreciation expense) plus a bonus of 5 percent of sales realized during the last quarter of the

calendar year. This bonus is paid in February of each year.

Dividends: In March, $12,000 in dividends will be paid.

Taxes: The tax rate is 40 percent. For the past year, $4,000 in taxes must be paid by January 15,

and no other taxes are payable in the period January to April.

Salaries: Wages and salaries amount to 15 percent of the monthly dollar sales or $24,000,

whichever is greater.

Capital Expenditures: The company will buy new fixed assets for $40,000 in January. These

assets have a five-year life with no residual value.

Prepare a schedule of cash receipts, a schedule of cash payments and cash budget for the

period of January to April 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT