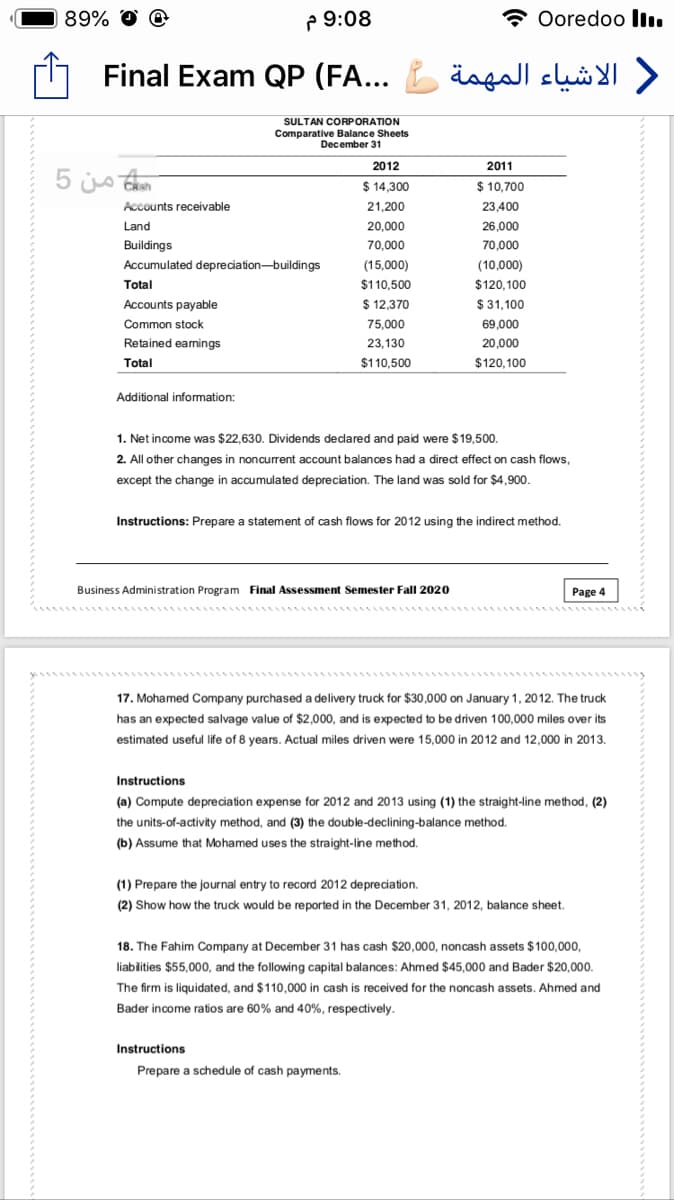

SULTAN CORPORATION Comparative Balance Sheets December 31 2012 2011 $ 14,300 $ 10,700 Accounts receivable 21,200 23,400 Land 20,000 26,000 Buildings 70,000 70,000 Accumulated depreciation-buildings (15,000) (10,000) Total $110,500 $120,100 Accounts payable $ 12,370 $ 31,100 Common stock 75,000 69,000 Retained eamings 23,130 20,000 Total $110,500 $120,100 Additional information: 1. Net income was $22,630. Dividends dedared and paid were $19,500. 2. All other changes in noncurrent account balances had a direct effect on cash flows, except the change in accumulated depreciation. The land was sold for $4,900. Instructions: Prepare a statement of cash flows for 2012 using the indirect method.

SULTAN CORPORATION Comparative Balance Sheets December 31 2012 2011 $ 14,300 $ 10,700 Accounts receivable 21,200 23,400 Land 20,000 26,000 Buildings 70,000 70,000 Accumulated depreciation-buildings (15,000) (10,000) Total $110,500 $120,100 Accounts payable $ 12,370 $ 31,100 Common stock 75,000 69,000 Retained eamings 23,130 20,000 Total $110,500 $120,100 Additional information: 1. Net income was $22,630. Dividends dedared and paid were $19,500. 2. All other changes in noncurrent account balances had a direct effect on cash flows, except the change in accumulated depreciation. The land was sold for $4,900. Instructions: Prepare a statement of cash flows for 2012 using the indirect method.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

100%

Transcribed Image Text:89%

P 9:08

* Ooredoo Iı.

Final Exam QP (FA... L äagall suöy >

SULTAN CORPORATION

Comparative Balance Sheets

December 31

2012

2011

2$

$ 14,300

$ 10,700

Accounts receivable

21,200

23,400

Land

20,000

26,000

70,000

Buildings

Accumulated depreciation-buildings

70,000

(10,000)

$120,100

(15,000)

Total

$110,500

Accounts payable

$ 12,370

$ 31,100

Common stock

75,000

69,000

Retained eanings

23,130

20,000

Total

$110,500

$120,100

Additional information:

1. Net income was $22,630. Dividends declared and paid were $19,500.

2. All other changes in noncurrent account balances had a direct effect on cash flows,

except the change in accumulated depreciation. The land was sold for $4,900.

Instructions: Prepare a statement of cash flows for 2012 using the indirect method.

Business Administration Program Final Assessment Semester Fall 2020

Page 4

17. Mohamed Company purchased a delivery truck for $30,000 on January 1, 2012. The truck

has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its

estimated useful life of 8 years. Actual miles driven were 15,000 in 2012 and 12,000 in 2013.

Instructions

(a) Compute depreciation expense for 2012 and 2013 using (1) the straight-line method, (2)

the units-of-activity method, and (3) the double-declining-balance method.

(b) Assume that Mohamed uses the straight-line method.

(1) Prepare the journal entry to record 2012 depreciation.

(2) Show how the truck would be reported in the December 31, 2012, balance sheet.

18. The Fahim Company at December 31 has cash $20,000, noncash assets $100,000,

liablities $55,000, and the following capital balances: Ahmed $45,000 and Bader $20,000.

The firm is liquidated, and $110,000 in cash is received for the noncash assets. Ahmed and

Bader income ratios are 60% and 40%, respectively.

Instructions

Prepare a schedule of cash payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning