Simple Things Industries Ltd. Comparative Balance Sheet December 31, 2014 and 2013 2014 | 2013 Increase/(Decrease) Assets Cash 238,000 215,200 Accounts Receivable 303,200 259,300 Inventories 358,300 348,200 Prepaid expenses Intangible assets Plant assets, net 35,350 43,100 205,000 205,000 ? 1,105,000 910,000 ? Total Assets 2,244,850 1,980,800 Liabilities 254,300 415,300 240,000 ? Acemed liabilities onverted by P to 410,000 Income tax payable Long-term notes payable Stockholders Equity Čommon Stock 115,000 135,400 845,400 910,500 ? htetelak RauiyW.PDF-Helper.com/pdf-to-jpg/ 295,500 275,300 Retained earnings 345,600 295,400 ? Treasury stock Total liabilities and stockholders' equity (26,250) 2,244,850 (285,800) 1,980,800

Simple Things Industries Ltd. Comparative Balance Sheet December 31, 2014 and 2013 2014 | 2013 Increase/(Decrease) Assets Cash 238,000 215,200 Accounts Receivable 303,200 259,300 Inventories 358,300 348,200 Prepaid expenses Intangible assets Plant assets, net 35,350 43,100 205,000 205,000 ? 1,105,000 910,000 ? Total Assets 2,244,850 1,980,800 Liabilities 254,300 415,300 240,000 ? Acemed liabilities onverted by P to 410,000 Income tax payable Long-term notes payable Stockholders Equity Čommon Stock 115,000 135,400 845,400 910,500 ? htetelak RauiyW.PDF-Helper.com/pdf-to-jpg/ 295,500 275,300 Retained earnings 345,600 295,400 ? Treasury stock Total liabilities and stockholders' equity (26,250) 2,244,850 (285,800) 1,980,800

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

can these two questions be worked out please

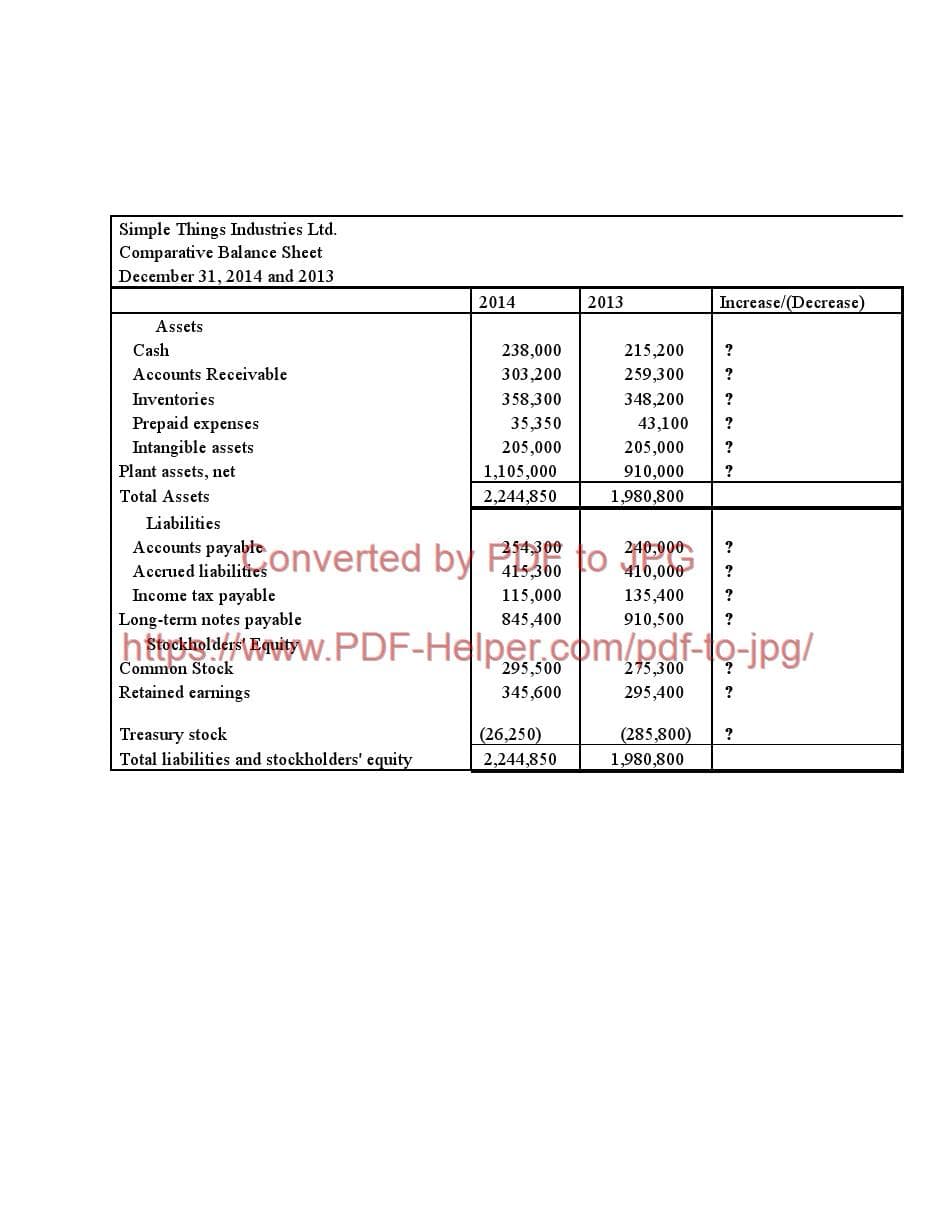

Transcribed Image Text:Simple Things Industries Ltd.

Comparative Balance Sheet

December 31, 2014 and 2013

2014

2013

Increase/(Decrease)

Assets

Cash

238,000

215,200

303,200

358,300

Accounts Receivable

259,300

Inventories

348,200

Prepaid expenses

Intangible assets

35,350

43,100

205,000

205,000

Plant assets, net

1,105,000

910,000

Total Assets

2,244,850

1,980,800

Liabilities

Accounts payable

254,300

240,000

Acerued liabilities onverted by F to 90

415,300

135,400

Income tax payable

Long-term notes payable

Stockholders Equity

Čommon Stock

Retained earnings

115,000

845,400

910,500

htest Raiw.PDF-Helper com/pdf-to-jpg/

295,500

275,300

345,600

295,400

Treasury stock

Total liabilities and stockholders' equity

(26,250)

(285,800)

2,244,850

1,980,800

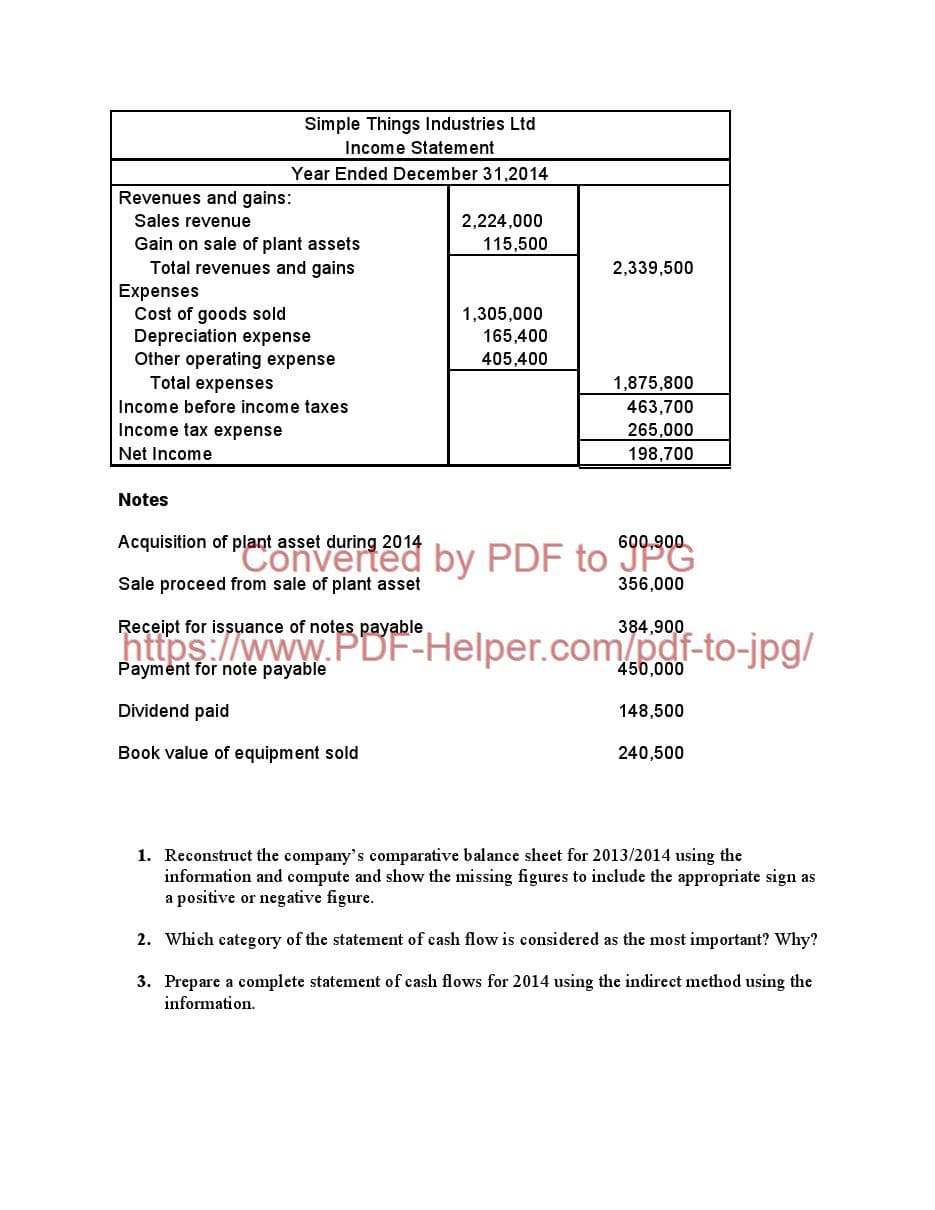

Transcribed Image Text:Simple Things Industries Ltd

Income Statement

Year Ended December 31,2014

Revenues and gains:

Sales revenue

2,224,000

Gain on sale of plant assets

Total revenues and gains

Expenses

Cost of goods sold

115,500

2,339,500

1,305,000

165,400

Depreciation expense

Other operating expense

Total expenses

405,400

1,875,800

Income before income taxes

463,700

Income tax expense

265,000

Net Income

198,700

Notes

Acquisition of plant asset during 2014

600,900.

PConverted by PDF to JPG

Sale proceed from sale of plant asset

356,000

Receipt for issuance of notes payable

384,900

https://www.PDF-Helper.com/pof-to-jpg/

Payment for note payable

450,000

Dividend paid

148,500

Book value of equipment sold

240,500

1. Reconstruct the company's comparative balance sheet for 2013/2014 using the

information and compute and show the missing figures to inclue

a positive or negative figure.

the appropriate sign as

2. Which category of the statement of cash flow is considered as the most important? Why?

3. Prepare a complete statement of cash flows for 2014 using the indirect method using the

information.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning