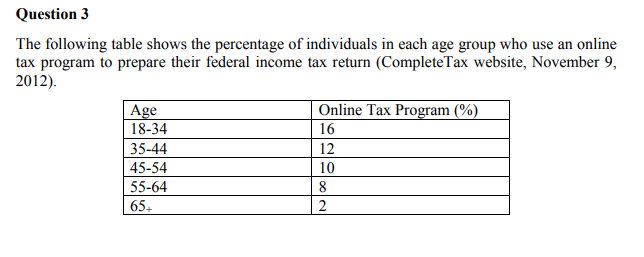

Suppose a follow-up study consisting of personal interviews is to be conducted to deter- mine the most important factors in selecting a method for filing taxes. 1.How many 18–34-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return? 2. How many 35–44-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return? 3. How many 651-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return? 4. If the number of 18–34-year-olds sampled is equal to the value identified in part (a), what is the standard deviation of the percentage who use an online tax program?

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Suppose a follow-up study consisting of personal interviews is to be conducted to deter- mine the most important factors in selecting a method for filing taxes.

1.How many 18–34-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return?

2. How many 35–44-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return?

3. How many 651-year-olds must be sampled to find an expected number of at least 25 who use an online tax program to prepare their federal income tax return?

4. If the number of 18–34-year-olds sampled is equal to the value identified in part (a), what is the standard deviation of the percentage who use an online tax program?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images