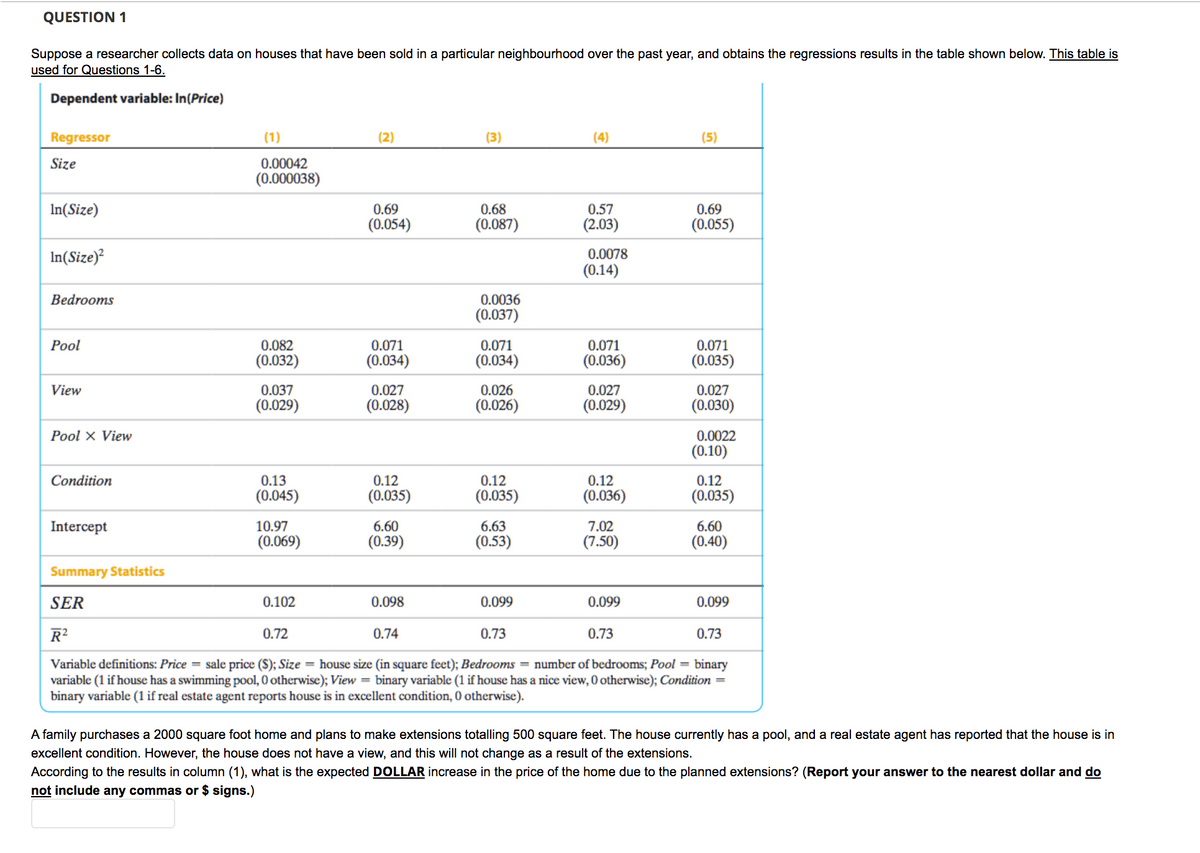

Suppose a researcher collects data on houses that have been sold in a particular neighbourhood over the past year, and obtains the regressions results in the table shown below. This table is used for Questions 1-6. Dependent variable: In(Price) Regressor (1) (2) (3) (4) (5) Size 0.00042 (0.000038) 0.57 (2.03) 0.69 (0.055) In(Size) 0.69 (0.054) 0.68 (0.087) In(Size)² 0.0078 (0.14) Bedrooms 0.0036 (0.037) 0.082 (0.032) 0.071 (0.034) 0.071 (0.034) 0.071 (0.036) 0.071 (0.035) Pool View 0.037 0.027 0.026 0.027 0.027 (0.030) (0.029) (0.028) (0.026) (0.029) Pool x View 0.0022 (0.10) 0.13 (0.045) 0.12 (0.035) 0.12 (0.035) Condition 0.12 (0.036) 0.12 (0.035) Intercept 10.97 6.60 (0.39) 6.63 (0.53) 7.02 (7.50) 6.60 (0.069) (0.40) Summary Statistics SER 0.102 0.098 0.099 0.099 0.099 R² 0.72 0.74 0.73 0.73 0.73 Variable definitions: Price = sale price ($); Size = house size (in square feet); Bedrooms = number of bedrooms; Pool = binary variable (1 if house has a swimming pool, O otherwise); View = binary variable (1 if house has a nice view, 0 otherwise); Condition = binary variable (1 if real estate agent reports house is in excellent condition, 0 otherwise). A family purchases a 2000 square foot home and plans to make extensions totalling 500 square feet. The house currently has a pool, and a real estate agent has reported that the house is in excellent condition. However, the house does not have view, and this will not change as a result of the extensions. According to the results in column (1), what is the expected DOLLAR increase in the price of the home due to the planned extensions? (Report your answer to the nearest dollar and do not include any commas or $ signs.)

Suppose a researcher collects data on houses that have been sold in a particular neighbourhood over the past year, and obtains the regressions results in the table shown below. This table is used for Questions 1-6. Dependent variable: In(Price) Regressor (1) (2) (3) (4) (5) Size 0.00042 (0.000038) 0.57 (2.03) 0.69 (0.055) In(Size) 0.69 (0.054) 0.68 (0.087) In(Size)² 0.0078 (0.14) Bedrooms 0.0036 (0.037) 0.082 (0.032) 0.071 (0.034) 0.071 (0.034) 0.071 (0.036) 0.071 (0.035) Pool View 0.037 0.027 0.026 0.027 0.027 (0.030) (0.029) (0.028) (0.026) (0.029) Pool x View 0.0022 (0.10) 0.13 (0.045) 0.12 (0.035) 0.12 (0.035) Condition 0.12 (0.036) 0.12 (0.035) Intercept 10.97 6.60 (0.39) 6.63 (0.53) 7.02 (7.50) 6.60 (0.069) (0.40) Summary Statistics SER 0.102 0.098 0.099 0.099 0.099 R² 0.72 0.74 0.73 0.73 0.73 Variable definitions: Price = sale price ($); Size = house size (in square feet); Bedrooms = number of bedrooms; Pool = binary variable (1 if house has a swimming pool, O otherwise); View = binary variable (1 if house has a nice view, 0 otherwise); Condition = binary variable (1 if real estate agent reports house is in excellent condition, 0 otherwise). A family purchases a 2000 square foot home and plans to make extensions totalling 500 square feet. The house currently has a pool, and a real estate agent has reported that the house is in excellent condition. However, the house does not have view, and this will not change as a result of the extensions. According to the results in column (1), what is the expected DOLLAR increase in the price of the home due to the planned extensions? (Report your answer to the nearest dollar and do not include any commas or $ signs.)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4A: Problems In Applying The Linear Regression Model

Section: Chapter Questions

Problem 1E

Related questions

Question

Transcribed Image Text:QUESTION 1

Suppose a researcher collects data on houses that have been sold in a particular neighbourhood over the past year, and obtains the regressions results in the table shown below. This table is

used for Questions 1-6.

Dependent variable: In(Price)

Regressor

(1)

(2)

(3)

(4)

(5)

0.00042

(0.000038)

Size

In(Size)

0.57

(2.03)

0.69

0.68

0.69

(0.055)

(0.054)

(0.087)

In(Size)²

0.0078

(0.14)

Bedrooms

0.0036

(0.037)

Рol

0.082

0.071

0.071

0.071

0.071

(0.032)

(0.034)

(0.034)

(0.036)

(0.035)

0.037

0.027

0.026

0.027

0.027

(0.030)

View

(0.029)

(0.028)

(0.026)

(0.029)

Pool x View

0.0022

(0.10)

0.12

(0.035)

Condition

0.13

0.12

0.12

(0.035)

0.12

(0.045)

(0.035)

(0.036)

6.63

(0.53)

Intercept

10.97

6.60

7.02

6.60

(0.069)

(0.39)

(7.50)

(0.40)

Summary Statistics

SER

0.102

0.098

0.099

0.099

0.099

R?

0.72

0.74

0.73

0.73

0.73

Variable definitions: Price = sale price ($); Size = house size (in square feet); Bedrooms = number of bedrooms; Pool = binary

variable (1 if house has a swimming pool, 0 otherwise); View = binary variable (1 if house has a nice view, 0 otherwise); Condition =

binary variable (1 if real estate agent reports house is in excellent condition, 0 otherwise).

A family purchases a 2000 square foot home and plans to make extensions totalling 500 square feet. The house currently has a pool, and a real estate agent has reported that the house is in

excellent condition. However, the house does not have a view, and this will not change as a result of the extensions.

According to the results in column (1), what is the expected DOLLAR increase in the price of the home due to the planned extensions? (Report your answer to the nearest dollar and do

not include any commas or $ signs.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning