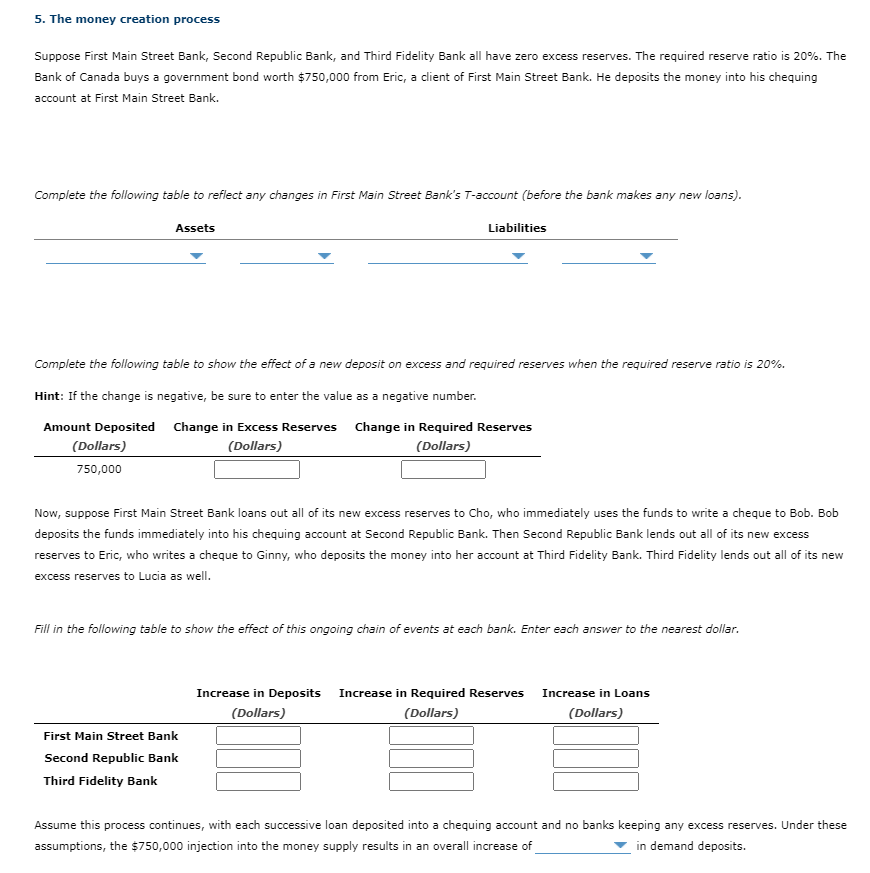

Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 20%. The Bank of Canada buys a government bond worth $750,000 from Eric, a client of First Main Street Bank. He deposits the money into his chequing account at First Main Street Bank. NOTE: the options for the LEFT dropdown question for ASSETS are (building and furniture or deposits or loans or networth or reserves) the options for the RIGHT dropdown question for ASSETS are ($150,000 or $600,000 or $750,000 or $1,800,000) the options for the LEFT dropdown question for LIABILITIES are (building and furniture or deposits or loans or networth or reserves) the options for the RIGHT dropdown question for LIABILITIES are ($150,000 or $600,000 or $750,000 or $1,800,000) the VERY last dropdown question at the bottom choices are ($375,000 or $3,000,000 or $3,750,000)

Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero

NOTE:

the options for the LEFT dropdown question for ASSETS are (building and furniture or deposits or loans or networth or reserves) the options for the RIGHT dropdown question for ASSETS are ($150,000 or $600,000 or $750,000 or $1,800,000)

the options for the LEFT dropdown question for LIABILITIES are (building and furniture or deposits or loans or networth or reserves) the options for the RIGHT dropdown question for LIABILITIES are ($150,000 or $600,000 or $750,000 or $1,800,000)

the VERY last dropdown question at the bottom choices are ($375,000 or $3,000,000 or $3,750,000)

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images