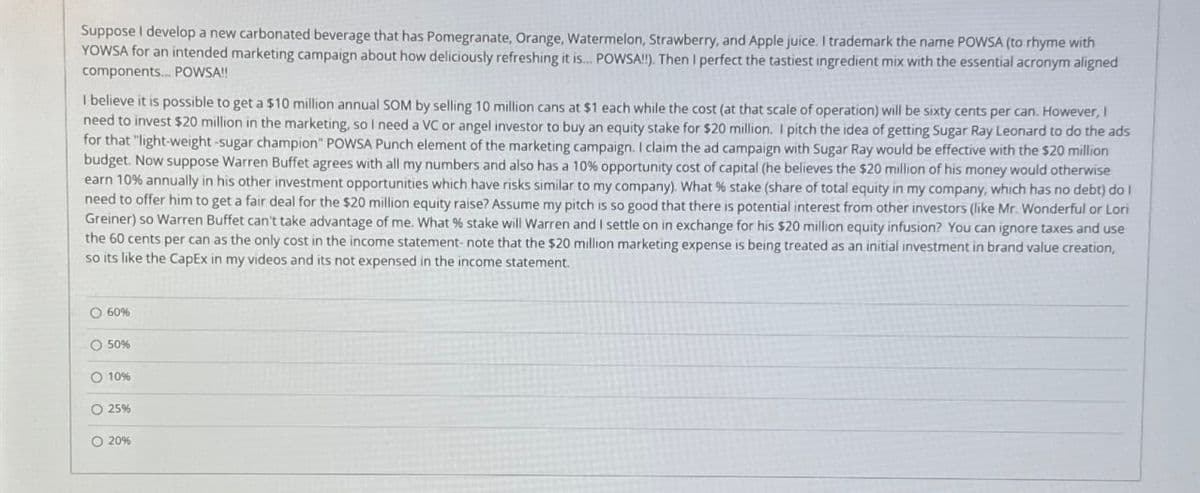

Suppose I develop a new carbonated beverage that has Pomegranate, Orange, Watermelon, Strawberry, and Apple juice. I trademark the name POWSA (to rhyme with YOWSA for an intended marketing campaign about how deliciously refreshing it is... POWSA!!). Then I perfect the tastiest ingredient mix with the essential acronym aligned components... POWSA!! I believe it is possible to get a $10 million annual SOM by selling 10 million cans at $1 each while the cost (at that scale of operation) will be sixty cents per can. However, I need to invest $20 million in the marketing, so I need a VC or angel investor to buy an equity stake for $20 million. I pitch the idea of getting Sugar Ray Leonard to do the ads for that "light-weight-sugar champion" POWSA Punch element of the marketing campaign. I claim the ad campaign with Sugar Ray would be effective with the $20 million budget. Now suppose Warren Buffet agrees with all my numbers and also has a 10% opportunity cost of capital (he believes the $20 million of his money would otherwise earn 10% annually in his other investment opportunities which have risks similar to my company). What % stake (share of total equity in my company, which has no debt) do I need to offer him to get a fair deal for the $20 million equity raise? Assume my pitch is so good that there is potential interest from other investors (like Mr. Wonderful or Lori Greiner) so Warren Buffet can't take advantage of me. What % stake will Warren and I settle on in exchange for his $20 million equity infusion? You can ignore taxes and use the 60 cents per can as the only cost in the income statement-note that the $20 million marketing expense is being treated as an initial investment in brand value creation, so its like the CapEx in my videos and its not expensed in the income statement. 60% 50% O 10% 0 0 0 оо ○ 25% O 20%

Suppose I develop a new carbonated beverage that has Pomegranate, Orange, Watermelon, Strawberry, and Apple juice. I trademark the name POWSA (to rhyme with YOWSA for an intended marketing campaign about how deliciously refreshing it is... POWSA!!). Then I perfect the tastiest ingredient mix with the essential acronym aligned components... POWSA!! I believe it is possible to get a $10 million annual SOM by selling 10 million cans at $1 each while the cost (at that scale of operation) will be sixty cents per can. However, I need to invest $20 million in the marketing, so I need a VC or angel investor to buy an equity stake for $20 million. I pitch the idea of getting Sugar Ray Leonard to do the ads for that "light-weight-sugar champion" POWSA Punch element of the marketing campaign. I claim the ad campaign with Sugar Ray would be effective with the $20 million budget. Now suppose Warren Buffet agrees with all my numbers and also has a 10% opportunity cost of capital (he believes the $20 million of his money would otherwise earn 10% annually in his other investment opportunities which have risks similar to my company). What % stake (share of total equity in my company, which has no debt) do I need to offer him to get a fair deal for the $20 million equity raise? Assume my pitch is so good that there is potential interest from other investors (like Mr. Wonderful or Lori Greiner) so Warren Buffet can't take advantage of me. What % stake will Warren and I settle on in exchange for his $20 million equity infusion? You can ignore taxes and use the 60 cents per can as the only cost in the income statement-note that the $20 million marketing expense is being treated as an initial investment in brand value creation, so its like the CapEx in my videos and its not expensed in the income statement. 60% 50% O 10% 0 0 0 оо ○ 25% O 20%

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Transcribed Image Text:Suppose I develop a new carbonated beverage that has Pomegranate, Orange, Watermelon, Strawberry, and Apple juice. I trademark the name POWSA (to rhyme with

YOWSA for an intended marketing campaign about how deliciously refreshing it is... POWSA!!). Then I perfect the tastiest ingredient mix with the essential acronym aligned

components... POWSA!!

I believe it is possible to get a $10 million annual SOM by selling 10 million cans at $1 each while the cost (at that scale of operation) will be sixty cents per can. However, I

need to invest $20 million in the marketing, so I need a VC or angel investor to buy an equity stake for $20 million. I pitch the idea of getting Sugar Ray Leonard to do the ads

for that "light-weight-sugar champion" POWSA Punch element of the marketing campaign. I claim the ad campaign with Sugar Ray would be effective with the $20 million

budget. Now suppose Warren Buffet agrees with all my numbers and also has a 10% opportunity cost of capital (he believes the $20 million of his money would otherwise

earn 10% annually in his other investment opportunities which have risks similar to my company). What % stake (share of total equity in my company, which has no debt) do I

need to offer him to get a fair deal for the $20 million equity raise? Assume my pitch is so good that there is potential interest from other investors (like Mr. Wonderful or Lori

Greiner) so Warren Buffet can't take advantage of me. What % stake will Warren and I settle on in exchange for his $20 million equity infusion? You can ignore taxes and use

the 60 cents per can as the only cost in the income statement-note that the $20 million marketing expense is being treated as an initial investment in brand value creation,

so its like the CapEx in my videos and its not expensed in the income statement.

60%

50%

O 10%

0 0 0 оо

○ 25%

O 20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education