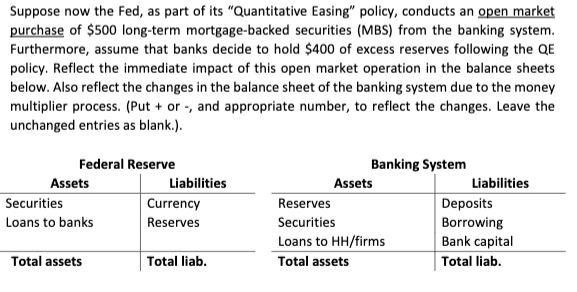

Suppose now the Fed, as part of its "Quantitative Easing" policy, conducts an open market purchase of $500 long-term mortgage-backed securities (MBS) from the banking system. Furthermore, assume that banks decide to hold $400 of excess reserves following the QE policy. Reflect the immediate impact of this open market operation in the balance sheets below. Also reflect the changes in the balance sheet of the banking system due to the money multiplier process. (Put + or -, and appropriate number, to reflect the changes. Leave the unchanged entries as blank.). Federal Reserve Banking System Assets Liabilities Assets Liabilities Securities Currency Reserves Deposits Borrowing Bank capital Loans to banks Reserves Securities Loans to HH/firms Total assets Total liab. Total assets Total liab.

Suppose now the Fed, as part of its "Quantitative Easing" policy, conducts an open market purchase of $500 long-term mortgage-backed securities (MBS) from the banking system. Furthermore, assume that banks decide to hold $400 of excess reserves following the QE policy. Reflect the immediate impact of this open market operation in the balance sheets below. Also reflect the changes in the balance sheet of the banking system due to the money multiplier process. (Put + or -, and appropriate number, to reflect the changes. Leave the unchanged entries as blank.). Federal Reserve Banking System Assets Liabilities Assets Liabilities Securities Currency Reserves Deposits Borrowing Bank capital Loans to banks Reserves Securities Loans to HH/firms Total assets Total liab. Total assets Total liab.

Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 16CQ

Related questions

Question

Transcribed Image Text:Suppose now the Fed, as part of its "Quantitative Easing" policy, conducts an open market

purchase of $500 long-term mortgage-backed securities (MBS) from the banking system.

Furthermore, assume that banks decide to hold $400 of excess reserves following the QE

policy. Reflect the immediate impact of this open market operation in the balance sheets

below. Also reflect the changes in the balance sheet of the banking system due to the money

multiplier process. (Put + or -, and appropriate number, to reflect the changes. Leave the

unchanged entries as blank.).

Federal Reserve

Banking System

Assets

Liabilities

Assets

Liabilities

Securities

Currency

Reserves

Deposits

Borrowing

Bank capital

Loans to banks

Reserves

Securities

Loans to HH/firms

Total assets

Total liab.

Total assets

Total liab.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc