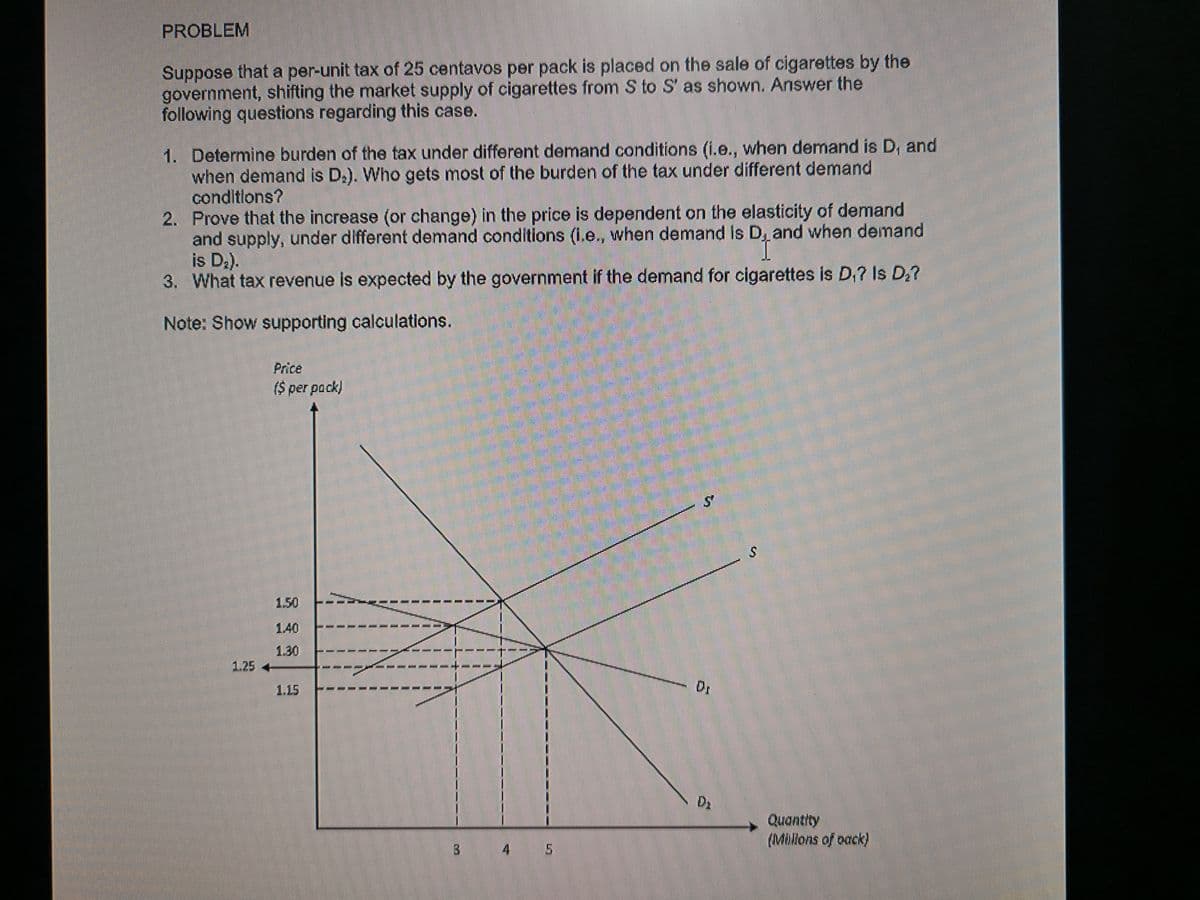

Suppose that a per-unit tax of 25 centavos per pack is placed on the sale of cigarettes by the government, shifting the market supply of cigarettes from S to S' as shown. Answer the following questions regarding this case. 1. Determine burden of the tax under different demand conditions (i.e., when demand is D, and when demand is D.). Who gets most of the burden of the tax under different demand conditlons? 2. Prove that the increase (or change) in the price is dependent on the elasticity of demand and supply, under different demand conditions (i.e., when demand is D, and when demand is D.). 3. What tax revenue is expected by the government if the demand for cigarettes is D,? Is D? Note: Show supporting calculations. Price ($ per pack) 1.50 1.40 1.30 1.25 1.15 DI D2 Quantity (Millons of oack) 3 4 5 S'

Suppose that a per-unit tax of 25 centavos per pack is placed on the sale of cigarettes by the government, shifting the market supply of cigarettes from S to S' as shown. Answer the following questions regarding this case. 1. Determine burden of the tax under different demand conditions (i.e., when demand is D, and when demand is D.). Who gets most of the burden of the tax under different demand conditlons? 2. Prove that the increase (or change) in the price is dependent on the elasticity of demand and supply, under different demand conditions (i.e., when demand is D, and when demand is D.). 3. What tax revenue is expected by the government if the demand for cigarettes is D,? Is D? Note: Show supporting calculations. Price ($ per pack) 1.50 1.40 1.30 1.25 1.15 DI D2 Quantity (Millons of oack) 3 4 5 S'

Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Costs Of Taxation

Section: Chapter Questions

Problem 3CQQ

Related questions

Question

1. Determine burden of the tax under different

when demand is D 2 ). Who gets most of the burden of the tax under different demand

conditions?

2. Prove that the increase (or change) in the price is dependent on the elasticity of demand

and supply, under different demand conditions (i.e., when demand is D 1 and when demand

is D 2 ).

3. What tax revenue is expected by the government if the demand for cigarettes is D 1 ? Is D 2 ?

Transcribed Image Text:PROBLEM

Suppose that a per-unit tax of 25 centavos per pack is placed on the sale of cigarettes by the

government, shifting the market supply of cigarettes from S to S' as shown. Answer the

following questions regarding this case.

1. Determine burden of the tax under different demand conditions (i.e., when demand is D, and

when demand is D.). Who gets most of the burden of the tax under different demand

conditlons?

2. Prove that the increase (or change) in the price is dependent on the elasticity of demand

and supply, under different demand conditions (1.e., when demand is D, and when demand

is D,).

3. What tax revenue is expected by the government if the demand for cigarettes is D.? Is D?

Note: Show supporting calculations.

Price

($ per pock)

1.50

1.40

1.30

1.25 4

ーーーーナ

------

---

1.15

D2

Quantity

(MAlions of oack)

13

4 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning