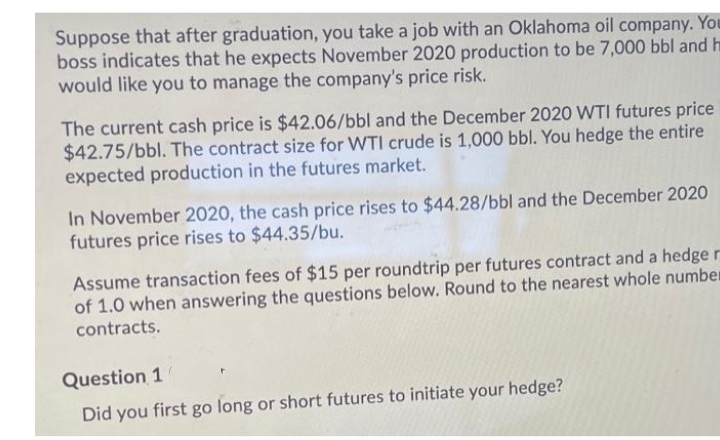

Suppose that after graduation, you take a job with an Oklahoma oil company. Yo boss indicates that he expects November 2020 production to be 7,000 bbl and would like you to manage the company's price risk. The current cash price is $42.06/bbl and the December 2020 WTI futures price $42.75/bbl. The contract size for WTI crude is 1,000 bbl. You hedge the entire expected production in the futures market. In November 2020, the cash price rises to $44.28/bbl and the December 2020 futures price rises to $44.35/bu. Assume transaction fees of $15 per roundtrip per futures contract and a hedge of 1.0 when answering the questions below. Round to the nearest whole numb- contracts. Question 1 Did you first go long or short futures to initiate your hedge?

Suppose that after graduation, you take a job with an Oklahoma oil company. Yo boss indicates that he expects November 2020 production to be 7,000 bbl and would like you to manage the company's price risk. The current cash price is $42.06/bbl and the December 2020 WTI futures price $42.75/bbl. The contract size for WTI crude is 1,000 bbl. You hedge the entire expected production in the futures market. In November 2020, the cash price rises to $44.28/bbl and the December 2020 futures price rises to $44.35/bu. Assume transaction fees of $15 per roundtrip per futures contract and a hedge of 1.0 when answering the questions below. Round to the nearest whole numb- contracts. Question 1 Did you first go long or short futures to initiate your hedge?

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 3BIC

Related questions

Question

Transcribed Image Text:Suppose that after graduation, you take a job with an Oklahoma oil company. You

boss indicates that he expects November 2020 production to be 7,000 bbl and h

would like you to manage the company's price risk.

The current cash price is $42.06/bbl and the December 2020 WTI futures price

$42.75/bbl. The contract size for WTI crude is 1,000 bbl. You hedge the entire

expected production in the futures market.

In November 2020, the cash price rises to $44.28/bbl and the December 2020

futures price rises to $44.35/bu.

Assume transaction fees of $15 per roundtrip per futures contract and a hedge r

of 1.0 when answering the questions below. Round to the nearest whole number

contracts.

Question 1

Did you first go long or short futures to initiate your hedge?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT