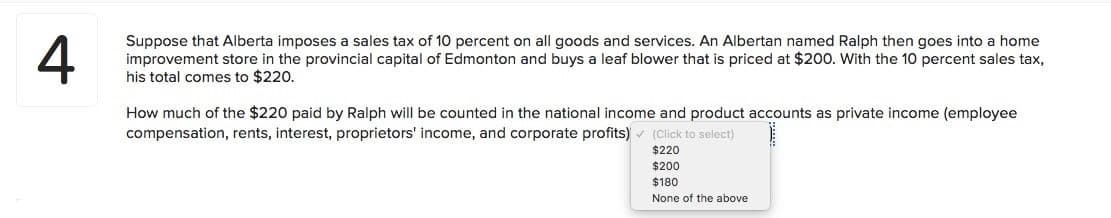

Suppose that Alberta imposes a sales tax of 10 percent on all goods and services. An Albertan named Ralph then goes into a home improvement store in the provincial capital of Edmonton and buys a leaf blower that is priced at $200. With the 10 percent sales tax, his total comes to $220. How much of the $220 paid by Ralph will be counted in the national income and product accounts as private income (employee compensation, rents, interest, proprietors' income, and corporate profits) (Click to select) $220

Suppose that Alberta imposes a sales tax of 10 percent on all goods and services. An Albertan named Ralph then goes into a home improvement store in the provincial capital of Edmonton and buys a leaf blower that is priced at $200. With the 10 percent sales tax, his total comes to $220. How much of the $220 paid by Ralph will be counted in the national income and product accounts as private income (employee compensation, rents, interest, proprietors' income, and corporate profits) (Click to select) $220

Chapter12: Federal Budgets And Public Policy

Section: Chapter Questions

Problem 3.6P

Related questions

Question

Transcribed Image Text:4

Suppose that Alberta imposes a sales tax of 10 percent on all goods and services. An Albertan named Ralph then goes into a home

improvement store in the provincial capital of Edmonton and buys a leaf blower that is priced at $200. With the 10 percent sales tax,

his total comes to $220.

How much of the $220 paid by Ralph will be counted in the national income and product accounts as private income (employee

compensation, rents, interest, proprietors' income, and corporate profits) v (Click to select)

$220

$200

$180

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you