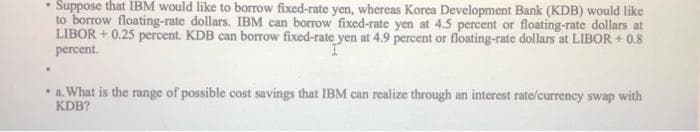

•Suppose that IBM would like to borrow fixed-rate yen, whereas Korea Development Bank (KDB) would like to borrow floating-rate dollars. IBM can borrow fixed-rate yen at 4.5 percent or floating-rate dollars at LIBOR +0.25 percent. KDB can borrow fixed-rate yen at 4.9 percent or floating-rate dollars at LIBOR +0.8 percent. . a. What is the range of possible cost savings that IBM can realize through an interest rate/currency swap with KDB?

Q: You have estimated that your vehicle will need to be replaced 10 years from now at a cost of K120,…

A: Compound = quarterly = 4 Time = t = 10 * 4 = 40 quarter Future value = fv = K120,000 Interest rate =…

Q: You’re trying to determine whether or not to expand your business by building a new manufacturing…

A: To determine capital spending priorities, the ARR formula is employed. It is employed by businesses…

Q: Before recommending a credit line amount to seek from First Bank, determine the following: What…

A: When determining credit line amount to seek from a bank, it is important to consider a variety of…

Q: A credit union is offering a $425,000 30 year loan with an annual rate of 4.1% with 1.4 points or…

A: The number of months refers to the period to be taken to recover the initial investment made by the…

Q: 2. What is the major difference in the obligation of one with a long position in a futures (or…

A: The main difference between a futures (or forward) contract and an options contract is that a buyer…

Q: How to calculate PMT, P/Y and C/Y

A: As per the given information: The time value of money concept states that earlier receipts are more…

Q: Analyse apple Working capital

A: Working capital is a financial metric that measures a company's ability to meet its short-term…

Q: A financial obligation requires payments of $200 today, $250 in three years, and $550 in five years.…

A: The concept of TVM states that the money earned earlier has more value than the same amount earned…

Q: Jimenez Enterprises recently paid a dividend of $1.95. It currently expects to have a growth rate in…

A: Current dividend = d0 = $1.95 Growth rate for first two years = G = 8% Constant growth rate = g = 4%…

Q: Remy obtains a 30-year mortgage in the amount of $625,000 for a co-op. She secures a 7/1 ARM at an…

A: ARM is a type of variable interest loan, where the interest amount changes after the initial period.…

Q: Assuming all other variables stay the same, an increase in accounts payable would cause cash flow…

A: Accounts payable is one of the current liability being incurred in business. It means goods and…

Q: Duo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 4 5 Cash Flow -$…

A: The modified rate of return is a financial tool used to determine the effectiveness of investment…

Q: Caleb purchased a house for $300,000. He made a down payment of 25.00% of the value of the house and…

A: Loan: It represents the amount that will be borrowed by the borrower for the purpose of expanding…

Q: Compute the risk and return of the above two stocks and justify using your answers as well as any…

A: To calculate the expected return and risk of both stocks, we need to first calculate the weighted…

Q: The preferred stock of Clara Inc. has a par value of K100 and a K1 dividend payout per month. You…

A: Annual dividend per share = Dividend per month×Number of months in a year = K1×12 = 12K

Q: A man wants to set up a 529 college savings account for his granddaughter. How much would he need to…

A: Annual Deposit is that amount which is required to deposit by investor every year for receiving the…

Q: 17. One year ago, your company purchased a machine used in manufacturing for $110,000. You have…

A: The process that analyzes and evaluates any project or investment's feasibility and profitability is…

Q: Bond Valuation with Annual Payments Jackson Corporation's bonds have 9 years remaining to maturity.…

A: A bond is a debt instrument that carries a fixed rate of interest. The market price of bonds is the…

Q: 1. Outline the key project activities that your team will use/do to properly initiate or start the…

A: NOTE; Up to 3 Sub question can only be Solve due to Honour code. Upload again remaining sub…

Q: For a capital investment project, a net present value (NPV) of $500 indicates that the: Multiple…

A: Capital budgeting refers to the project evaluation methodology used extensively by businesses. There…

Q: 5. ABC Inc. had the following data for last year: Net income = $1000; Net operating profit after…

A: Formula for Free Cash Flow=NOPAT - Net Investment in Working Capital Working Note#1 Calculation…

Q: DLR Rheosystems makes high performance rotational viscometers capable of steady shear and yield…

A: The amount that the company can spend is the sum of PV of future payments. The PV of each payment…

Q: Henning Ltd is involved in the manufacture of pharmaceutical products and is currently considering…

A: Net Present Value is a capital budgeting techniques which help in decision making on the basis of…

Q: You are a tenant who pays rent of CAD 1,200 per month. At year-end, you realize you only made 11…

A: The proper accrual amount to set up at year-end is the amount of rent owed but not yet paid, which…

Q: A 10 year 8% coupon bond with face value 100 sells for 90 and a 10 year 4% coupon bond with face…

A: In this problem, we have to buy ( long ) one bond and sell ( short ) the other bond so that we earn…

Q: Indicate whether each of the following statements is true or false. Support your answers with the…

A: The cost of capital is the rate of return that investors require to invest in a company's…

Q: You currently own 2,000 shares of Industrial Industries stock. You purchase the stock for $128.34…

A: Holding period return on stock is calculated below Holding period return = P1-P0+D1P0 Where, P1 is…

Q: X and Y are offered the rates (per annum) below on a $5 million 10-year investment. X needs fixed…

A: An interest rate swap is when two parties want either the fixed or the floating rate. In the case…

Q: Table 9.2 Average Returns for Bonds 1950 to 1959 1960 to 1969 1970 to 1979 1980 to 1989 1990 to 1999…

A:

Q: (a) The finance charge is $ (Round to the nearest dollar as needed.)

A: To determine the finance charge, we first need to determine the loan amount. This can be calculated…

Q: Tuition of $2075 will be due when the spring term begins in 6 months. What amount should a student…

A: Time value of money is one of the important concept of finance which says that a dollar amount…

Q: You must decide whether to buy a new car for $19,000 or lease the same car over a three-year…

A: Cost of buying refers to the amount that is incurred while purchasing an asset from the market. It…

Q: ROE Net Income/Shareholder equity Retention Retained earning/net income SGR Retention ratio x ROE…

A: Net income is the income generated by the company after the adjustment of all the direct and…

Q: What are three things that can lower your credit score?

A: A credit report is a detailed record of an individual's credit history, including information on…

Q: Is there any cricket organization that uses corporate, public, private, equity, or debt financing?

A: The area of finance known as corporate finance is focused on how businesses handle capital…

Q: Consider the following cash flows: Year Cash Flow 0 −$ 29,000 1 14,700 2 14,200 3 10,600 What is…

A: Profitability index is a measure ratio between present value of cashflows and the initial…

Q: An electric motor has a cash price of Php 8000. It can also be bought on installment basis with down…

A: Lease Installment is that amount which is paid by the lessor to lessee at fix time period. It…

Q: a) The higher the proportion of equity in a company’s overall capital structure, the higher return…

A: Equity represents ownership in a company, and equity holders bear more risk than debtholders. This…

Q: Which of the following is a consequence of inflation a. An increase in economic growth b. An…

A: Inflation defines the changes made in the rising price of goods or services in a certain period of…

Q: Mett Co. is planning to develop a new product. A year after the launch of the product, it can…

A: Initial Investment = £90,000 Cost of capital = r = 6%

Q: Is Apple in good financial standing in 2022 ? The corporate finance manager strategies and actions…

A: Apple Inc., is an American multinational technology company founded on April 1, 1976 by Steve Jobs,…

Q: Determine the present value of an increasing perpetuity-due with annual payments starting at 100 and…

A: An annuity is a payment series that provides a periodic sum to the annuity holder in exchange for a…

Q: Given a Risk Free Rate (RFR) of 15%, draw the Security Market Line (SML) clearly plotting the two…

A: The Security Market Line (SML) is a graphical representation of the Capital Asset Pricing Model…

Q: A bond is priced at 1169 and has a YTM of 0.055 when interest rates suddenly change by -80 basis…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Q: A hair stylist obtains a home loan for $411,000 at an annual interest rate of 5.25% compounded…

A: To find the monthly mortgage payment, we can use the formula: M = P [ i(1 + i)^n ] / [ (1 + i)^n –…

Q: The optimal credit utilization rate is 50% - 70%. O True False

A: A credit score is a numerical representation of an individual's creditworthiness, based on their…

Q: What is the term structure of interest rates? What is a yield curve? At any given time, how would…

A: Bonds are fixed-income assets that serve as a representation of investor loans to borrowers…

Q: A 5-year bond has a coupon rate of 6.8% and pays coupons semi-annually. If the required return is…

A: The annual income a bondholder can expect while holding a bond is called the coupon rate. The value…

Q: calculate the approximate convexity for this bond.

A: Convexity of a bond measures the curvature of modified duration. Modified duration measures the…

Q: Determine the price of a single bond given the following information. Round your final answer to two…

A: Bonds are fixed-income securities. It is important for the investors to identify the correct price…

9

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- assuming japan to be the home country, suppose you have the following data: Japanese interst rate=1% p.a., Brazilian interest rate = 10% p.a. Spot rate=0.025BRL/Yen, 1 year forward rate=0.026BRL/yen 1). Compute the annualized forward premium/discount on Yen b). Compute the annual interest rate differential between countries c). is tere a possibilit for earning risk-free profit? if soc compute the profit if you have an equivalent of 100 million Yen at your disposal. d). what is such a profit called? e). at what forward rate, the profit making arrangement will lose its lucrativeness?Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100 000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the LIBOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of LIBOR plus 2.5%. Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20bp between the rates at which it deals equally with them. Label the graph below and show all calculations leading to your conclusions.Suppose that you are the treasurer of IBM with an extra U.S. $1,000,000 to invest for six months. You are considering the purchase of U.S. T-bills that yield 1.810% (that’s a six month rate, not an annual rate by the way) and have a maturity of 26 weeks. The spot exchange rate is $1.00 = ¥100, and the six month forward rate is $1.00 = ¥110. The interest rate in Japan (on an investment of comparable risk) is 13 percent. What is your strategy?

- Convert the projected franc flows into dollar flows and calculate the NPV. (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) b-1. What is the required return on franc flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-2. What is the NPV of the project in Swiss francs? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) b-3. What is the NPV in dollars if you convert the franc NPV to dollars?Proposal #1 would extend trade credit to some customers that previously have been denied credit because they were considered poor risks. Sales are projected to increase by $200,000 per year if credit is extended to these new customers. Of the new accounts receivable generated, 7% are projected to be uncollectible. Additional collection costs are projected to be 3% of incremental sales (whether they actually end up collected or not), and production and selling costs are projected to be 80% of sales. Your firm expects to pay a total of 40% of its income after expenses in taxes. 1.Compute the incremental income after taxes that would result from these projections: 2.Compute the incremental Return on Sales if these new credit customers are accepted: If the receivable turnover ratio is expected to be 4 to 1 and no other asset buildup is needed to serve the new customers… 3.Compute the additional investment in Accounts Receivable 4.Compute the incremental Return on New Investment…Diamond Bank expects that the Singapore dollar will depreciate against the dollar from its spot rate of $.43 to $.42 in 60 days. The following interbank lending and borrowing rates exist: Lending Rate Borrowing Rate U.S. dollar 7.0% 7.2% Singapore dollar 22.0% 24.0% Diamond Bank considers borrowing 10 million Singapore dollars in the interbank market a nd investing the funds in dollars for 60 days. Estimate the profits (or losses) that could be earned from this strategy. Should Diamond Bank pursue this strategy?

- The manager believes that given the Fx change to £0.840$ and the price sensitivities, the local price can be increased 10% over the initial price. What will be the new price in euros? € How many units will be sold, and what is the resulting total contribution for the (a) low and (b) high price sensitivity scenarios? \table[[Price Increase Scenario,Sales Volume,Total Contribution],[(a) Low Price Sensitivity,units,$A company in country X with currency XSD is analyzing a potential investment in country Y with currency YSD. The best estimate is that YSD will be devalued in the international markets at an average of 3%. If the MARR of this company in country X is 23% what is the MARR that the company should use in country Y?You are the treasury department of a JFINEX Bank and your client has some excess Euros. If he wants to sell EUR to you, what will be your EUR buying rate if you want 0.020 spread assuming the inter-bank market quote is EUR/USD 1.1580 - 1.6100? 1.1560 1.5900 1.1380 1.6300

- Acacia Bank expects the euro to depreciate against the dollar and plans to take a short position in euros and a long position in dollars. Assume the following1. Interest rate on borrowed euros is 5 percent annualized2. Interest rate on dollars loaned out is 6 percent annualized3. Spot rate is 0.90 per dollar4. Expected spot rate in ten days is 0.95 per dollar5. Acacia Bank can borrow 10 millionDescribe the steps Acacia should take to profit from shorting euros and going long on dollars, show your calculations.Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and takes discounts. What is the average amount of accounts payable net of discounts? (Assume the $3.65 million of purchases is net of discounts—that is, gross purchases are $3,724,489.80, discounts are $74,489.80, and net purchases are $3.65 million.) Is there a cost of the trade credit the firm uses? If the firm did not take discounts but did pay on the due date, what would be its average payables and the cost of this nonfree trade credit? What would be the firm’s cost of not taking discounts if it could stretch its payments to 40 days?At what rate are you going to sell USD to minimize cost given Dollar Yen quotes from three counterparties? Bank A: 110.60-90; Bank B: 110.75-95; Bank C: 110.65-85 110.95 110.75 110.60 110.85 At what rate are you going to buy JPY to minimize cost given Dollar Yen quotes from three counterparties? Bank A: 110.60-90 Bank B: 110.75-95 Bank C: 110.65-85 110.95 110.75 110.60 110.85 Market is quoting: USD/AUD 1.35 – 1.50. As an intermediary between your client and the market, what will be your AUD buying rate from your corporate client if you want a spread of 5 pips? 1.40 1.30 1.55 1.45 The Philippine economy is expected to recover from pandemic as inflation and interest rates are expected to rise. If you are the bank, which of following strategies should you do to take advantage of this view? Borrow Long and Lend Short Lend Long and Borrow Short Borrow and Lend Long Borrow and Lend Short You took a long position on HKD when the prevailing market rate was: USD/HKD…