Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter10: Dynamic Change, Economic Fluctuations, And The Ad-as Model

Section: Chapter Questions

Problem 1CQ

Related questions

Question

i need in words (not handwritten) ... in your own words dont copy

i need plagrism free

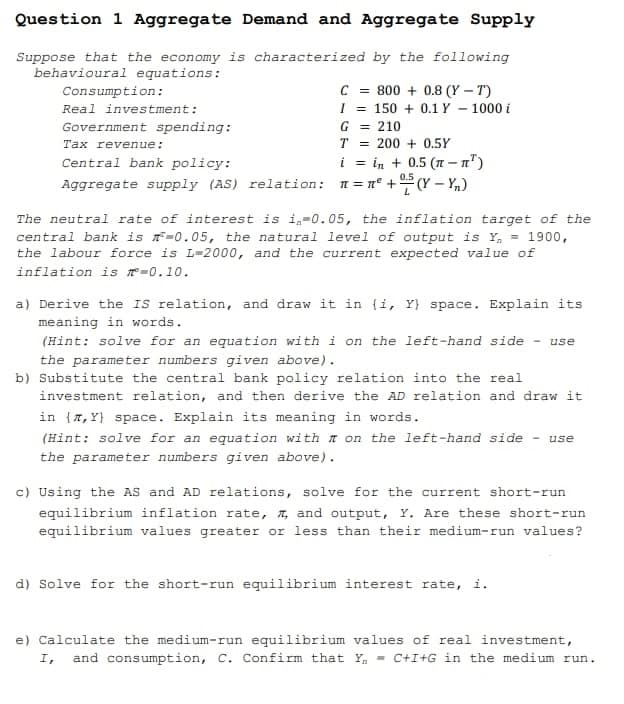

Transcribed Image Text:Question 1 Aggregate Demand and Aggregate Supply

Suppose that the economy is characterized by the following

behavioural equations:

C = 800 + 0.8 (Y – T)

I = 150 + 0.1 Y – 1000 i

G = 210

Consumption:

Real investment:

Government spending:

Tax revenue:

T

200 + 0.5Y

i = in + 0.5 (n – n")

0.5

Central bank policy:

%3D

Aggregate supply (AS) relation: 1= n° + (Y – Y,)

The neutral rate of interest is i,-0.05, the inflation target of the

central bank is n=0.05, the natural level of output is Y, = 1900,

the labour force is L=2000, and the current expected value of

inflation is T=0.10.

a) Derive the IS relation, and draw it in {i, Y} space. Explain its

meaning in words.

(Hint: solve for an equation with i on the left-hand side

use

the parameter numbers given above).

b) Substitute the central bank policy relation into the real

investment relation, and then derive the AD relation and draw it

in {7, Y} space. Explain its meaning in words.

(Hint: solve for an equation with m on the left-hand side

use

the parameter numbers given above).

c) Using the AS and AD relations, solve for the current short-run

equilibrium inflation rate, 7, and output, Y. Are these short-run

equilibrium values greater or less than their medium-run values?

d) Solve for the short-run equilibrium interest rate, i.

e) Calculate the medium-run equilibrium values of real investment,

and consumption, C. Confirm that Y, - C+I+G in the medium run.

I,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning