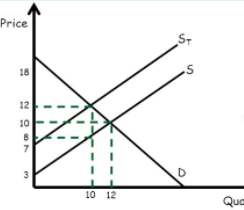

Suppose that the government imposes a tax on cigarettes. Use the diagram in the photo below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after tax. a. Calculate the consumer surplus before the tax b. Calculate the producer surplus before tax c. For the market for cigarettes with the tax. Indicate: The tax Price paid by consumers Price received by producers Quantity of cigarettes sold

Suppose that the government imposes a tax on cigarettes. Use the diagram in the photo below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after tax. a. Calculate the consumer surplus before the tax b. Calculate the producer surplus before tax c. For the market for cigarettes with the tax. Indicate: The tax Price paid by consumers Price received by producers Quantity of cigarettes sold

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter14: Pricing Techniques And Analysis

Section: Chapter Questions

Problem 1.1CE: What life cycle cost concept begins raising concerns by year 5 with any electric vehicle (EV)? If...

Related questions

Question

1. Suppose that the government imposes a tax on cigarettes. Use the diagram in the photo below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after tax.

a. Calculate the

b. Calculate the

c. For the market for cigarettes with the tax. Indicate:

- The tax

Price paid by consumers- Price received by producers

- Quantity of cigarettes sold

Transcribed Image Text:Price

18

12

10

3

D

10 12

Qua

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning