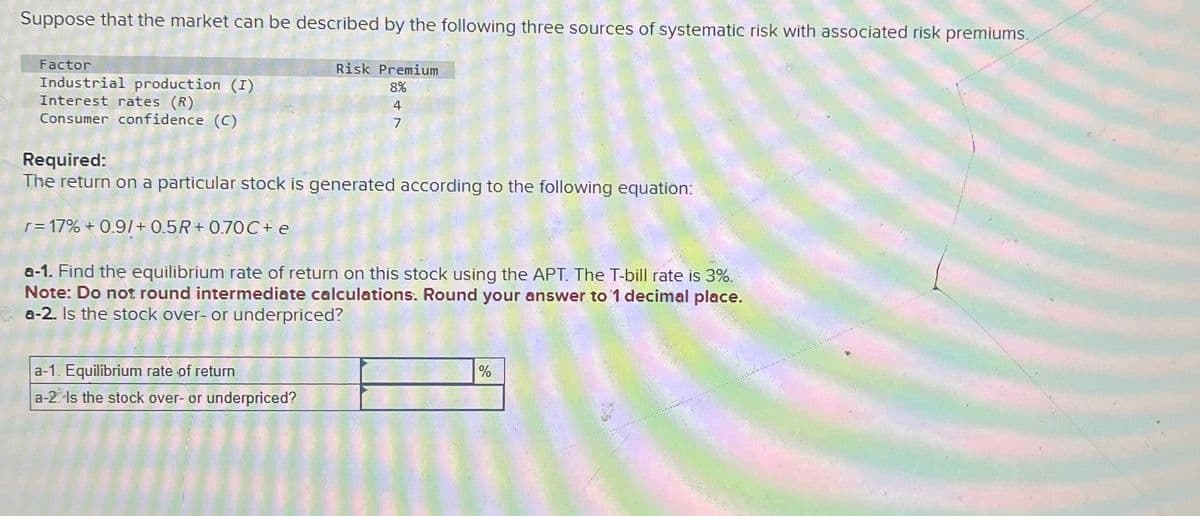

Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Risk Premium Factor Industrial production (I) Interest rates (R) Consumer confidence (C) Required: 8% 4 7 The return on a particular stock is generated according to the following equation: r = 17% +0.9/+0.5R+0.70 C+ e a-1. Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 3%. Note: Do not round intermediate calculations. Round your answer to 1 decimal place. a-2. Is the stock over- or underpriced? a-1. Equilibrium rate of return a-2 Is the stock over- or underpriced? %

Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Risk Premium Factor Industrial production (I) Interest rates (R) Consumer confidence (C) Required: 8% 4 7 The return on a particular stock is generated according to the following equation: r = 17% +0.9/+0.5R+0.70 C+ e a-1. Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 3%. Note: Do not round intermediate calculations. Round your answer to 1 decimal place. a-2. Is the stock over- or underpriced? a-1. Equilibrium rate of return a-2 Is the stock over- or underpriced? %

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums.

Risk Premium

Factor

Industrial production (I)

Interest rates (R)

Consumer confidence (C)

Required:

8%

4

7

The return on a particular stock is generated according to the following equation:

r = 17% +0.9/+0.5R+0.70 C+ e

a-1. Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 3%.

Note: Do not round intermediate calculations. Round your answer to 1 decimal place.

a-2. Is the stock over- or underpriced?

a-1. Equilibrium rate of return

a-2 Is the stock over- or underpriced?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning