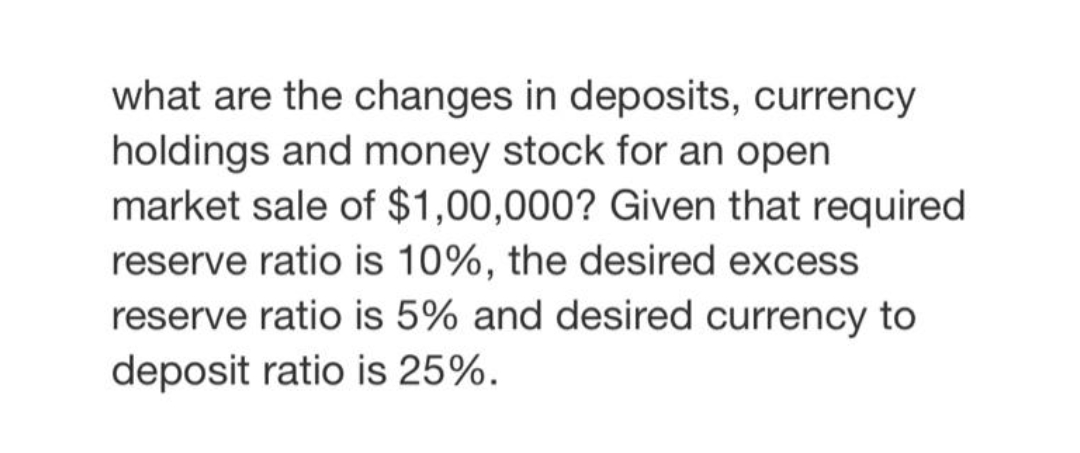

what are the changes in deposits, currency holdings and money stock for an open market sale of $1,00,000? Given that required reserve ratio is 10%, the desired excess reserve ratio is 5% and desired currency to deposit ratio is 25%.

Q: is a measure of how much money can be afforded for investment in excess of cost O a. Future Cost O b...

A: Future Worth The future cost is how much is the costs, that would come in the life years and how muc...

Q: Please answer fast

A: Given the slope = 12 - 13qp = 6q = 4 a. Income = pq = Rslope = dRdq=12-13q∫dR=∫12-13qdqR = 12q - 132...

Q: (Table: Four persons) The table lists the minutes that it will take four people to wash a car and to...

A: Opportunity cost of washing a car = (Minutes takes to wash a car / Minutes takes to sort & fold ...

Q: Suppose the Bank o Englndwshes toresta ifiaton o ceses Bak Rate Whch of theflwing enswil n te artf t...

A: Answer: Bank rate refers to the rate at which the central bank of a nation lends to the commercial b...

Q: If, next year, the production possibilities curve passes through point W on which point on this year...

A: Production Possibility curve is the locus of different combinations of two goods that a country can ...

Q: 6. There is no safe hobby, is there? What could be healthier than gardening? Apparently, not-gardeni...

A: Given information

Q: Is the demographic transition a universal process?

A: Demographic transition:- The chronological transition from high population growth and high mortality...

Q: Currently, the federal minimum wage is set at $7.25 per hour. A survey conducted by Newsweekmagazine...

A: Minimum wage is defined as the equilibrium wage of workers which is fixed by the government and is p...

Q: The information on three different technologies named as q, v and x is listed in the table below. No...

A: With the use of technology, a firm can minimize its cost for production to get more profit.

Q: Christ Embassy Complete te hallowing coA schedules LOutPutiobal costAverage coA Marginal cost LCA CH...

A: "Since you have asked a question with multiple sub-parts, we will solve first three sub-parts for yo...

Q: For the following questions, make use of provided information. Since the peak of the pandemic shutdo...

A: Money supply means the supply of currency into the economy. It means the money moves by the Federal ...

Q: Given an economy is currently producing at $1.2T rGDP, natural rGDP is $1.3T, and the MPC is 0.9, th...

A: The output produced by the country is less than the potential output so there is a contractionary ga...

Q: Discuss it objectively

A: Through the movement of air in the atmosphere, the flow of water in rivers, and the migration of ani...

Q: Jun works every week and is paid by the hour. From each week’s paycheck a constant amount is taken o...

A: Jun worked 30 hours and had a take-home pay of $245.17. Another week she worked 40 hours and took ho...

Q: A company owes P 80,000, which includes the interest, to be paid one year from now. To provide for t...

A: Disclaimer: Since you have posted two questions, I am providing you with the answer to the first one...

Q: There are N sites that need protection (number them 1 to N). Someone is going to pick one of them to...

A: Number of sites requiring protection = N Therefore , probability of choosing any site by defender o...

Q: f lowering of fares reduces ailway's revenues and increasing of fares increases, then the demand for...

A: To find : Elasticity for demand of rail.

Q: titution offect and income effect to c

A: As per the question when there is any demand curve vertically straight this implies the commodity to...

Q: Refer to the graph below. It shows 2 indifference curves: for person A and for person B. Which perso...

A: Choice under uncertainty is the decision of an individual or any firm where outcomes are uncertain a...

Q: Explain why the FOMC is expected to increase its target overnight interest rate.

A:

Q: Which of the following will NOT shift the AD curve? Oa. O a. Changes in consumer confidence O b. Cha...

A: Aggregate demand curve is a downward sloping curve which represents a total demand of final goods an...

Q: The Filthy Chemical Company dumps 100 tons of pollutants every year in the Pristine Lake. The Trout ...

A: Total amount of waste dump in the lake = 100 tons Constant average cost for cleaning the pollutants...

Q: Complete solution for full credit. Mariel owes P35,000 in 5 months with interest at 9% and another P...

A: Introduction 1st 5 months payment value of Mariel's money: = P (1 + rt) = 35,000 ( 1 + 9100 × 512) =...

Q: A firm has a production function Q in function of K and L that can be written as follows: Q = 2/K/L ...

A: The production function is a model that expressed the relationship between inputs (like labor and ca...

Q: The Uniform Commercial Code contains both remedies for express and varranties. 1) True 2) False

A: Numerous organizations are associated with a lot of goods, or versatile property. Products are thing...

Q: Arbitrage trading strategy implies that O Arbitrage opportunities will continue to exist in equilibr...

A: A trading strategy is a method for making systematic purchases and sales of securities. A trading st...

Q: Maia and Yousef just got married. Yousef recently graduated and received a master's degree in childh...

A: Here, when analyzing the given information it can be said that Mala and Yousef are unemployed due to...

Q: Has the researcher tested for representativeness: comparing the sex distribution ofthe population an...

A: A representative sample is a subset of a population that attempts to correctly reflect the larger gr...

Q: When a small country imposes a tariff on an imported good, domestic consumers bear of the statutory ...

A: In an economy, statutory burden refers to the tax that actually paid by the market participant, and ...

Q: What type of social research methodology would you use to study the relationship between income and ...

A: There are different type sof social and economic researchers methodology to derive the relationship ...

Q: Suppose market demand for oil is Q(P) = 100 – 0. 75P where Q is billions of barrels (BBL)or oil per ...

A: Yearly Market Demand : Q = 100 - 0.75 P => P = 133.33 - 1.33 Q Marginal Cost = 7Q2 - 3Q + 6 To...

Q: Suppose the Federal Reserve increases the amount of reserves by $150 million and the total money sup...

A: (a) There are an increase in the amount of reserves by $150 million and the total money supply incre...

Q: how price system affects the Industries pricing products and Services

A: Elasticity of demand and elasticity of supply are two things that affect the pricing for goods and s...

Q: OPaying higher wages tends to reduce the average experience level of a firm's workers. O Higher wage...

A: Theory of Efficiency wage : The theory of efficiency wage implies firms paying higher wage than the ...

Q: A competitive industry consists of 100 identical firms. The short run cost function of each firm is ...

A: Cost curve refers to the curve that shows the different levels of expenses that firms or producers i...

Q: Suppose that K(t+3)/N > K(t+1)/N, where K(t+3) is capital in period t+3 and K(t+1) is capital in per...

A: Capital is an input that is used to produce goods and services in the economy. It means more capital...

Q: Question 14 Marginal Social Cost (dollars per course) Quantity (Number of Students) Marginal Private...

A: We know that the social optimal quantity is the level of quantity at which the social marginal benef...

Q: A country is the only production site in the world for "hyperhoney infinite pasta", a wonderful prod...

A: International economics is concerned with the effects of international differences in productive res...

Q: A firm has a production function Q in function of K and L that can be written as follows: Q = 2/K/L ...

A: Here, we have Production function, Q=2KL or Q=2K0.5L0.5 Rental rate of a unit of capital is given b...

Q: Is the relationship between total fertility rate and the rate of enrollment of girls in secondary sc...

A: Yes, the overall fertility rate and the rate of female secondary school enrolment are linked.

Q: Elinor Ostrom and Oliver Williamson are the Nobel Prize Laureates in Economics in 2009. Do you know ...

A: To find : Year of publish.

Q: Which of the following best describes an contractionary monetary policy? * a. more spending b. more...

A: Monetary policy is a policy used by the Federal reserve to influence money supply and interest rate ...

Q: 10. A job-search model of the natural rate of unemployment This question refers to the job search mo...

A: Here, given information is: Separation rate (s)= 0.03 Job finding rate (f)= 0.12 Labor force= 200 m...

Q: If the chain-weighted growth rate of real GDP from 2007 to 2008 is 13% using 2007 as the reference y...

A: The chain-weighted growth rate is defined as the ratio of GDP values of two adjacent years calculate...

Q: A. Low-cost Carriers vs. Legacy Carriers B. Pricing and Demand C. Airline Costs

A: Low-cost carriers are budget airlines whereas legacy carriers are luxury airlines.

Q: Christ Embassy Complete the hollowing coA schedules LoutPutTodalcostlAverage coA Marginal cost LCA C...

A: NOTE: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: Describe the labour's and worker's rights act pertaining to the healthcare system

A: In the healthcare system, the rights and the duties of the employees are limited to taking care and ...

Q: Notice the major differences between our Keynesian Cross (in your chapter 9 appendix) and the Macro ...

A: When short run aggregate supply (SRAS) equals aggregate demand, it is called short run macroeconomic...

Q: The most efficient scale of production of a firm is where

A: To find : Which is most effective case of efficient scale of production.

Q: 4. Which two ministries use up more of the provincial budget than all the others combined?

A: When product or a particular service is manufactured, cost takes place and process of business foll...

Step by step

Solved in 2 steps

- Calculate the legal reserve requirement if initial deposit of $300 million lead to creation of total deposits of $1800 millionDefine in-the-money and out-of-the-money swaps.Determine whether each of the following is included in both M1 and M2 or M2 only: a. a Connecticut quarter b. a savings account at a local savings bank c. a share draft account at a credit union d. money market deposit accounts e. American Express travelers’ checks

- Which of the following is not counted in M2? A. U.S. Savings account balances B. U.S. Checking account balances C. All are counted in M2 D. U.S. currency in circulation overseas (in foreign countries) E. U.S. currency in circulationCompare the tools of controlling the money supply—open market operations, loans to financial institutions, and changes in reserve requirements—--on the basis of the following criteria: flexibility, reversibility, effectiveness, and speed of implementation.All items included in ____ are also included in ____, but ____ are not included in either M1 or M2 M2; M1; U.S. Treasury bills and cash advances M2; M1; small time deposits and savings accounts M1; M2; cash advances and U.S. Treasury bills M1; M2; Negotiable Order of Withdrawal accounts

- Which two of the following financial insitituions offer checkable deposits included within the M1 money supply : mutual fund companies ; insurance companies ; commercial banks ; securities firms; thrift instituions ? which of the following is not included in either M1 OR M2: currently held by the public; checkable deposits money market mutual fund balances ; small - denominated (less than $100,000) time deposits ; currency held by banks ; savings deposits?BOP Transactions. Identify the correct BOP account for each of the following transactions. Identify the correct BOP account for each of the following transactions. Specify credit or debit as well. 1 A Japanese auto company pays the salaries of its executives working for its U.S. subsidiaries.2 A U.S. tourist pays for a restaurant meal in Bangkok.3 A U.K. corporation purchases a euro-denominated bond from an Italian MNE.M1 includes currency, checkable deposits, and traveler's checks, but M2 does not include M1 in any way. True False

- In defining money as M1, economists exclude time deposits because: the intrinsic value of time deposits is nil. the purchasing power of time deposits is much less stable than that of checkable deposits and currency. they are not directly or immediately a medium of exchange. they are not recognized by the Federal government as legal tender.46 Excess reserves are equal to: a. required reserves minus loans. b. demand deposits multiplied by required reserves. c. demand deposits minus loans. d. demand deposits minus required reserves. e. demand deposits plus required reserves.Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars. The maximum amount by which the commercial banking system can expand the supply of money by lending is Multiple Choice a. $250 billion. b. $600 billion. c. $450 billion. d. $350 billion.