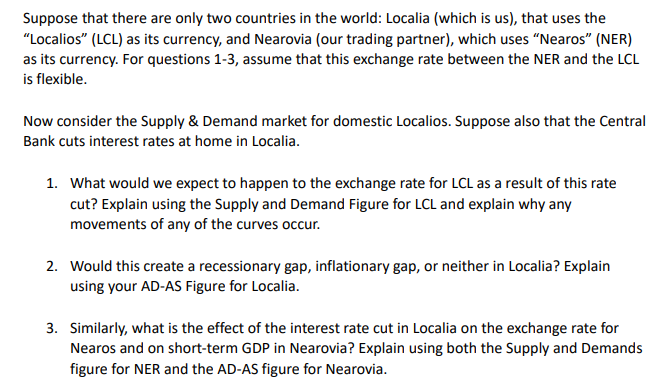

Suppose that there are only two countries in the world: Localia (which is us), that uses the "Localios" (LCL) as its currency, and Nearovia (our trading partner), which uses “Nearos" (NER) as its currency. For questions 1-3, assume that this exchange rate between the NER and the LCL is flexible. Now consider the Supply & Demand market for domestic Localios. Suppose also that the Central Bank cuts interest rates at home in Localia. 1. What would we expect to happen to the exchange rate for LCL as a result of this rate cut? Explain using the Supply and Demand Figure for LCL and explain why any movements of any of the curves occur. 2. Would this create a recessionary gap, inflationary gap, or neither in Localia? Explain using vour AD-AS Figure for Localia

Suppose that there are only two countries in the world: Localia (which is us), that uses the "Localios" (LCL) as its currency, and Nearovia (our trading partner), which uses “Nearos" (NER) as its currency. For questions 1-3, assume that this exchange rate between the NER and the LCL is flexible. Now consider the Supply & Demand market for domestic Localios. Suppose also that the Central Bank cuts interest rates at home in Localia. 1. What would we expect to happen to the exchange rate for LCL as a result of this rate cut? Explain using the Supply and Demand Figure for LCL and explain why any movements of any of the curves occur. 2. Would this create a recessionary gap, inflationary gap, or neither in Localia? Explain using vour AD-AS Figure for Localia

Chapter29: International Finance

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Suppose that there are only two countries in the world: Localia (which is us), that uses the

"Localios" (LCL) as its currency, and Nearovia (our trading partner), which uses “Nearos" (NER)

as its currency. For questions 1-3, assume that this exchange rate between the NER and the LCL

is flexible.

Now consider the Supply & Demand market for domestic Localios. Suppose also that the Central

Bank cuts interest rates at home in Localia.

1. What would we expect to happen to the exchange rate for LCL as a result of this rate

cut? Explain using the Supply and Demand Figure for LCL and explain why any

movements of any of the curves occur.

2. Would this create a recessionary gap, inflationary gap, or neither in Localia? Explain

using your AD-AS Figure for Localia.

3. Similarly, what is the effect of the interest rate cut in Localia on the exchange rate for

Nearos and on short-term GDP in Nearovia? Explain using both the Supply and Demands

figure for NER and the AD-AS figure for Nearovia.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc