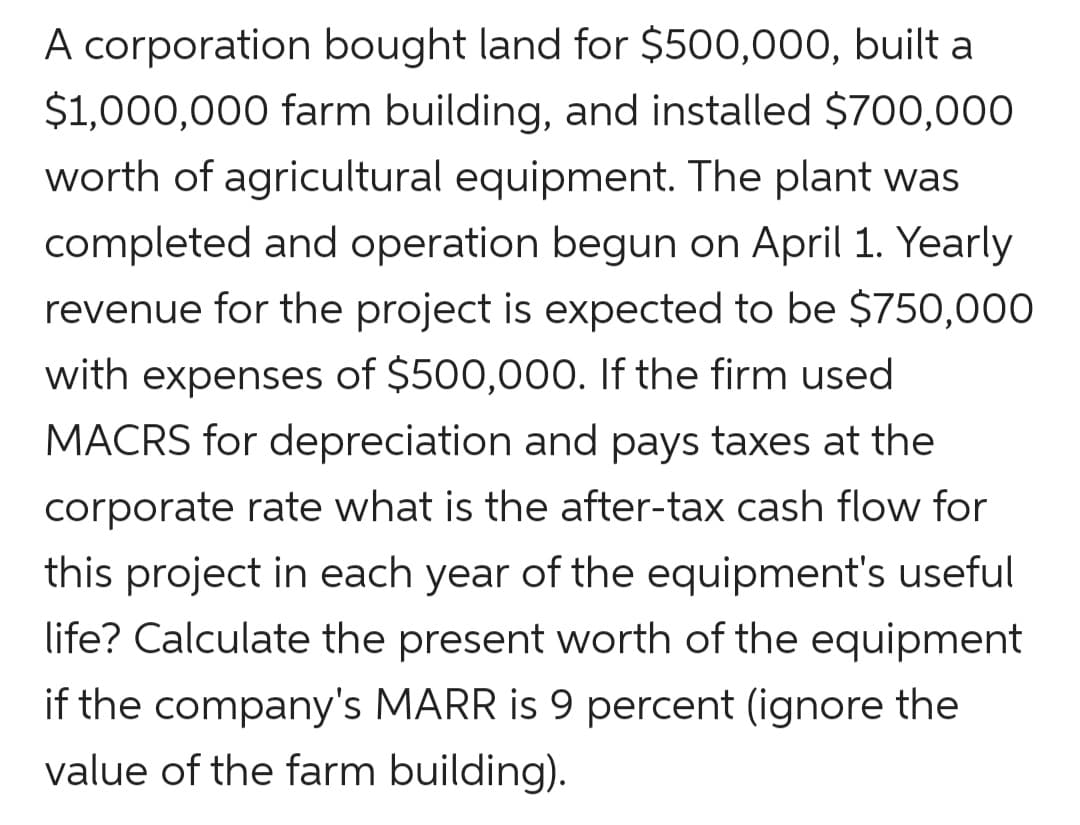

MACRS for depreciation and pays taxes at the corporate rate what is the after-tax cash flow for this project in each year of the equipment's useful life? Calculate the present worth of the equipment if the company's MARR is 9 percent (ignore the

Q: globalization

A: Some would contend that globalization has spread riches and prompted the improvement of ways of life…

Q: Persuasive essay about money laundering in the Philippines 1000 words

A: Money laundering is the illicit technique of making significant sums of money obtained through…

Q: What is new in America’s health care reform law?

A: The Health Care Reform Law enacted in March 2010 brought the Affordable Care Act in America.

Q: Aggregate price level LRAS SRAS, AD2 AD AD Real GDP Y2 Ref 13-9

A: Equilibrium output level occurs at the intersection point of AD and SRAS. Long-run aggregate supply…

Q: If Gross National Product at market prices is RM200 billion, depreciation is RM25 billion and…

A: Given information GNP at market price = RM 200 billion Depreciation = RM 25 billion Indirect taxes =…

Q: QUESTION 6 In Diamond Dybvig (DD) model of bank run, each person is either an early type, or a late…

A: Dybvig model is utilized for an inevitable methodology among the depositors and its bank run model…

Q: Discuss the concepts of internal and external supply chain integration, and explain why eachof these…

A: External supply chain integration:- External supply chain integration is the process of working…

Q: Goods that are rival in consumption include both club goods and public goods. public goods and…

A: In economics, rivalry of a good explains it's characteristics about the availability of a good when…

Q: E. A producer has two production processes, both using a single input, r, and both producing the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Suppose the government borrows $20 million more next year than this year. a. Draw and fully label a…

A: Answer: If the government borrows $20 million more next year it means the government revenue falls…

Q: Suppose for commodity X, the price elasticity of demand is 3 and the Marginal cost is RM 200.…

A:

Q: A company uses a type of truck which costs P2M, with life of 3 years and a final salvage value of…

A: Salvage value is the assessed book worth of a resource after deterioration is finished, in view of…

Q: The world price of a ton of steel is $100. The price of a ton of steel in Mexico was S250 before…

A: The cheaper import reduces the price of good in the market. the domestic price becomes equal to the…

Q: What is included in U.S. aggregate demand? a) all spending by consumers, firms, the government, and…

A: The curve that depicts quantities of goods and services being produced in an economy at various…

Q: American Heart Association (AHA) announcement about corn Change in the demand for barley Change in…

A: Answer- (a) Change in the demand for barley.

Q: If the minimum wage is set above the equilibrium wage, the quantity of labor supplied by workers is…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: explain how, using elasticity as the basis for your answer, it can be determined whether two goods,…

A: Elasticity is used to compute the relationship between mean two components, it determines the change…

Q: Question 1 A toy manufacturing company is selling pokemon figures in Latin America, generating…

A: Future worth is the worth of a present resource sometimes not too far off in view of an accepted…

Q: are there in the long-run equilibrium? There are () vendors in the long run. d) Suppose the city…

A: The correct answer is given in the second step.

Q: Define equilibrium and steady state. Can we find a steady state for each dynamic general equilibrium…

A: Equilibrium is a state where the pace of the forward response approaches the pace of the backward…

Q: e difference between the top and the tom is 10 percent) what is the maximum ssible change in the…

A: The interest rate is the sum a bank charges a borrower and is a level of the head the sum advanced.

Q: A firm is considering purchasing computers that will reduce annual costs by P40,000. The Computers…

A:

Q: Marginal Cost to Eliminate (Dollars) Firm First Unit Second Unit Third Unit Fourth Unit A 54 67 82…

A: 1) Given the marginal cost of each firm, in order to reduce 10 units of pollution, the first two…

Q: Under which of the following scenarios is a highway, owned by the government, considered a club…

A: Club good refers to a specfiic type of goods that are non-rival in nature, but they are excludable…

Q: If the real exchange rate for the dollar is above the equilibrium level, the quantity of dollars…

A: The economics as a study is based upon the idea that the resources which are present with the…

Q: U, Uz U3 U4 Us 20 28 42 60 Income Currently the consumer has $60. If there is an accident their…

A: Given information Income=60 When accident income=20 Probability of accident=0.45

Q: monopolist has a (high/low) price elasticity of demand for its output. A monopoly is always…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: What is uninformed “noise” trading associated with? a. Negative autocorrelation in stock returns…

A: Market noise: Market noise can either generate profit or may lead to generate loss depending on the…

Q: Demand in a domestic market is represented by the curve P = 200 - Q. Supply is represented by P = 20…

A: Equilibrium is achieved at a point where demand curve intersect the supply curve. When the world…

Q: A technological advance leads to a shift in O a) both SRAS and LRAS. O b) only aggregate demand…

A: A technology advancement leads to a shift in Correct Answer: Option (a) both SRAS and LRAS This is…

Q: Price level (P) LAAS SRAS, -SRAS, AD AD, Real GDP Based on the graph, which points represent…

A:

Q: Describe the ways the various components of GDP were impacted by the pandemic? Plz do fast asap.

A: GDP refers to the total production of goods and services in an economy during a year. Components of…

Q: A decrease in proportional consumption tax makes the budget constraint A. flatter…

A: Budget constraint is combination of consumption which someone can afford with given prices and…

Q: A computer engineer is considering the purchase of a laptop whose operating characteristics are…

A: Fundamentally, engineering economics entails defining, estimating, and evaluating economic…

Q: Why is the United States and Iran conflict in the strait of hormuz important? and why does it…

A: A series of naval encounters between the US and Iran in the Strait of Hormuz occurred in December…

Q: Assume that the inputs are the perfect complement, if the price of one input (i.e wage rate) has…

A: Inputs are complement when they are used together in a given proportion.

Q: Goodson Healthcare purchased a new sonogram imaging unit for $300,000 and a truck body and chassis…

A: * SOLUTION :- (3)

Q: III. True/False - Explain: 1) According to Walras Law excess demand in the money market would also…

A: 1. According to Walras law excess demand in money market would also be associated with an excess…

Q: Who doesn't love food trucks? Imagine you are being offered to invest in a food truck as part of a…

A: Given information First cost=$100000 Salvage value=$5000 O& M cost =$5000 Overhaul cost=$20000…

Q: Suppose that next year 150,000 existing jobs in the economy are eliminated through layoffs and plant…

A: Given information: 150,000 existing jobs in the economy are eliminated through layoffs and plant…

Q: what is explicit cost with example

A: The correct answer is given in the second step .

Q: Compute the total cost per year of the following pair of expenses. Then complete the sentence: On an…

A: First set of expenses as a percentage of the second set of expenses = [First set of expenses per…

Q: Using examples specific to tEl Salvador, discuss TWO positive impacts and TWO negative impacts that…

A: El Salvador is a country in Central America. For measuring the overall macroeconomic performance of…

Q: For the cash flows shown, determine the incremental cash flow between machines B and A. Machine A В…

A: The net cash flow of every investment consists of an initial cost, next comes the operating cost…

Q: If the price of the product is GH¢2.00 and cost per unit of labour is GH¢10.00, Complete the table…

A: The labor cost per unit is obtained by multiplying the direct labor hourly rate by the time required…

Q: 4. Two investments, A and B, produce a continuous income stream of 3%, compounded continuously. The…

A: In this question:- The rate of flow of income from investment A is ft=3000e0.04t and the rate of…

Q: Here is a chance to figure out technical material as a group. What are the key features and…

A: The Central Bank is the prime bank of any economy since without it there would exist no institution…

Q: Yearly demand for water by residents and businesses in the city of Black Bear Lake is equal to Qo…

A: According to the question, The yearly demand : QD = 2000 - 10P , where QD is millions of gallons…

Q: 24. If you were to consider the cost of funds in a payback period calculation, you would have to…

A: Since you have posted multiple questions, we will solve first question for you. In case you want any…

Step by step

Solved in 2 steps

- A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm uses the straight-line depreciation method with a zero salvage value and has a (marginal) income tax rate of 40 percent. The firms cost of capital is 12 percent. Compute the IRR and the NPV. Should the firm accept or reject the project?Omar Shipping Company bought a tugboat for $75,000 (year 0) and expectedto use it for five years after which it will be sold for $12,000. Suppose the companyestimates the following revenues and expenses from the tugboat investmentfor the first operating year:Operating revenue $200,000Operating expenses $8400Depreciation $4000 If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?A corporate expects to receive $36,144 each year for 15 years if a particular project is undertaken. There will be an initial investment of $100,705. The expenses associated with the project are expected to be $7,740 per year. Assume straight-line depreciation, a 15-year useful life, and no salvage value. Use a combined state and federal 48% marginal tax rate, MARR of 8%, determine the project's after-tax net present worth.

- Given: Before -Tax Cash Flow (BT-CF) for Kal Tech Systems in 2012 for an equipment that will be depreciated using the SL method with salvage value of $10,000. Year 0 1 2 3 4 5 BT-CF -$120,000 32,000 32,000 32,000 32,000 32,000 Market value - $36,000 What is the after-tax return if the company is in the 34% income tax bracket? The incremental tax rate is 34%. Also, it is known that the before-tax return is 16.65% Group of answer choices 9.65% 11.29% 10.16% 10.99%Perform an after-tax cash flow analysis on the following data on the replacement of an old equipment with a more energy-afficient version. Use an effective tax rate of 30% and the straight-line method for depreciation. Initial Investment: 500,000Useful life: 5 yearsTerminal Value: 50,000Annual Revenues, 240,000 Annual Expenses Power: 75,000Maintenance: 25,000Property Insurance: 20,000 1. If the after-tax MARR is 6%, what is the net present worth (in pesos) of replacing the old equipment? (2 decimal places) 2. After evaluation, is the replacement of the old equipment economically feasible?Determine whether the following contract described below is worthwhile ofundertaking after taxes if at the end of the 3-year of ownership the contract, you expect to sellboth depreciable equipment and land. Use present worth analysis under MARR = 8% andeffective tax rate.

- A trucking company computes depreciation on its vehicles by a mileage basis.Suppose a delivery truck has a cost of $20.000. a sa lvage value of $2.000. andan estimated useful life of 200.000 miles. Determine the depreciation rateper mile.(a) $0.08(b) $0.09(c) $0.10(d) $0.11In 2015, a firm has receipts of $8 million and expenses (excluding depreciation) of $4 million. Its depreciation for 2015 amounts to $2 million. If the effective income tax rate is 40%, what is this firm’s net operating income after taxes (NOPAT)?The Advanced Silicon Devices semiconductor factory costs $20 million to build and is depreciated (on a straight line basis, to make this simple) over 20 years. Also it borrows the money to build the factory at 8% interest. The factory has a capacity of 400,000 chips per year that sell for $30 apiece. Labor costs are $1.5 million, and raw material costs are $0.5 million. Ongoing research and development costs are $3 million. The factory sells all its chips to the Itty Bitty Machine company, which manufactures 40,000 computers a year that sell (wholesale) for $800 each. That factory costs $35 million to build, with the same rate of interest and depreciation as the semiconductor factory. Besides paying for the chips, the costs are $4 million for labor, $2 million for other parts (half of which are imported), and $2.5 million for ongoing R&D. The computer company sells its entire stock to Computers R Us, which then sells them to individuals at an average retail price of $1,200 plus 5%…

- A): Calculate the total cost, total depreciation, and annual depreciation (in $) for the following assets by using the straight-line method. (Round your answers to the nearest cent.) *chart attached* B): Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,831. The useful life is 7 years and the salvage value is $12,938. Prepare a depreciation schedule using the straight-line method. *CHART ATTACHED*Refer to the chapter opener and Example 7-14. As an alternative to the coal-fired plant, PennCo could construct an 800 MW natural gas–fired plant. This plant would require the same initial investment of $1.12 billion dollars to be depreciated over its 30-year life using the SL method with SV30=0SV30=0. The capacity factor estimate of the plant would still be 80%, but the efficiency of the natural gas–fired plant would be 40%. The annual operating and maintenance expense is expected to be $0.01 per kWh. The cost of natural gas is $8.00 per million Btu and the carbon dioxide tax is $15 per metric ton. Natural gas emits 55 metric tons of carbon dioxide per billion Btu produced. The effective income tax rate is 25%, and the after-tax MARR is 10% per year. Based on the after-tax cost of electricity, create a spreadsheet to determine whether PennCo should construct a natural gas–fired or coal-fired plant. Note: 1kWh=3,413 Btu. Chapter Opener - (1st image), Example - (2nd image) For the…A manufacturing company purchased an equipment for methods improvement for P 53,000. Paid P 1,500 for freight and delivery charges to the job site. What is the yearly depreciation cost using the sinking fund method at 6% interest. The machine has P 5,000 trade in cost and 10 yrs life.