Suppose that today's date was December 31, 2015. Consider the following data on the only two firms in the stock market of Andorra: Share price on Shares outstanding (in millions) Dividend per share Stock 12/31/2015 during 2015 A 102 4 2 95 You calculate the dividend-to-price ratio of the stock market by dividing total dividends paid in a year by the total value of the stock market at the end of that year. You regress annual Andorran stock market returns on the previous year's Andorran dividend-to-price ratio. This results in an intercept estimate of 0.01 (t-stat = 2.41) and a slope estimate of 4.32 (t-stat = 3.59). The regression's R-squared is 0.22. What is the regression-implied expectation of the return on the Andorran stock market in 2016? O A. 16.08% O B. 12.57% O C. 14.16% O D. 8.03%

Suppose that today's date was December 31, 2015. Consider the following data on the only two firms in the stock market of Andorra: Share price on Shares outstanding (in millions) Dividend per share Stock 12/31/2015 during 2015 A 102 4 2 95 You calculate the dividend-to-price ratio of the stock market by dividing total dividends paid in a year by the total value of the stock market at the end of that year. You regress annual Andorran stock market returns on the previous year's Andorran dividend-to-price ratio. This results in an intercept estimate of 0.01 (t-stat = 2.41) and a slope estimate of 4.32 (t-stat = 3.59). The regression's R-squared is 0.22. What is the regression-implied expectation of the return on the Andorran stock market in 2016? O A. 16.08% O B. 12.57% O C. 14.16% O D. 8.03%

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.58TI: What is the total effect on the economy of a government tax rebate of $500 to each household in...

Related questions

Question

Transcribed Image Text:QUESTION 13

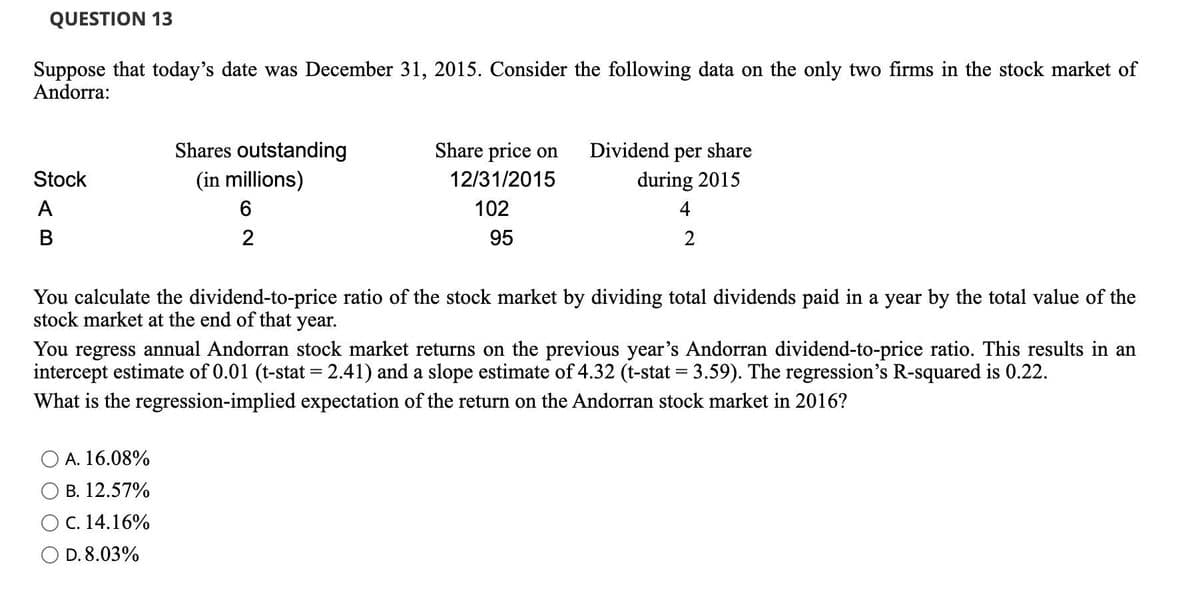

Suppose that today's date was December 31, 2015. Consider the following data on the only two firms in the stock market of

Andorra:

Shares outstanding

Share price on

Dividend per share

Stock

(in millions)

12/31/2015

during 2015

A

6

102

4

В

95

You calculate the dividend-to-price ratio of the stock market by dividing total dividends paid in a year by the total value of the

stock market at the end of that year.

You regress annual Andorran stock market returns on the previous year's Andorran dividend-to-price ratio. This results in an

intercept estimate of 0.01 (t-stat = 2.41) and a slope estimate of 4.32 (t-stat = 3.59). The regression's R-squared is 0.22.

What is the regression-implied expectation of the return on the Andorran stock market in 2016?

A. 16.08%

B. 12.57%

C. 14.16%

O D. 8.03%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill