Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves. Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level increases from 90 to 105. Shift the appropriate curve on the graph to show the impact of an increase in the overall price level on the market for money. 18 15 INTEREST RATE (Percent) 10 0 20 Money Supply Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 Money Demand 0- Money Supply Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be supplied by the Fed at this interest rate. As a result, individuals will attempt to bonds and other interest-bearing assets, and bond issuers will realize that they restored in the money market at an interest rate of than the quantity of money their money holdings. In order to do so, they will interest rates until equilibrium is

Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves. Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level increases from 90 to 105. Shift the appropriate curve on the graph to show the impact of an increase in the overall price level on the market for money. 18 15 INTEREST RATE (Percent) 10 0 20 Money Supply Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 Money Demand 0- Money Supply Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be supplied by the Fed at this interest rate. As a result, individuals will attempt to bonds and other interest-bearing assets, and bond issuers will realize that they restored in the money market at an interest rate of than the quantity of money their money holdings. In order to do so, they will interest rates until equilibrium is

Chapter16: Monetary Policy

Section: Chapter Questions

Problem 8SQ

Related questions

Question

2. The theory of liquidity preference and the downward-slopingaggregate demand curve.

Transcribed Image Text:Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be

than the quantity of money

supplied by the Fed at this interest rate. As a result, individuals will attempt to

their money holdings. In order to do so, they will

interest rates until equilibrium is

bonds and other interest-bearing assets, and bond issuers will realize that they

restored in the money market at an interest rate of

%

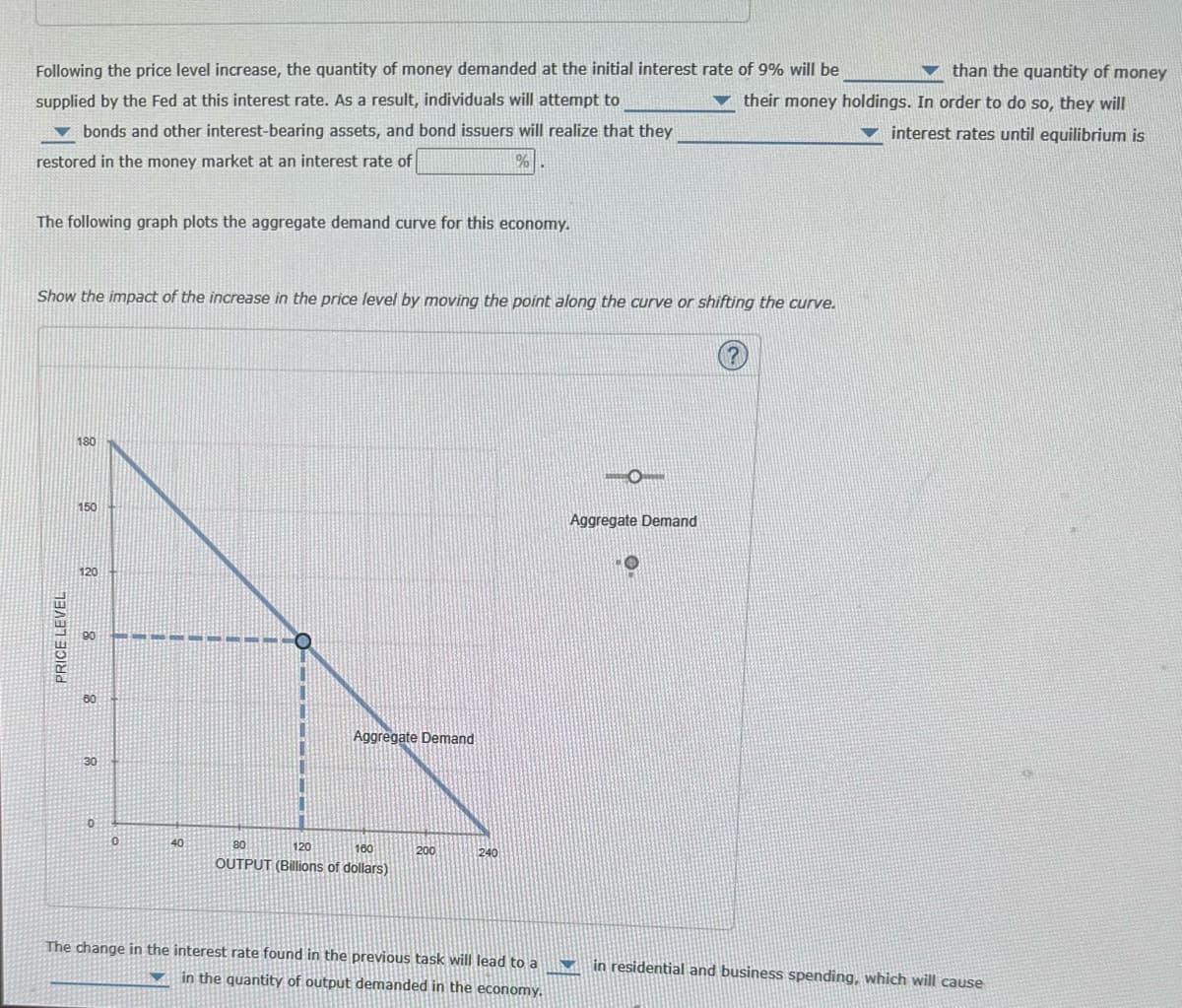

The following graph plots the aggregate demand curve for this economy.

Show the impact of the increase in the price level by moving the point along the curve or shifting the curve.

PRICE LEVEL

180

150

120

8

8

8

1

B

U

Aggregate Demand

80

120

160

OUTPUT (Billions of dollars)

200

The change in the interest rate found in the previous task will lead to a

in the quantity of output demanded in the economy.

Aggregate Demand

in residential and business spending, which will cause

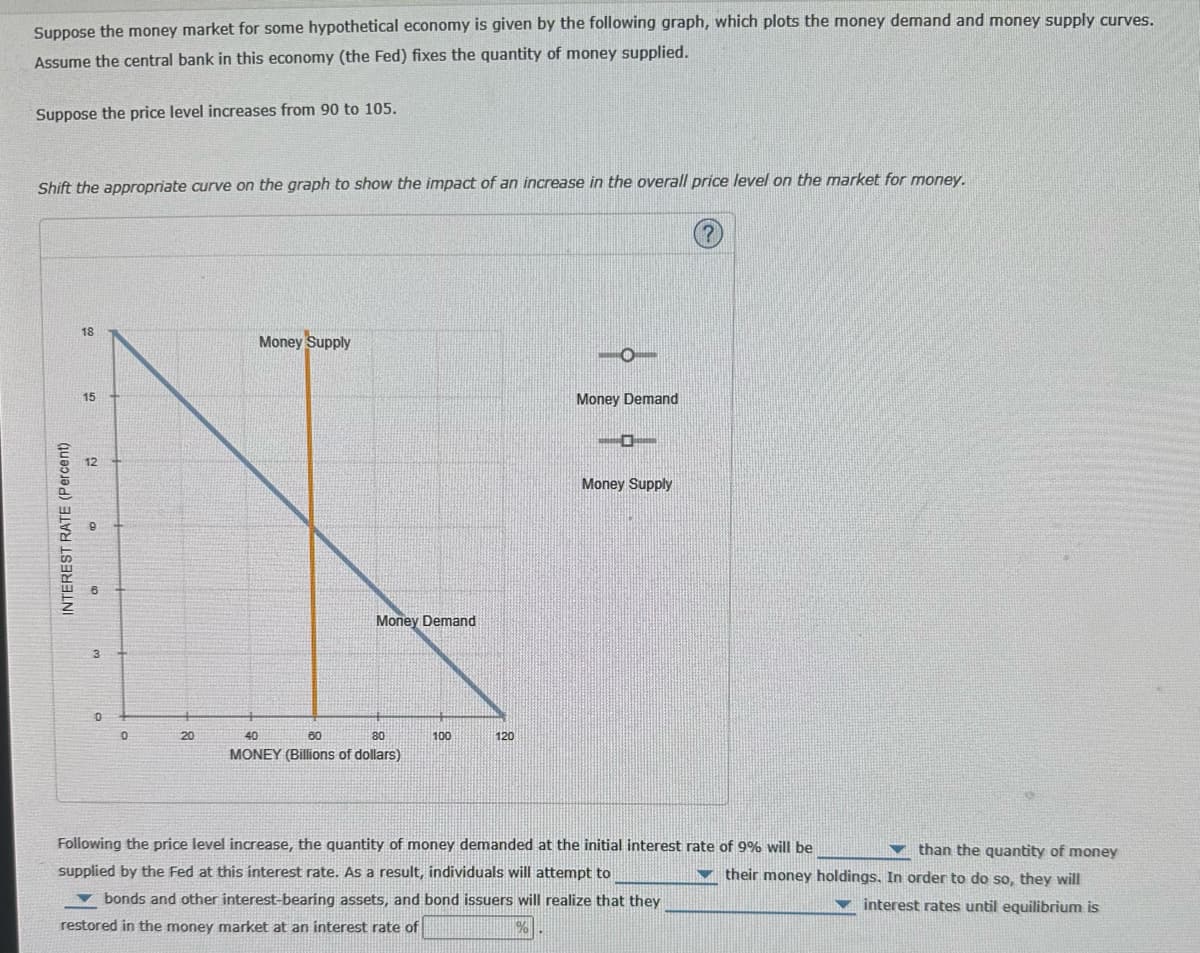

Transcribed Image Text:Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves.

Assume the central bank in this economy (the Fed) fixes the quantity of money supplied.

Suppose the price level increases from 90 to 105.

Shift the appropriate curve on the graph to show the impact of an increase in the overall price level on the market for money.

INTEREST RATE (Percent)

18

3₁

15

12

a

3

0

0

20

Money Supply

Money Demand

40

60

80

MONEY (Billions of dollars)

100

120

O

Money Demand

---

Money Supply

Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be

supplied by the Fed at this interest rate. As a result, individuals will attempt to

bonds and other interest-bearing assets, and bond issuers will realize that they

restored in the money market at an interest rate of

%

than the quantity of money

their money holdings. In order to do so, they will

interest rates until equilibrium is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning