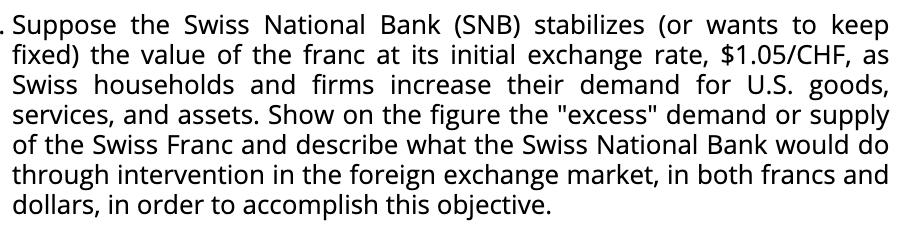

Suppose the Swiss National Bank (SNB) stabilizes (or wants to keep fixed) the value of the franc at its initial exchange rate, $1.05/CHF, as Swiss households and firms increase their demand for U.S. goods, services, and assets. Show on the figure the "excess" demand or supply of the Swiss Franc and describe what the Swiss National Bank would do through intervention in the foreign exchange market, in both francs and dollars, in order to accomplish this objective.

Suppose the Swiss National Bank (SNB) stabilizes (or wants to keep fixed) the value of the franc at its initial exchange rate, $1.05/CHF, as Swiss households and firms increase their demand for U.S. goods, services, and assets. Show on the figure the "excess" demand or supply of the Swiss Franc and describe what the Swiss National Bank would do through intervention in the foreign exchange market, in both francs and dollars, in order to accomplish this objective.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter29: Exchange Rates And International Capital Flows

Section: Chapter Questions

Problem 2SCQ: Suppose that political unrest in Egypt leads financial markets to anticipate a depreciation in the...

Related questions

Question

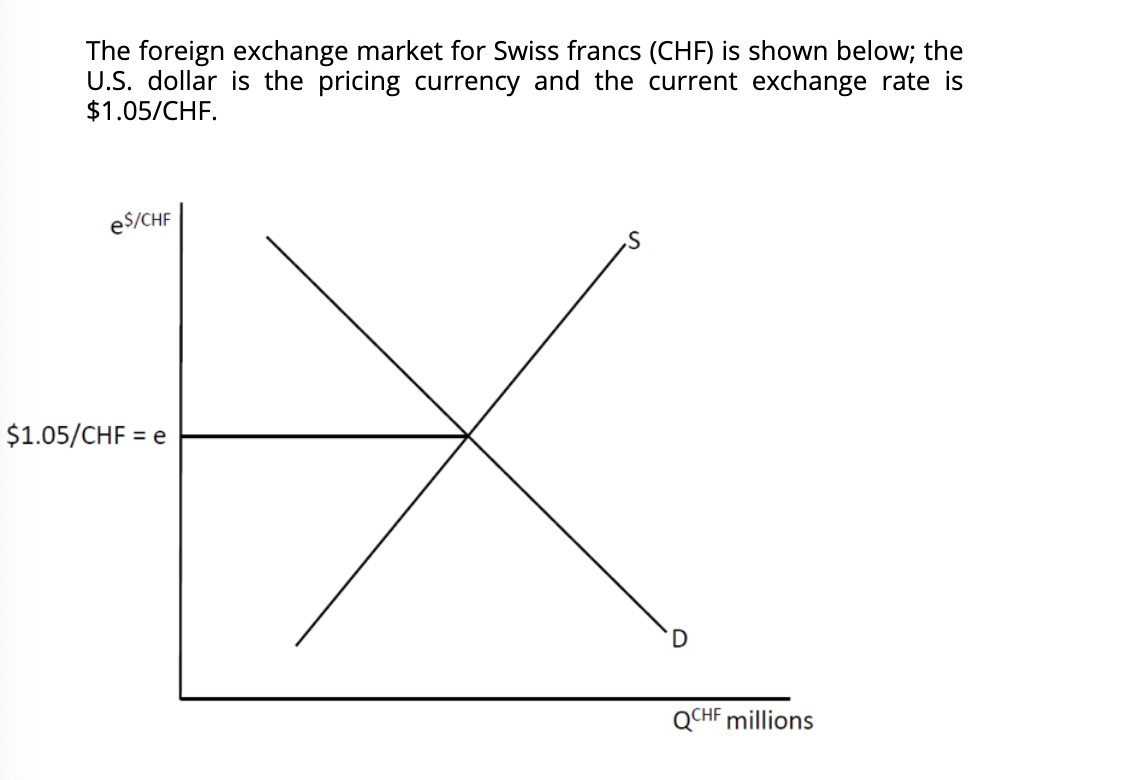

Transcribed Image Text:The foreign exchange market for Swiss francs (CHF) is shown below; the

U.S. dollar is the pricing currency and the current exchange rate is

$1.05/CHF.

es/CHF

$1.05/CHF = e

D.

QCHF millions

Transcribed Image Text:. Suppose the Swiss National Bank (SNB) stabilizes (or wants to keep

fixed) the value of the franc at its initial exchange rate, $1.05/CHF, as

Swiss households and firms increase their demand for U.S. goods,

services, and assets. Show on the figure the "excess" demand or supply

of the Swiss Franc and describe what the Swiss National Bank would do

through intervention in the foreign exchange market, in both francs and

dollars, in order to accomplish this objective.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning