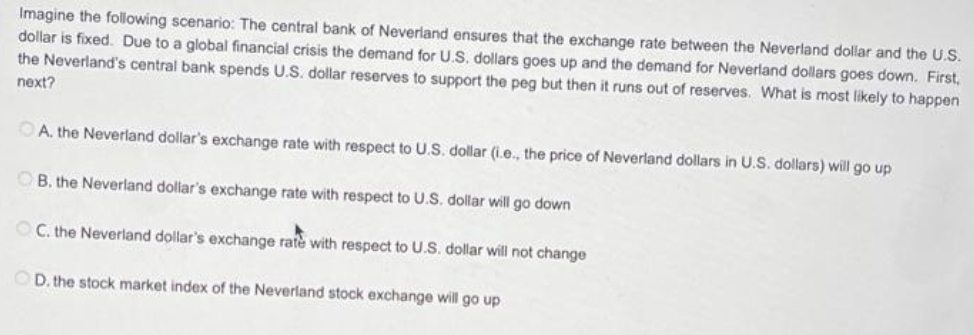

Imagine the following scenario: The central bank of Neverland ensures that the exchange rate between the Neverland dollar and the U.S. dollar is fixed. Due to a global financial crisis the demand for U.S. dollars goes up and the demand for Neverland dollars goes down. First, the Neverland's central bank spends U.S. dollar reserves to support the peg but then it runs out of reserves. What is most likely to happen next? OA. the Neverland dollar's exchange rate with respect to U.S. dollar (i.e., the price of Neverland dollars in U.S. dollars) will go up OB. the Neverland dollar's exchange rate with respect to U.S. dollar will go down OC. the Neverland dollar's exchange rate with respect to U.S. dollar will not change D. the stock market index of the Neverland stock exchange will go up

Imagine the following scenario: The central bank of Neverland ensures that the exchange rate between the Neverland dollar and the U.S. dollar is fixed. Due to a global financial crisis the demand for U.S. dollars goes up and the demand for Neverland dollars goes down. First, the Neverland's central bank spends U.S. dollar reserves to support the peg but then it runs out of reserves. What is most likely to happen next? OA. the Neverland dollar's exchange rate with respect to U.S. dollar (i.e., the price of Neverland dollars in U.S. dollars) will go up OB. the Neverland dollar's exchange rate with respect to U.S. dollar will go down OC. the Neverland dollar's exchange rate with respect to U.S. dollar will not change D. the stock market index of the Neverland stock exchange will go up

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 8PA

Related questions

Question

Transcribed Image Text:Imagine the following scenario: The central bank of Neverland ensures that the exchange rate between the Neverland dollar and the U.S.

dollar is fixed. Due to a global financial crisis the demand for U.S. dollars goes up and the demand for Neverland dollars goes down. First,

the Neverland's central bank spends U.S. dollar reserves to support the peg but then it runs out of reserves. What is most likely to happen

next?

A. the Neverland dollar's exchange rate with respect to U.S. dollar (i.e., the price of Neverland dollars in U.S. dollars) will go up

B. the Neverland dollar's exchange rate with respect to U.S. dollar will go down

OC. the Neverland dollar's exchange rate with respect to U.S. dollar will not change

OD. the stock market index of the Neverland stock exchange will go up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning