Suppose the U.S. economy is in equilibrium at a potential output of $10 trillion so that unemployment is at the natural rate. the beginning of the year, the Federal Reserve announces that its monetary policy will aim to maintain output at potential output and sustain the current price level throughout the year. Firms and workers negotiate annual wage and resource price agreements based on the belief that the Fed is committed to price stability. The following graph shows the aggregate demand curve (AD), the long-run aggregate supply curve (LRAS), and the short-run aggregate supply curve (SRAS) at an expected price level of 120. Now suppose that several months later, the Fed abandons its stated goal of price stability and shifts toward an expansionary monetary policy. On the following graph, show the short-run effect of this policy shifting the appropriate curve or curves. Note: Select and drag one, both, or all of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps

Suppose the U.S. economy is in equilibrium at a potential output of $10 trillion so that unemployment is at the natural rate. the beginning of the year, the Federal Reserve announces that its monetary policy will aim to maintain output at potential output and sustain the current price level throughout the year. Firms and workers negotiate annual wage and resource price agreements based on the belief that the Fed is committed to price stability. The following graph shows the aggregate demand curve (AD), the long-run aggregate supply curve (LRAS), and the short-run aggregate supply curve (SRAS) at an expected price level of 120. Now suppose that several months later, the Fed abandons its stated goal of price stability and shifts toward an expansionary monetary policy. On the following graph, show the short-run effect of this policy shifting the appropriate curve or curves. Note: Select and drag one, both, or all of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps

Chapter22: Aggregate Demand And Aggregate Supply

Section: Chapter Questions

Problem 5P

Related questions

Question

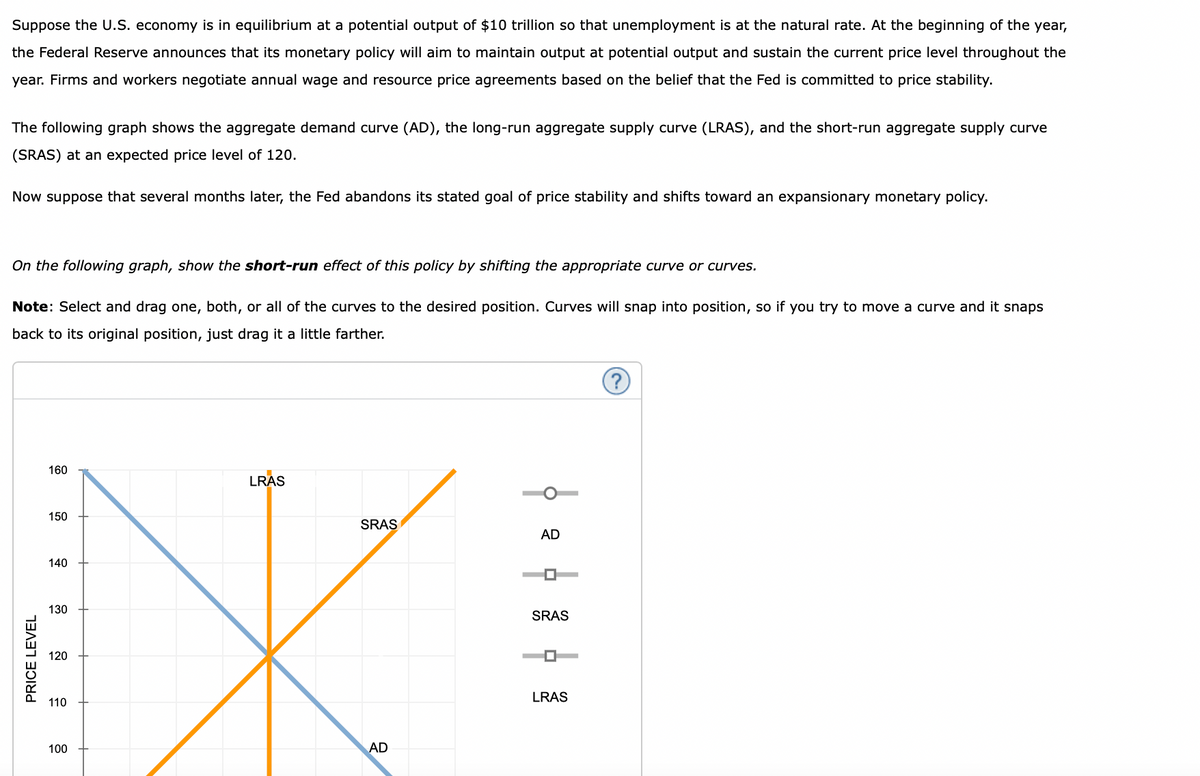

Transcribed Image Text:Suppose the U.S. economy is in equilibrium at a potential output of $10 trillion so that unemployment is at the natural rate. At the beginning of the year,

the Federal Reserve announces that its monetary policy will aim to maintain output at potential output and sustain the current price level throughout the

year. Firms and workers negotiate annual wage and resource price agreements based on the belief that the Fed is committed to price stability.

The following graph shows the aggregate demand curve (AD), the long-run aggregate supply curve (LRAS), and the short-run aggregate supply curve

(SRAS) at an expected price level of 120.

Now suppose that several months later, the Fed abandons its stated goal of price stability and shifts toward an expansionary monetary policy.

On the following graph, show the short-run effect of this policy by shifting the appropriate curve or curves.

Note: Select and drag one, both, or all of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps

back to its original position, just drag it a little farther.

PRICE LEVEL

160

150

140

130

120

110

100

LRAS

SRAS

AD

AD

|

SRAS

LRAS

Transcribed Image Text:6

8 9

10

11

12

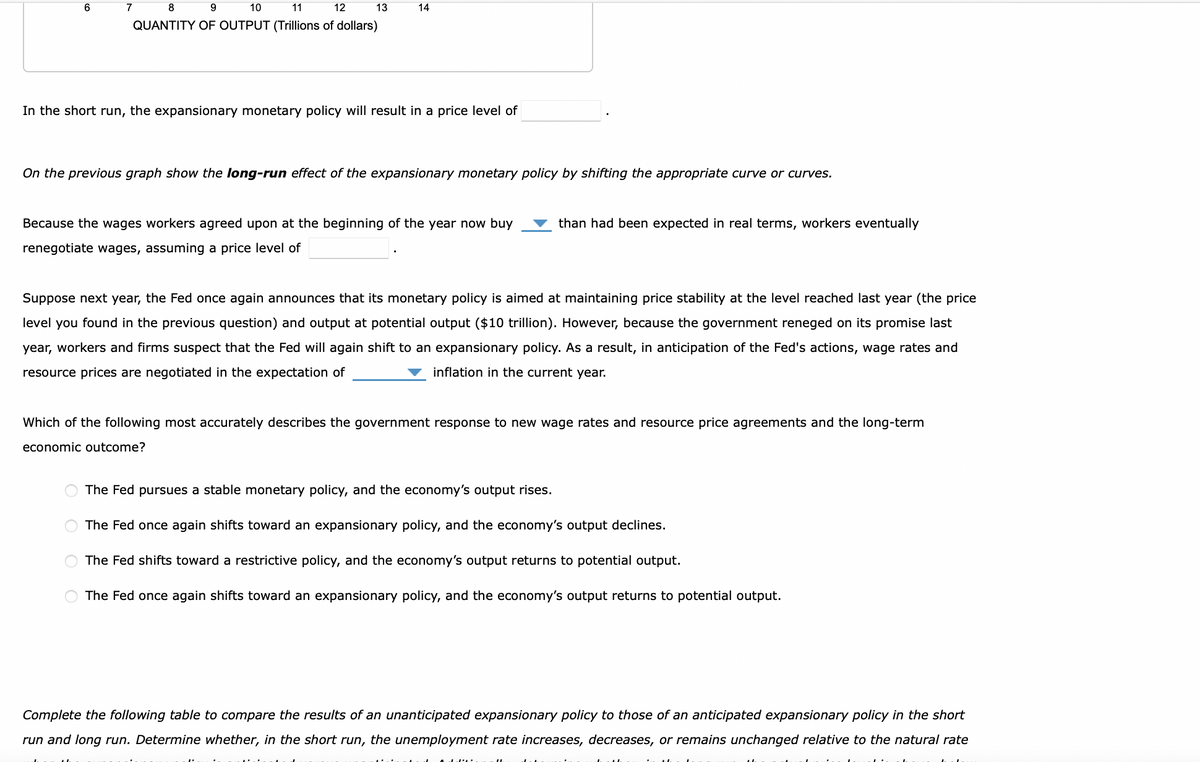

QUANTITY OF OUTPUT (Trillions of dollars)

7

13

In the short run, the expansionary monetary policy will result in a price level of

O

14

On the previous graph show the long-run effect of the expansionary monetary policy by shifting the appropriate curve or curves.

O

Because the wages workers agreed upon at the beginning of the year now buy

renegotiate wages, assuming a price level of

Suppose next year, the Fed once again announces that its monetary policy is aimed at maintaining price stability at the level reached last year (the price

level you found in the previous question) and output at potential output ($10 trillion). However, because the government reneged on its promise last

year, workers and firms suspect that the Fed will again shift to an expansionary policy. As a result, in anticipation of the Fed's actions, wage rates and

resource prices are negotiated in the expectation of

inflation in the current year.

than had been expected in real terms, workers eventually

Which of the following most accurately describes the government response to new wage rates and resource price agreements and the long-term

economic outcome?

The Fed pursues a stable monetary policy, and the economy's output rises.

The Fed once again shifts toward an expansionary policy, and the economy's output declines.

The Fed shifts toward a restrictive policy, and the economy's output returns to potential output.

The Fed once again shifts toward an expansionary policy, and the economy's output returns to potential output.

Complete the following table to compare the results of an unanticipated expansionary policy to those of an anticipated expansionary policy in the short

run and long run. Determine whether, in the short run, the unemployment rate increases, decreases, or remains unchanged relative to the natural rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning