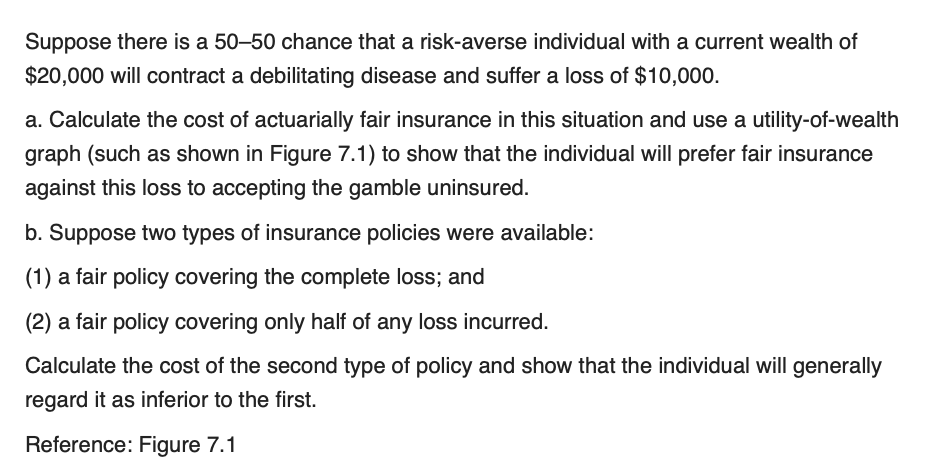

Suppose there is a 50–50 chance that a risk-averse individual with a current wealth of $20,000 will contract a debilitating disease and suffer a loss of $10,000. a. Calculate the cost of actuarially fair insurance in this situation and use a utility-of-wealth graph (such as shown in Figure 7.1) to show that the individual will prefer fair insurance against this loss to accepting the gamble uninsured. b. Suppose two types of insurance policies were available: (1) a fair policy covering the complete loss; and (2) a fair policy covering only half of any loss incurred. Calculate the cost of the second type of policy and show that the individual will generally regard it as inferior to the first. Reference: Figure 7.1

Suppose there is a 50–50 chance that a risk-averse individual with a current wealth of $20,000 will contract a debilitating disease and suffer a loss of $10,000. a. Calculate the cost of actuarially fair insurance in this situation and use a utility-of-wealth graph (such as shown in Figure 7.1) to show that the individual will prefer fair insurance against this loss to accepting the gamble uninsured. b. Suppose two types of insurance policies were available: (1) a fair policy covering the complete loss; and (2) a fair policy covering only half of any loss incurred. Calculate the cost of the second type of policy and show that the individual will generally regard it as inferior to the first. Reference: Figure 7.1

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.4P

Related questions

Question

Transcribed Image Text:Suppose there is a 50–50 chance that a risk-averse individual with a current wealth of

$20,000 will contract a debilitating disease and suffer a loss of $10,000.

a. Calculate the cost of actuarially fair insurance in this situation and use a utility-of-wealth

graph (such as shown in Figure 7.1) to show that the individual will prefer fair insurance

against this loss to accepting the gamble uninsured.

b. Suppose two types of insurance policies were available:

(1) a fair policy covering the complete loss; and

(2) a fair policy covering only half of any loss incurred.

Calculate the cost of the second type of policy and show that the individual will generally

regard it as inferior to the first.

Reference: Figure 7.1

![e utility-of-wealth function is concave (i.e., exhibits a diminishing marginal utility of wealth), ther

person will refuse fair bets. A 50-50 chance of winning or losing h dollars, for example, yields les:

ected utility [EU(A)] than does refusing the bet. The reason for this is that winning h dollars mear

to this individual than does losing h dollars.

Utility

U(W)

U(W)

EU(A) = U(CE^)

EU(B)

%3D

3D

%3D

%3D

%3D

Wo-2h

Wo+h i Wo

Wo+h

Wo+2h

Wealth (W)

CEA](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff55c9744-9a37-452e-9181-f583bc88159f%2F9c34e210-dab1-4d67-8873-f98b912583e4%2Ff4h3zhe_processed.png&w=3840&q=75)

Transcribed Image Text:e utility-of-wealth function is concave (i.e., exhibits a diminishing marginal utility of wealth), ther

person will refuse fair bets. A 50-50 chance of winning or losing h dollars, for example, yields les:

ected utility [EU(A)] than does refusing the bet. The reason for this is that winning h dollars mear

to this individual than does losing h dollars.

Utility

U(W)

U(W)

EU(A) = U(CE^)

EU(B)

%3D

3D

%3D

%3D

%3D

Wo-2h

Wo+h i Wo

Wo+h

Wo+2h

Wealth (W)

CEA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning