Suppose you are a part of a group of students from a prominent university and were sent out as a team to work with a leading merchandizing company as a part of a work experience program. The team having been introduced to the general manger was told that the Accountant who normally prepares the financial statements has suddenly resigned and there is no one available to prepare the company’s financial statements which are now due. As aspiring university students, you have expressed an interest in taking on the task. You are required to analyse the problem at hand then apply the accrual basis of accounting in the preparation of the company’s financial statements.

Suppose you are a part of a group of students from a prominent university and were sent out as a team to work with a leading merchandizing company as a part of a work experience program. The team having been introduced to the general manger was told that the Accountant who normally prepares the financial statements has suddenly resigned and there is no one available to prepare the company’s financial statements which are now due. As aspiring university students, you have expressed an interest in taking on the task. You are required to analyse the problem at hand then apply the accrual basis of accounting in the preparation of the company’s financial statements.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2PB: The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal...

Related questions

Question

Suppose you are a part of a group of students from a prominent university and were sent out as a team to work with a leading merchandizing company as a part of a work experience program. The team having been introduced to the general manger was told that the Accountant who normally prepares the financial statements has suddenly resigned and there is no one available to prepare the company’s financial statements which are now due. As aspiring university students, you have expressed an interest in taking on the task. You are required to analyse the problem at hand then apply the accrual basis of accounting in the preparation of the company’s financial statements.

![(i)

Insurance of $450,000 was paid on May 1, 2018 for the 10-months to February 2019.

(ii)

The furniture and fixtures have an estimated useful life of 10 years and is being depreciated

on the straight-line method down to a residual value of $100,000.

(iii)

The computer equipment was acquired on March 1, 2018 and is being depreciated over 10

years on the double-declining method of depreciation, down to a residue of $60,000.

(iv)

Wages earned by employees NOT yet paid amounted to 15,000 at December 31, 2018.

(v)

A physical count of inventory at December 31, reveals $180,000 worth of inventory on hand.

(vi)

At December 31, $140,000 of the previously unearned sales revenue had been earned.

(vii)

The aging of the Accounts Receivable schedule at December 31 indicated that the estimated

uncollectible on account receivable should be $45,000.

REQUIRED:

a)

Prepare the necessary adjusting journal entries on December 31. [Narrations are not required]

b)

Prepare Columbus Ltd multiple-step income statement for the year ended December 31, 2018.

c)

Prepare Columbus Ltd statement of owner's equity for the year ended December 31, 2018.

d)

Prepare Columbus Ltd classified balance sheet at December 31, 2018.

e)

Prepare the closing entries

f)

Prepare the post-closing trial balance](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F6a3f2e7d-5cb8-4afa-9389-12614fdb6539%2F8a2ba702-5f87-4a95-927d-51403744a157%2F5epcxob_processed.jpeg&w=3840&q=75)

Transcribed Image Text:(i)

Insurance of $450,000 was paid on May 1, 2018 for the 10-months to February 2019.

(ii)

The furniture and fixtures have an estimated useful life of 10 years and is being depreciated

on the straight-line method down to a residual value of $100,000.

(iii)

The computer equipment was acquired on March 1, 2018 and is being depreciated over 10

years on the double-declining method of depreciation, down to a residue of $60,000.

(iv)

Wages earned by employees NOT yet paid amounted to 15,000 at December 31, 2018.

(v)

A physical count of inventory at December 31, reveals $180,000 worth of inventory on hand.

(vi)

At December 31, $140,000 of the previously unearned sales revenue had been earned.

(vii)

The aging of the Accounts Receivable schedule at December 31 indicated that the estimated

uncollectible on account receivable should be $45,000.

REQUIRED:

a)

Prepare the necessary adjusting journal entries on December 31. [Narrations are not required]

b)

Prepare Columbus Ltd multiple-step income statement for the year ended December 31, 2018.

c)

Prepare Columbus Ltd statement of owner's equity for the year ended December 31, 2018.

d)

Prepare Columbus Ltd classified balance sheet at December 31, 2018.

e)

Prepare the closing entries

f)

Prepare the post-closing trial balance

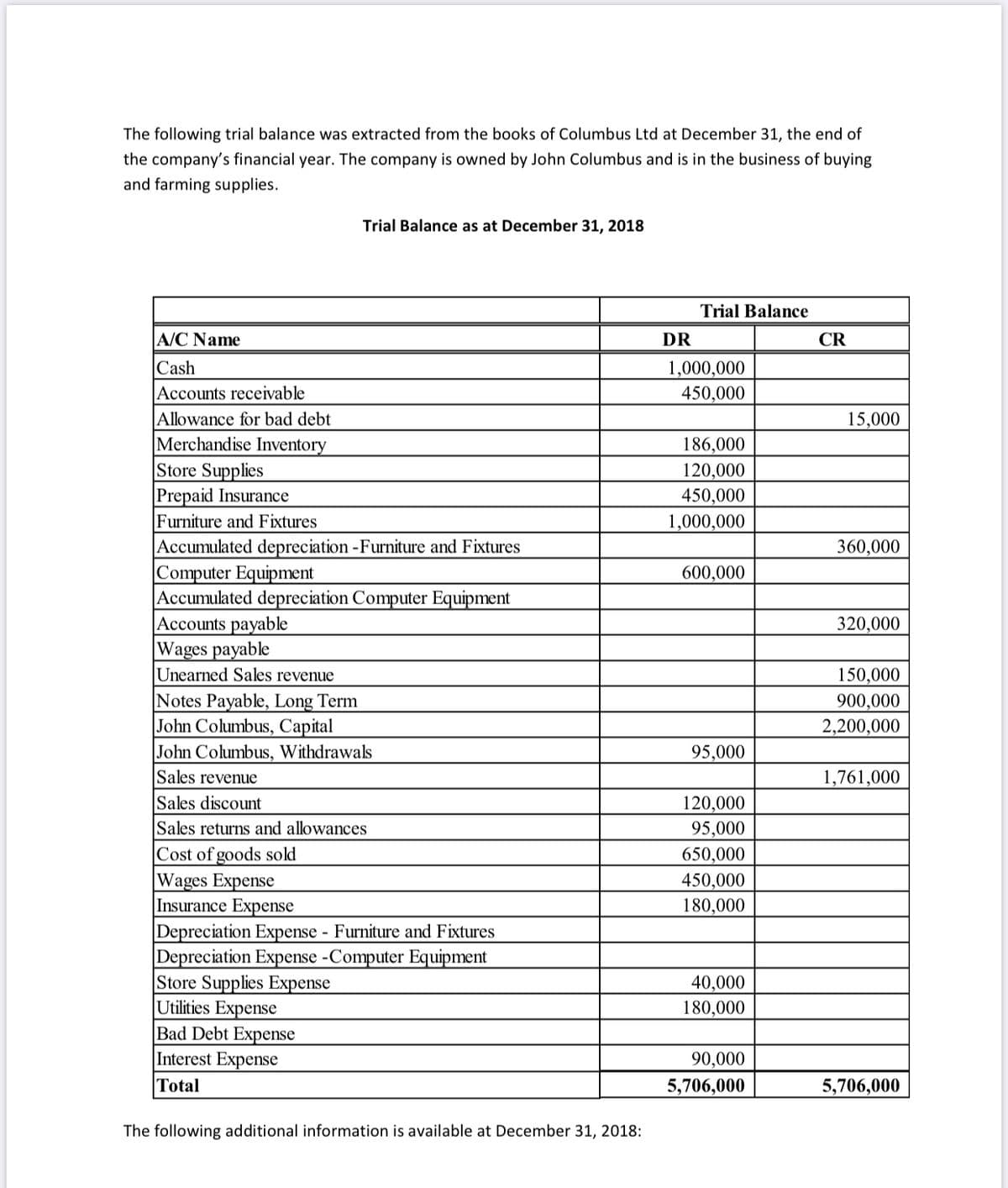

Transcribed Image Text:The following trial balance was extracted from the books of Columbus Ltd at December 31, the end of

the company's financial year. The company is owned by John Columbus and is in the business of buying

and farming supplies.

Trial Balance as at December 31, 2018

Trial Balance

A/C Name

DR

CR

Cash

1,000,000

450,000

Accounts receivable

Allowance for bad debt

Merchandise Inventory

Store Supplies

Prepaid Insurance

Furniture and Fixtures

Accumulated depreciation -Furniture and Fixtures

Computer Equipment

Accumulated depreciation Computer Equipment

|Accounts payable

Wages payable

Unearned Sales revenue

15,000

186,000

120,000

450,000

1,000,000

360,000

600,000

320,000

Notes Payable, Long Term

John Columbus, Capital

John Columbus, Withdrawals

150,000

900,000

2,200,000

95,000

Sales revenue

1,761,000

Sales discount

Sales returns and allowances

Cost of goods sold

Wages Expense

Insurance Expense

Depreciation Expense - Furniture and Fixtures

Depreciation Expense -Computer Equipment

Store Supplies Expense

Utilities Expense

Bad Debt Expense

Interest Expense

120,000

95,000

650,000

450,000

180,000

40,000

180,000

90,000

Total

5,706,000

5,706,000

The following additional information is available at December 31, 2018:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning