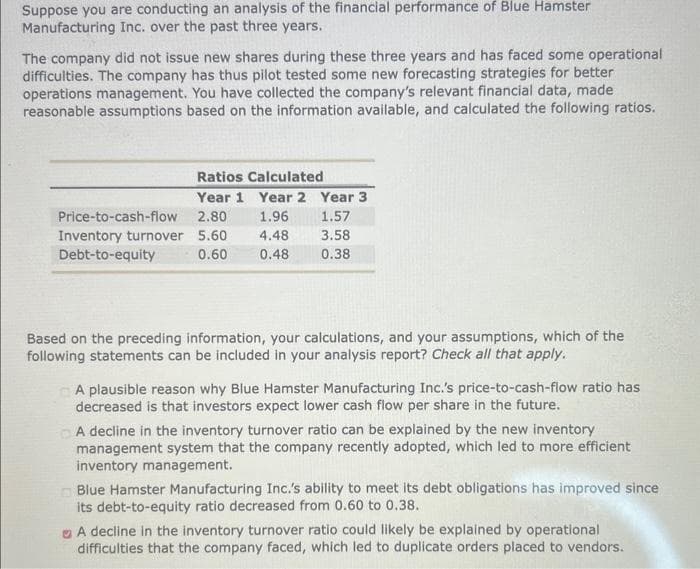

Suppose you are conducting an analysis of the financial performance Manufacturing Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Price-to-cash-flow Inventory turnover Debt-to-equity Ratios Calculated Year 1 Year 2 Year 3 2.80 1.96 1.57 5.60 48 3.58 0.60 0.48 0.38 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A plausible reason why Blue Hamster Manufacturing Inc.'s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future. A decline in the inventory turnover ratio can be explained by the new inventory management system that the company recently adopted, which led to more efficient inventory management. Blue Hamster Manufacturing Inc.'s ability to meet its debt obligations has improved since its debt-to-equity ratio decreased from 0.60 to 0.38. A decline in the inventory turnover ratio could likely be explained by operational difficulties that the company faced, which led to duplicate orders placed to vendors.

Suppose you are conducting an analysis of the financial performance Manufacturing Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Price-to-cash-flow Inventory turnover Debt-to-equity Ratios Calculated Year 1 Year 2 Year 3 2.80 1.96 1.57 5.60 48 3.58 0.60 0.48 0.38 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A plausible reason why Blue Hamster Manufacturing Inc.'s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future. A decline in the inventory turnover ratio can be explained by the new inventory management system that the company recently adopted, which led to more efficient inventory management. Blue Hamster Manufacturing Inc.'s ability to meet its debt obligations has improved since its debt-to-equity ratio decreased from 0.60 to 0.38. A decline in the inventory turnover ratio could likely be explained by operational difficulties that the company faced, which led to duplicate orders placed to vendors.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 19CYBK

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

Please do not give image format and correct answer with explanation

Transcribed Image Text:Suppose you are conducting an analysis of the financial performance of Blue Hamster

Manufacturing Inc. over the past three years.

The company did not issue new shares during these three years and has faced some operational

difficulties. The company has thus pilot tested some new forecasting strategies for better

operations management. You have collected the company's relevant financial data, made

reasonable assumptions based on the information available, and calculated the following ratios.

Price-to-cash-flow

Inventory turnover

Debt-to-equity

Ratios Calculated

Year 1 Year 2 Year 3

2.80 1.96 1.57

5.60 4.48 3.58

0.60 0.48 0.38

Based on the preceding information, your calculations, and your assumptions, which of the

following statements can be included in your analysis report? Check all that apply.

A plausible reason why Blue Hamster Manufacturing Inc.'s price-to-cash-flow ratio has

decreased is that investors expect lower cash flow per share in the future.

A decline in the inventory turnover ratio can be explained by the new inventory

management system that the company recently adopted, which led to more efficient

inventory management.

Blue Hamster Manufacturing Inc.'s ability to meet its debt obligations has improved since

its debt-to-equity ratio decreased from 0.60 to 0.38.

A decline in the inventory turnover ratio could likely be explained by operational

difficulties that the company faced, which led to duplicate orders placed to vendors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning