Suppose you earn $50,000 per year and pay taxes based on marginal tax rates. The first tax bracket, which taxes at 5 percent, ranges from $0 to $25,000. The second tax bracket, which taxes at 25 percent, ranges from $25,001 to $100,000. How much will you pay in total taxes? Instructions: Enter your answer as a whole number.

Suppose you earn $50,000 per year and pay taxes based on marginal tax rates. The first tax bracket, which taxes at 5 percent, ranges from $0 to $25,000. The second tax bracket, which taxes at 25 percent, ranges from $25,001 to $100,000. How much will you pay in total taxes? Instructions: Enter your answer as a whole number.

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: The Design Of The Tax System

Section: Chapter Questions

Problem 3CQQ

Related questions

Question

Transcribed Image Text:Suppose you earn $50,000 per year and pay taxes based on marginal tax rates. The first tax bracket, which taxes at 5 percent, ranges

from $0 to $25,000. The second tax bracket, which taxes at 25 percent, ranges from $25,001 to $100,000. How much will you pay in

total taxes?

Instructions: Enter your answer as a whole number.

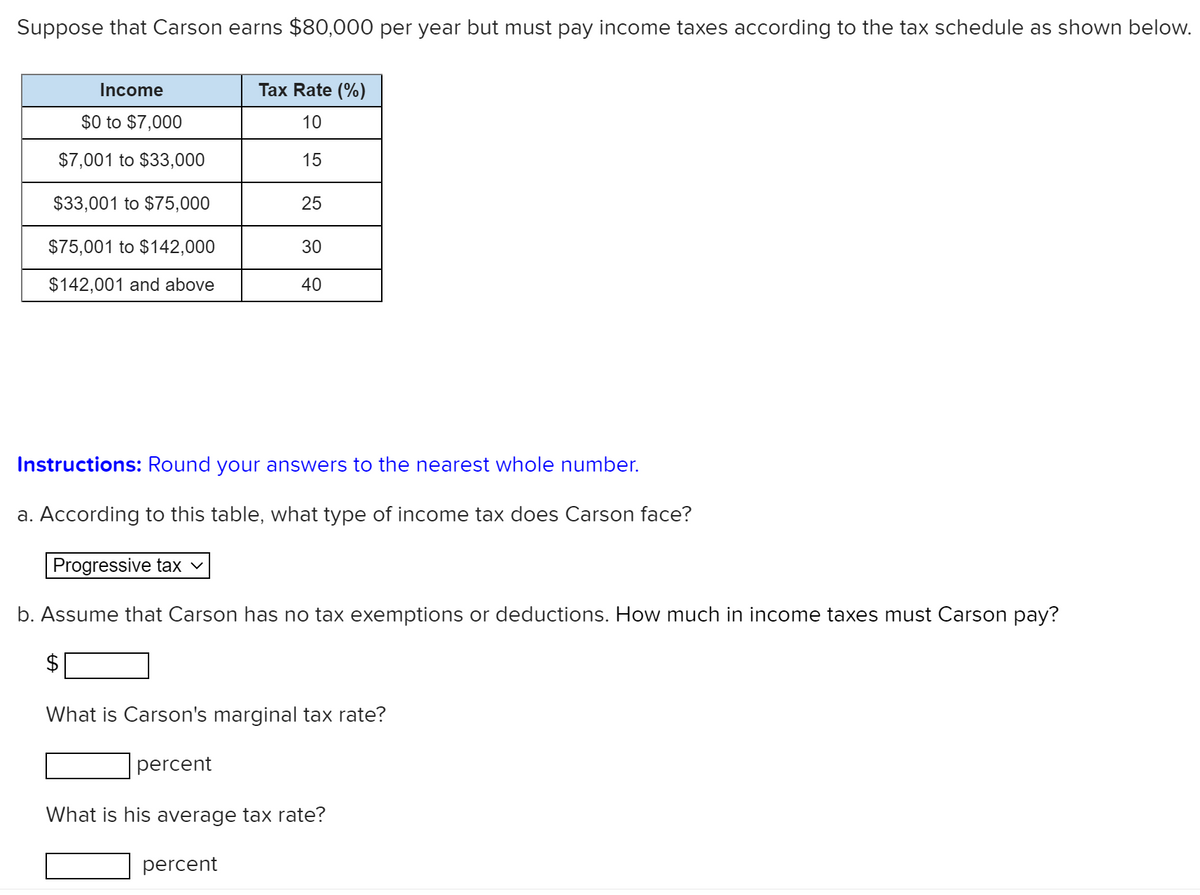

Transcribed Image Text:Suppose that Carson earns $80,000 per year but must pay income taxes according to the tax schedule as shown below.

Income

Tax Rate (%)

$0 to $7,000

10

$7,001 to $33,000

15

$33,001 to $75,000

25

$75,001 to $142,000

30

$142,001 and above

40

Instructions: Round your answers to the nearest whole number.

a. According to this table, what type of income tax does Carson face?

Progressive tax v

b. Assume that Carson has no tax exemptions or deductions. How much in income taxes must Carson pay?

2$

What is Carson's marginal tax rate?

percent

What is his average tax rate?

percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning