Suppose your firm receives a $5.82 million order on the last day of the year. You fill the order with $1.97 million worth of inventory. The customer picks up the entire order the same day and pays $1.09 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $4.73 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following: a. Revenues b. Earnings c. Receivables d. Inventory e. Cash a. Revenues Revenues will ▼ increase or decrease by $___ million. (Select from the drop-down menu and round to two decimal places.)

Suppose your firm receives a $5.82 million order on the last day of the year. You fill the order with $1.97 million worth of inventory. The customer picks up the entire order the same day and pays $1.09 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $4.73 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following: a. Revenues b. Earnings c. Receivables d. Inventory e. Cash a. Revenues Revenues will ▼ increase or decrease by $___ million. (Select from the drop-down menu and round to two decimal places.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 2MC

Related questions

Question

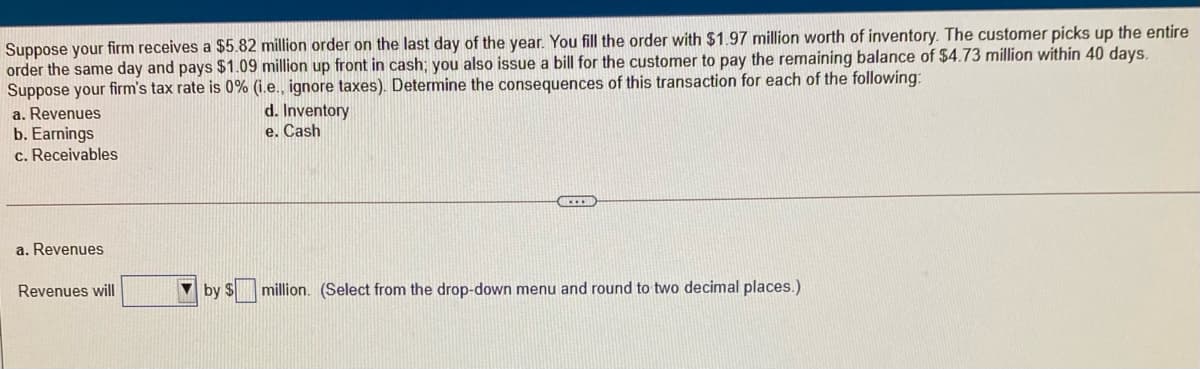

Suppose your firm receives a $5.82 million order on the last day of the year. You fill the order with $1.97 million worth of inventory. The customer picks up the entire order the same day and pays $1.09 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $4.73 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following:

a. Revenues

b. Earnings

c. Receivables

d. Inventory

e. Cash

a. Revenues

Revenues will

▼

increase or

decrease

by $___ million. (Select from the drop-down menu and round to two decimal places.)

Transcribed Image Text:Suppose your firm receives a $5.82 million order on the last day of the year. You fill the order with $1.97 million worth of inventory. The customer picks up the entire

order the same day and pays $1.09 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $4.73 million within 40 days.

Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following:

a. Revenues

b. Earnings

c. Receivables

d. Inventory

e. Cash

a. Revenues

Revenues will

by $

million. (Select from the drop-down menu and round to two decimal places.)

Expert Solution

Step 1

The sales value is calculated by multiplying the units sold equal to income, which is determined by multiplying the average sales price by the units sold. Receivables, also known as accounts receivable, are consumer debts owed to a business for products or services provided but not yet paid for. The term inventory relates to both raw materials in the manufacture and finished goods that are fully prepared for sale.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College