Using time value of money tables, a financial calculator, or Excel functions, calculate the amount of each of the following: (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) 1. 2. 3. Gross investment Unearned interest income. Net investment in the lease $ $

Using time value of money tables, a financial calculator, or Excel functions, calculate the amount of each of the following: (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) 1. 2. 3. Gross investment Unearned interest income. Net investment in the lease $ $

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

D4.

Account

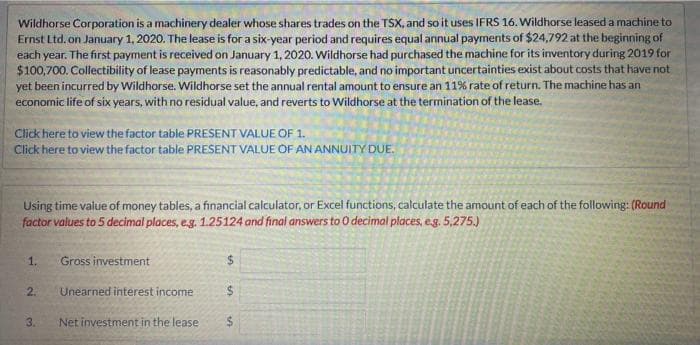

Transcribed Image Text:Wildhorse Corporation is a machinery dealer whose shares trades on the TSX, and so it uses IFRS 16. Wildhorse leased a machine to

Ernst Ltd. on January 1, 2020. The lease is for a six-year period and requires equal annual payments of $24,792 at the beginning of

each year. The first payment is received on January 1, 2020. Wildhorse had purchased the machine for its inventory during 2019 for

$100,700. Collectibility of lease payments is reasonably predictable, and no important uncertainties exist about costs that have not

yet been incurred by Wildhorse. Wildhorse set the annual rental amount to ensure an 11% rate of return. The machine has an

economic life of six years, with no residual value, and reverts to Wildhorse at the termination of the lease.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE.

Using time value of money tables, a financial calculator, or Excel functions, calculate the amount of each of the following: (Round

factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.)

1.

2.

3.

Gross investment

Unearned interest income

Net investment in the lease

$

$

$

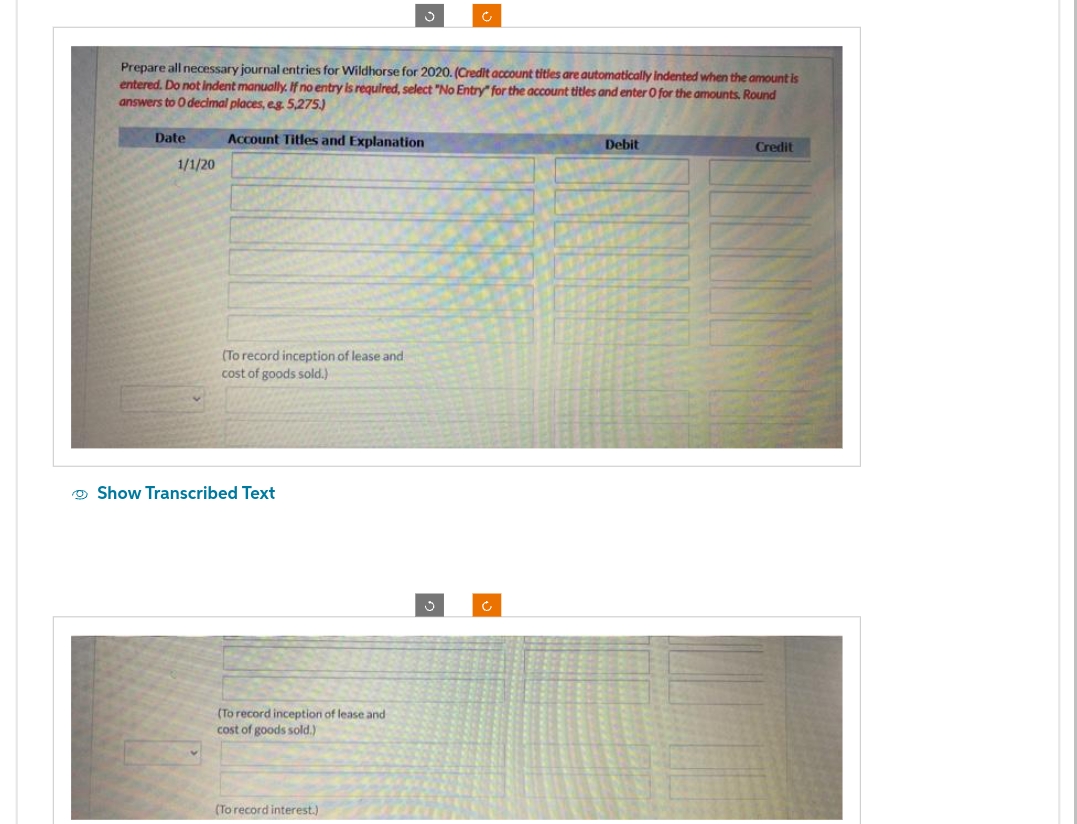

Transcribed Image Text:Prepare all necessary journal entries for Wildhorse for 2020. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts, Round

answers to 0 decimal places, eg. 5,275.)

Account Titles and Explanation

Date

1/1/20

(To record inception of lease and

cost of goods sold.)

Show Transcribed Text

(To record inception of lease and

cost of goods sold.)

(To record interest.)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT