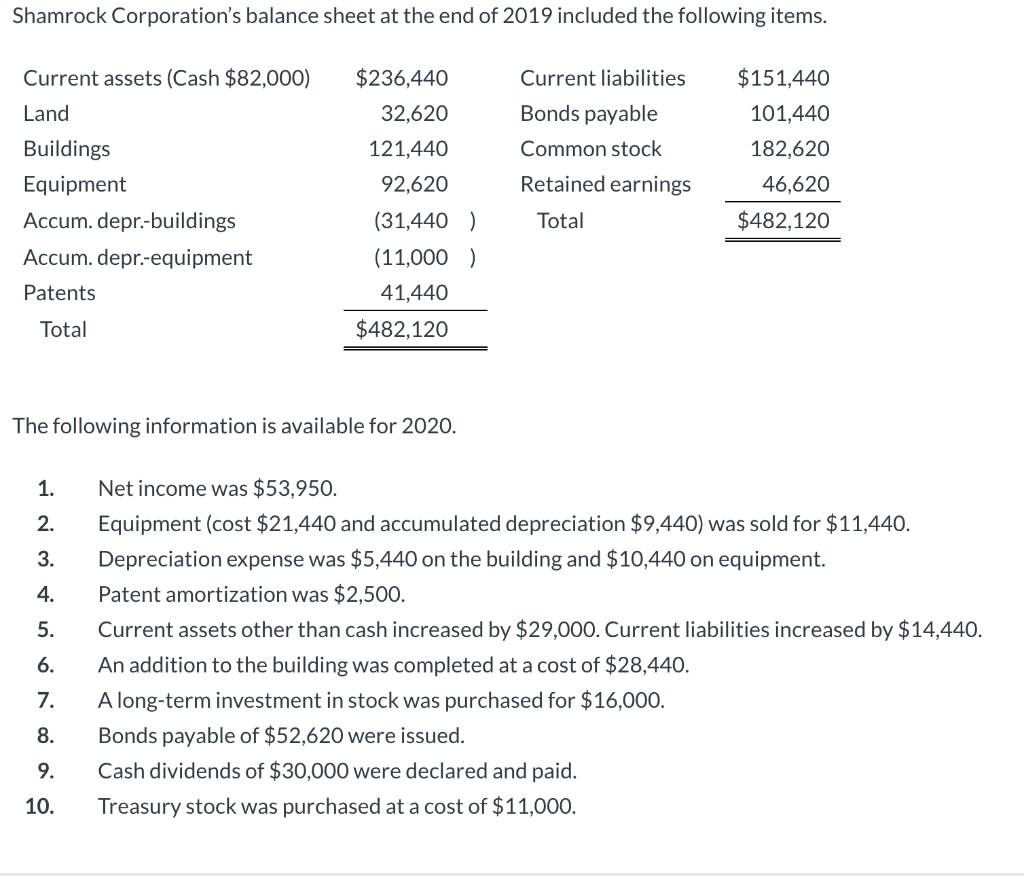

Shamrock Corporation's balance sheet at the end of 2019 included the following items. Current assets (Cash $82,000) Land Buildings Equipment Accum. depr.-buildings Accum. depr.-equipment Patents Total $236,440 32,620 121,440 92,620 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. (31,440) (11,000) 41,440 $482,120 The following information is available for 2020. Current liabilities Bonds payable Common stock Retained earnings Total $151,440 101,440 182,620 46,620 $482,120 Net income was $53,950. Equipment (cost $21,440 and accumulated depreciation $9,440) was sold for $11,440. Depreciation expense was $5,440 on the building and $10,440 on equipment. Patent amortization was $2,500. Current assets other than cash increased by $29,000. Current liabilities increased by $14,440. An addition to the building was completed at a cost of $28,440. A long-term investment in stock was purchased for $16,000. Bonds payable of $52,620 were issued. Cash dividends of $30,000 were declared and paid. Treasury stock was purchased at a cost of $11,000.

Shamrock Corporation's balance sheet at the end of 2019 included the following items. Current assets (Cash $82,000) Land Buildings Equipment Accum. depr.-buildings Accum. depr.-equipment Patents Total $236,440 32,620 121,440 92,620 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. (31,440) (11,000) 41,440 $482,120 The following information is available for 2020. Current liabilities Bonds payable Common stock Retained earnings Total $151,440 101,440 182,620 46,620 $482,120 Net income was $53,950. Equipment (cost $21,440 and accumulated depreciation $9,440) was sold for $11,440. Depreciation expense was $5,440 on the building and $10,440 on equipment. Patent amortization was $2,500. Current assets other than cash increased by $29,000. Current liabilities increased by $14,440. An addition to the building was completed at a cost of $28,440. A long-term investment in stock was purchased for $16,000. Bonds payable of $52,620 were issued. Cash dividends of $30,000 were declared and paid. Treasury stock was purchased at a cost of $11,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 9E: Partially Completed Spreadsheet Hanks Company has prepared the following changes in account balances...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Shamrock Corporation's balance sheet at the end of 2019 included the following items.

Current assets (Cash $82,000)

Land

Buildings

Equipment

Accum. depr.-buildings

Accum. depr.-equipment

Patents

Total

$236,440

32,620

121,440

92,620

(31,440)

(11,000 )

41,440

$482,120

The following information is available for 2020.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Current liabilities

Bonds payable

Common stock

Retained earnings

Total

$151,440

101,440

182,620

46,620

$482,120

Net income was $53,950.

Equipment (cost $21,440 and accumulated depreciation $9,440) was sold for $11,440.

Depreciation expense was $5,440 on the building and $10,440 on equipment.

Patent amortization was $2,500.

Current assets other than cash increased by $29,000. Current liabilities increased by $14,440.

An addition to the building was completed at a cost of $28,440.

A long-term investment in stock was purchased for $16,000.

Bonds payable of $52,620 were issued.

Cash dividends of $30,000 were declared and paid.

Treasury stock was purchased at a cost of $11,000.

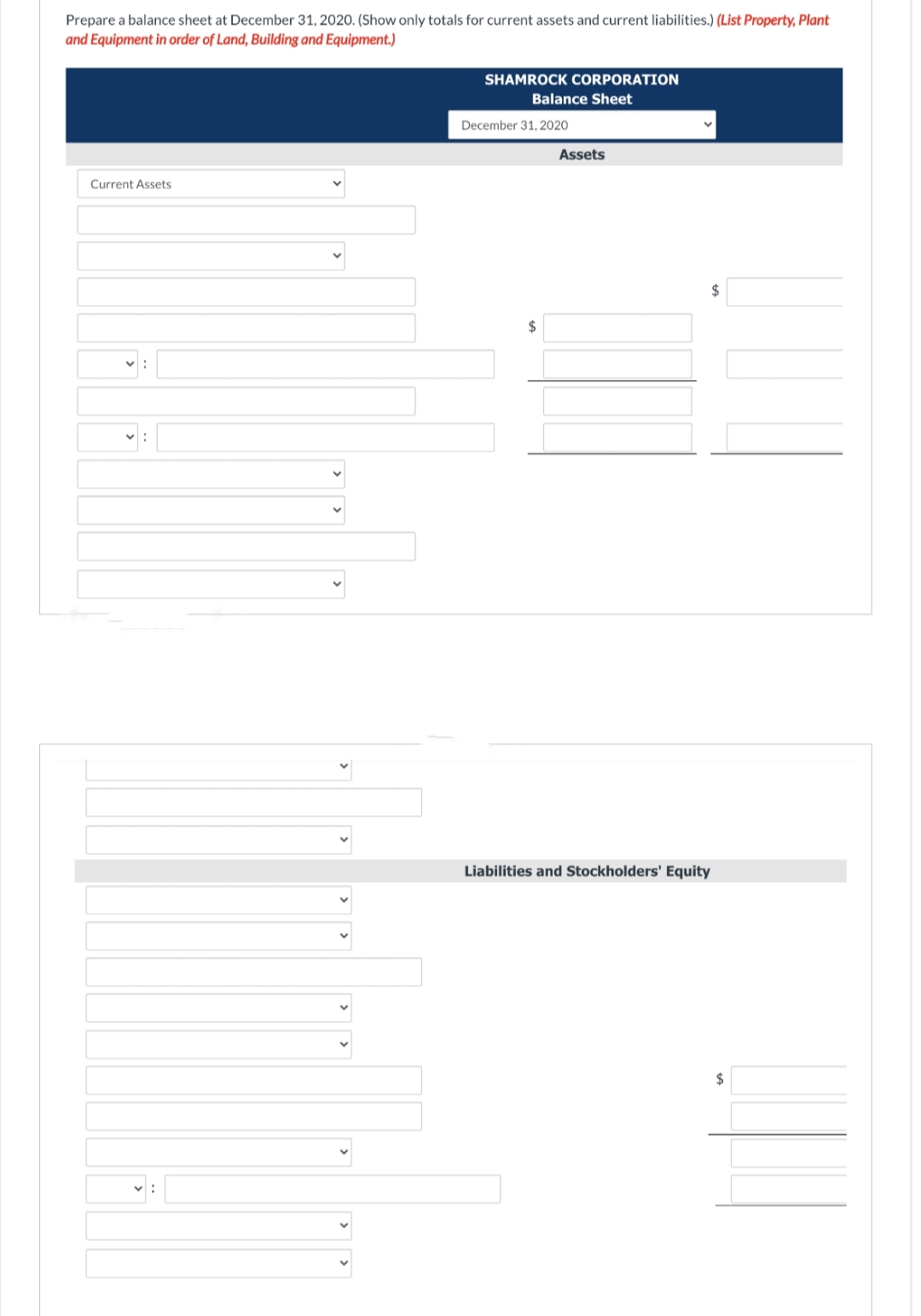

Transcribed Image Text:Prepare a balance sheet at December 31, 2020. (Show only totals for current assets and current liabilities.) (List Property, Plant

and Equipment in order of Land, Building and Equipment.)

Current Assets

M:

✓:

V:

✓

SHAMROCK CORPORATION

Balance Sheet

December 31, 2020

$

Assets

$

Liabilities and Stockholders' Equity

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning