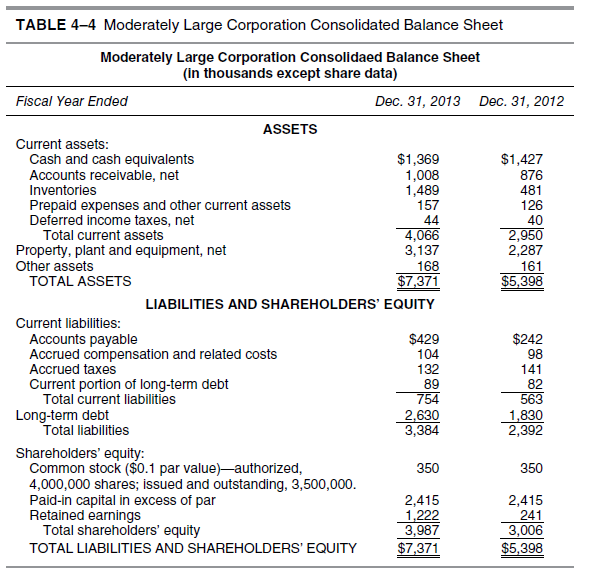

TABLE 4–4 Moderately Large Corporation Consolidated Balance Sheet Moderately Large Corporation Consolidaed Balance Sheet (in thousands except share data) Fiscal Year Ended Dec. 31, 2013 Dec. 31, 2012 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net $1,369 1,008 1,489 157 44 4,066 3,137 $1,427 876 481 126 40 2,950 2,287 161 $5,398 Inventories Prepaid expenses and other current assets Deferred income taxes, net Total current assets Property, plant and equipment, net Other assets TOTAL ASSETSS 168 $7,371 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued compensation and related costs Accrued taxes Current portion of long-term debt Total current liabilities Long-term debt Total liabilities $429 104 132 89 754 2,630 3,384 $242 98 141 82 563 1,830 2,392 Shareholders' equity: Common stock ($0.1 par value)-authorized, 4,000,000 shares; issued and outstanding, 3,500,000. Paid-in capital in excess of par Retained earnings Total shareholders' equity 350 350 2,415 1,222 3,987 $7,371 2,415 241 3,006 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $5,398

TABLE 4–4 Moderately Large Corporation Consolidated Balance Sheet Moderately Large Corporation Consolidaed Balance Sheet (in thousands except share data) Fiscal Year Ended Dec. 31, 2013 Dec. 31, 2012 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net $1,369 1,008 1,489 157 44 4,066 3,137 $1,427 876 481 126 40 2,950 2,287 161 $5,398 Inventories Prepaid expenses and other current assets Deferred income taxes, net Total current assets Property, plant and equipment, net Other assets TOTAL ASSETSS 168 $7,371 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued compensation and related costs Accrued taxes Current portion of long-term debt Total current liabilities Long-term debt Total liabilities $429 104 132 89 754 2,630 3,384 $242 98 141 82 563 1,830 2,392 Shareholders' equity: Common stock ($0.1 par value)-authorized, 4,000,000 shares; issued and outstanding, 3,500,000. Paid-in capital in excess of par Retained earnings Total shareholders' equity 350 350 2,415 1,222 3,987 $7,371 2,415 241 3,006 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $5,398

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3BE

Related questions

Question

Perform a vertical analysis of the MLC balance sheet (Table 4-4) for

December 31, 2012.

Transcribed Image Text:TABLE 4–4 Moderately Large Corporation Consolidated Balance Sheet

Moderately Large Corporation Consolidaed Balance Sheet

(in thousands except share data)

Fiscal Year Ended

Dec. 31, 2013 Dec. 31, 2012

ASSETS

Current assets:

Cash and cash equivalents

Accounts receivable, net

$1,369

1,008

1,489

157

44

4,066

3,137

$1,427

876

481

126

40

2,950

2,287

161

$5,398

Inventories

Prepaid expenses and other current assets

Deferred income taxes, net

Total current assets

Property, plant and equipment, net

Other assets

TOTAL ASSETSS

168

$7,371

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable

Accrued compensation and related costs

Accrued taxes

Current portion of long-term debt

Total current liabilities

Long-term debt

Total liabilities

$429

104

132

89

754

2,630

3,384

$242

98

141

82

563

1,830

2,392

Shareholders' equity:

Common stock ($0.1 par value)-authorized,

4,000,000 shares; issued and outstanding, 3,500,000.

Paid-in capital in excess of par

Retained earnings

Total shareholders' equity

350

350

2,415

1,222

3,987

$7,371

2,415

241

3,006

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$5,398

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning