Tax Drill - Business-Related Tax Credits Complete the following statements regarding various business-related tax credits. Enter percents as whole numbers. a. The disabled access exceed $10,250. credit is calculated at the rate of 50 percent of the eligible expenditures that exceed $250 but do not b. The incremental research activities credit is equal to year over the base amount. 20✔% of the excess of qualified research expenses for the taxable c. The credit for small employer pension plan start-up costs is available for eligible employers at the rate of qualified start-up costs. d. The credit for employer-provided child care, limited annually to % of qualified child care expenses and 50 ✓ % of 3,000 X, is composed of the aggregate of two components: % of qualified child care resource and referral services.

Tax Drill - Business-Related Tax Credits Complete the following statements regarding various business-related tax credits. Enter percents as whole numbers. a. The disabled access exceed $10,250. credit is calculated at the rate of 50 percent of the eligible expenditures that exceed $250 but do not b. The incremental research activities credit is equal to year over the base amount. 20✔% of the excess of qualified research expenses for the taxable c. The credit for small employer pension plan start-up costs is available for eligible employers at the rate of qualified start-up costs. d. The credit for employer-provided child care, limited annually to % of qualified child care expenses and 50 ✓ % of 3,000 X, is composed of the aggregate of two components: % of qualified child care resource and referral services.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 21E: Uncertain Tax Position At the end of the current year, Boyd Company claims a 200,000 tax credit on...

Related questions

Question

T1.

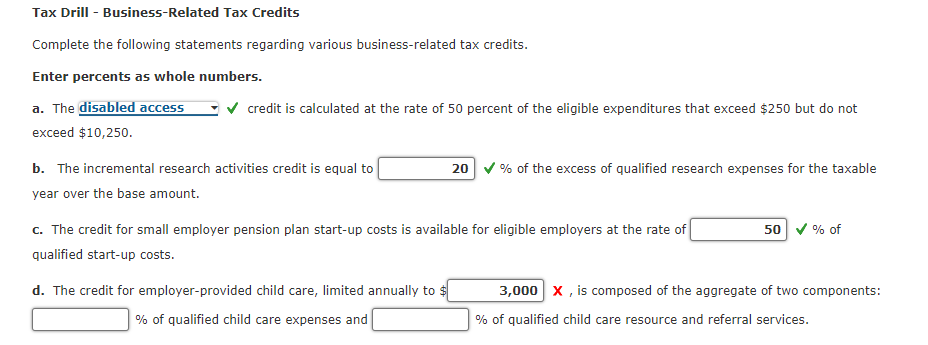

Transcribed Image Text:Tax Drill - Business-Related Tax Credits

Complete the following statements regarding various business-related tax credits.

Enter percents as whole numbers.

a. The disabled access

exceed $10,250.

✓ credit is calculated at the rate of 50 percent of the eligible expenditures that exceed $250 but do not

b. The incremental research activities credit is equal to

year over the base amount.

20✔% of the excess of qualified research expenses for the taxable

c. The credit for small employer pension plan start-up costs is available for eligible employers at the rate of

qualified start-up costs.

d. The credit for employer-provided child care, limited annually to $

% of qualified child care expenses and

50 % of

3,000 X, is composed of the aggregate of two components:

% of qualified child care resource and referral services.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning