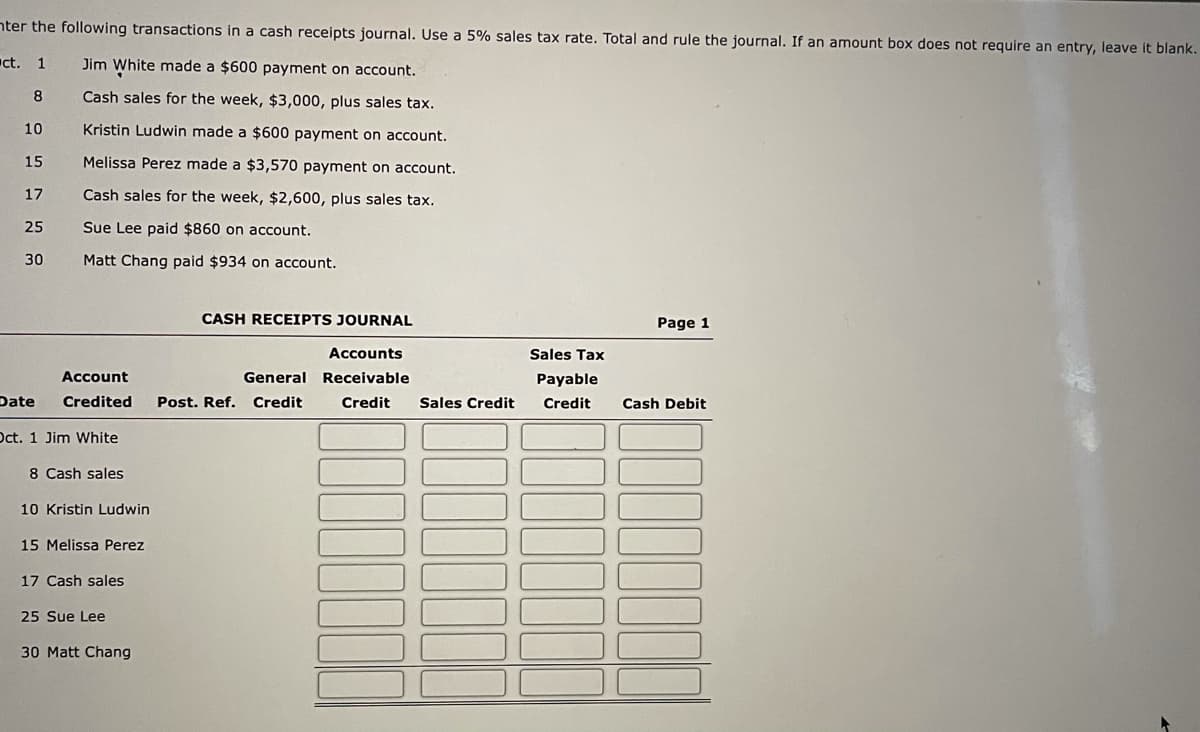

ter the following transactions in a cash receipts journal. Use a 5% sales tax rate. Total and rule the journal. If an amount box does not require an entry, leave it blan ct. 1 Jim White made a $600 payment on account. 8. Cash sales for the week, $3,000, plus sales tax. 10 Kristin Ludwin made a $600 payment on account. 15 Melissa Perez made a $3,570 payment on account. 17 Cash sales for the week, $2,600, plus sales tax. 25 Sue Lee paid $860 on account. 30 Matt Chang paid $934 on account. CASH RECEIPTS JOURNAL Page 1 Accounts Sales Tax Account General Receivable Payable Date Credited Post. Ref. Credit Credit Sales Credit Credit Cash Debit ct. 1 Jim White 8 Cash sales 10 Kristin Ludwin 15 Melissa Perez 17 Cash sales 25 Sue Lee 30 Matt Chang

ter the following transactions in a cash receipts journal. Use a 5% sales tax rate. Total and rule the journal. If an amount box does not require an entry, leave it blan ct. 1 Jim White made a $600 payment on account. 8. Cash sales for the week, $3,000, plus sales tax. 10 Kristin Ludwin made a $600 payment on account. 15 Melissa Perez made a $3,570 payment on account. 17 Cash sales for the week, $2,600, plus sales tax. 25 Sue Lee paid $860 on account. 30 Matt Chang paid $934 on account. CASH RECEIPTS JOURNAL Page 1 Accounts Sales Tax Account General Receivable Payable Date Credited Post. Ref. Credit Credit Sales Credit Credit Cash Debit ct. 1 Jim White 8 Cash sales 10 Kristin Ludwin 15 Melissa Perez 17 Cash sales 25 Sue Lee 30 Matt Chang

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 3EA: Consider the following transaction: On March 6, Fun Cards sells 540 card decks with a sales price of...

Related questions

Question

Transcribed Image Text:nter the following transactions in a cash receipts journal. Use a 5% sales tax rate. Total and rule the journal. If an amount box does not require an entry, leave it blank.

ct. 1

Jim White made a $600 payment on account.

8

Cash sales for the week, $3,000, plus sales tax.

10

Kristin Ludwin made a $600 payment on account.

15

Melissa Perez made a $3,570 payment on account.

17

Cash sales for the week, $2,600, plus sales tax.

25

Sue Lee paid $860 on account.

30

Matt Chang paid $934 on account.

CASH RECEIPTS JOURNAL

Page 1

Accounts

Sales Tax

Account

General Receivable

Payable

Date

Credited

Post. Ref.

Credit

Credit

Sales Credit

Credit

Cash Debit

Oct. 1 Jim White

8 Cash sales

10 Kristin Ludwin

15 Melissa Perez

17 Cash sales

25 Sue Lee

30 Matt Chang

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning