Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 Received payment on account from Michael Anderson, $1,360. 2 Received payment on account from Ansel Manufacturing, $382. 7 Cash sales for the week were $3,160 plus tax. Bank credit card sales for the week were $1,000 plus tax. Bank credit card fee is 3%. 8 Received payment on account from J. Gorbea, $880. 11 Michael Anderson returned merchandise for a credit, $60 plus tax. 14 Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $800 plus tax. Bank credit card fee is 3%. 20 Received payment on account from Tom Wilson, $1,110. 21 Ansel Manufacturing returned merchandise for a credit, $22 plus tax. 21 Cash sales for the week were $3,200 plus tax. 24 Received payment on account from Rachel Carson, $2,000 The beginning general ledger account balances have been entered in the accounts. Post from the journal to the general ledger accounts. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. After posting to the general ledger, go to part 1 and complete the posting. Enter the transactions in chronological order and in the order posted in part 1. Cash $9,862 Accounts Receivable 9,352

Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 Received payment on account from Michael Anderson, $1,360. 2 Received payment on account from Ansel Manufacturing, $382. 7 Cash sales for the week were $3,160 plus tax. Bank credit card sales for the week were $1,000 plus tax. Bank credit card fee is 3%. 8 Received payment on account from J. Gorbea, $880. 11 Michael Anderson returned merchandise for a credit, $60 plus tax. 14 Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $800 plus tax. Bank credit card fee is 3%. 20 Received payment on account from Tom Wilson, $1,110. 21 Ansel Manufacturing returned merchandise for a credit, $22 plus tax. 21 Cash sales for the week were $3,200 plus tax. 24 Received payment on account from Rachel Carson, $2,000 The beginning general ledger account balances have been entered in the accounts. Post from the journal to the general ledger accounts. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. After posting to the general ledger, go to part 1 and complete the posting. Enter the transactions in chronological order and in the order posted in part 1. Cash $9,862 Accounts Receivable 9,352

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 3MC

Related questions

Question

NEED HELP

Cash Receipts Transactions

Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%.

| Dec. 1 | Received payment on account from Michael Anderson, $1,360. |

| 2 | Received payment on account from Ansel Manufacturing, $382. |

| 7 | Cash sales for the week were $3,160 plus tax. Bank credit card sales for the week were $1,000 plus tax. Bank credit card fee is 3%. |

| 8 | Received payment on account from J. Gorbea, $880. |

| 11 | Michael Anderson returned merchandise for a credit, $60 plus tax. |

| 14 | Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $800 plus tax. Bank credit card fee is 3%. |

| 20 | Received payment on account from Tom Wilson, $1,110. |

| 21 | Ansel Manufacturing returned merchandise for a credit, $22 plus tax. |

| 21 | Cash sales for the week were $3,200 plus tax. |

| 24 | Received payment on account from Rachel Carson, $2,000 |

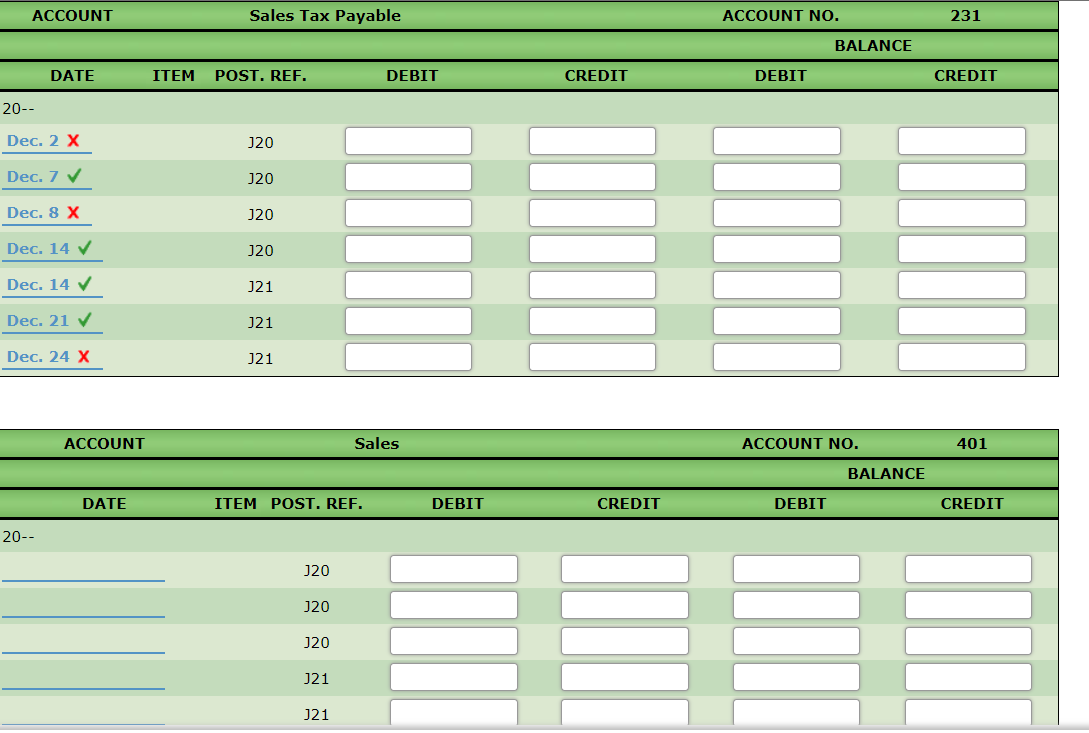

The beginning general ledger account balances have been entered in the accounts. Post from the journal to the general ledger accounts. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. After posting to the general ledger, go to part 1 and complete the posting. Enter the transactions in chronological order and in the order posted in part 1.

| Cash | $9,862 |

| 9,352 |

Transcribed Image Text:ACCOUNT

Sales Tax Payable

ACCOUNT NO.

231

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

20--

Dec. 2 X

J20

Dec. 7 V

J20

Dec. 8 X

J20

Dec. 14 V

J20

Dec. 14 V

J21

Dec. 21 V

J21

Dec. 24 X

J21

ACCOUNT

Sales

ACCOUNT NO.

401

BALANCE

DATE

ITEM POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

20--

J20

J20

J20

J21

J21

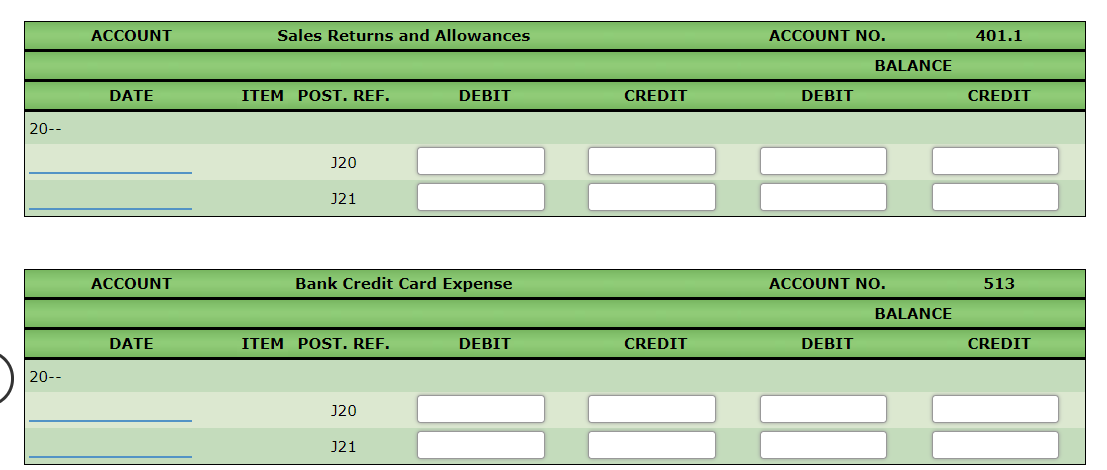

Transcribed Image Text:ACCOUNT

Sales Returns and Allowances

ACCOUNT NO.

401.1

BALANCE

DATE

ITEM POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

20--

J20

J21

ACCOUNT

Bank Credit Card Expense

ACCOUNT NO.

513

BALANCE

DATE

ITEM POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

20--

J20

J21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning