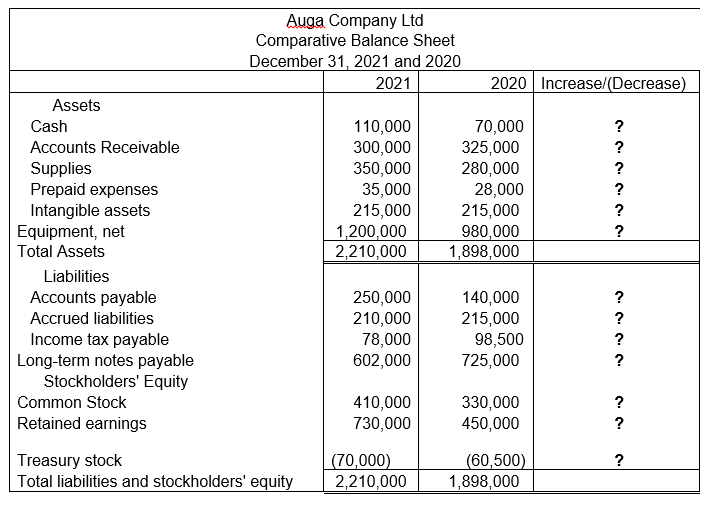

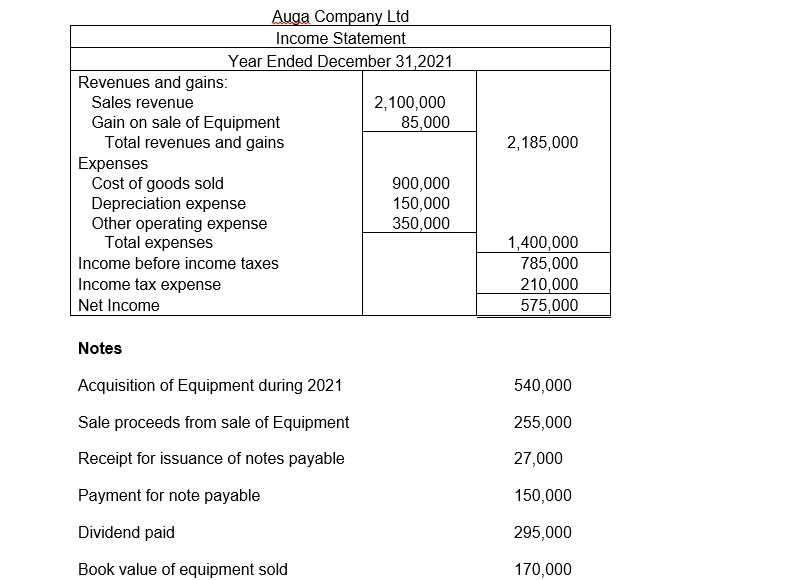

The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been distributed at a meeting of the company’s board of directors. The members of the board of directors were desirous of knowing the reason or reasons why the cash balance different from the net income. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the directors. The directors have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information (see images) Answer the following questions for the directors: True or false, the financing activities section of the statement of cash flows reflects the cash flows that affect current assets and liabilities? True or false, buying property, plant and equipment would be considered a cash outflow from financing? True or false, the financing section of the statement of cash flows reflects transactions in the equity accounts and the long-term liability accounts? 7. True or false, suppose Auga Company Ltd just started business and was looking for additional capital in order to purchase a property to build their headquarters. If they found an investor who was willing to sell them land worth $500,000 in exchange for stock in the company, would this transaction be shown in the investing activities section of the statement of cash flows?

The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been distributed at a meeting of the company’s board of directors. The members of the board of directors were desirous of knowing the reason or reasons why the cash balance different from the net income. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the directors.

The directors have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information (see images)

Answer the following questions for the directors:

- True or false, the financing activities section of the statement of cash flows reflects the cash flows that affect current assets and liabilities?

- True or false, buying property, plant and equipment would be considered a

cash outflow from financing? - True or false, the financing section of the statement of cash flows reflects transactions in the equity accounts and the long-term liability accounts?

7. True or false, suppose Auga Company Ltd just started business and was looking for additional capital in order to purchase a property to build their headquarters. If they found an investor who was willing to sell them land worth $500,000 in exchange for stock in the company, would this transaction be shown in the investing activities section of the statement of cash flows?

Step by step

Solved in 2 steps