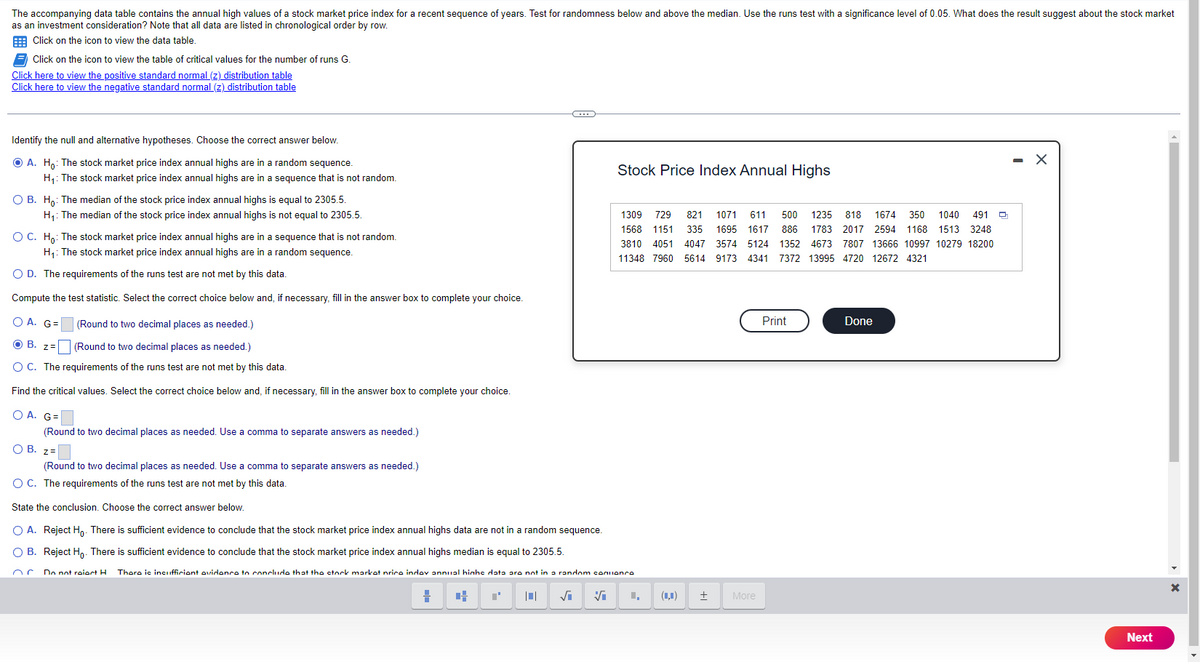

The accompanying data table contains the annual high values of a stock market price index for a recent sequence of years. Test for randomness below and above the median. Use the runs test with a significance level of 0.05. What does the result suggest about the stock market as an investment consideration? Note that all data are listed in chronological order by row. Click on the icon to view the data table. Click on the icon to view the table of critical values for the number of runs G. Click here to view the positive standard normal (2) distribution table Click here to view the negative standard normal (z) distribution table Identify the null and alternative hypotheses. Choose the correct answer below. A. Ho: The stock market price index annual highs are in a random sequence. H₁: The stock market price index annual highs are in a sequence that is not random. OB. Ho: The median of the stock price index annual highs is equal to 2305.5. H₁: The median of the stock price index annual highs is not equal to 2305.5. OC. Ho: The stock market price index annual highs are in a sequence that is not random. H₁: The stock market price index annual highs are in a random sequence. OD. The requirements of the runs test are not met by this data. Compute the test statistic. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. OA. G=(Round to two decimal places as needed.) B. z (Round to two decimal places as needed.) OC. The requirements of the runs test are not met by this data. Find the critical values. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. OA. G= (Round to two decimal places as needed. Use a comma to separate answers as needed.) Stock Price Index Annual Highs 4 1309 729 821 1071 611 500 1235 818 1674 350 1040 491 D 1568 1151 335 1695 1617 886 1783 2017 2594 1168 1513 3248 3810 4051 4047 3574 5124 1352 4673 7807 13666 10997 10279 18200 11348 7960 5614 9173 4341 7372 13995 4720 12672 4321 OB. 2= (Round to two decimal places as needed. Use a comma to separate answers as needed.) OC. The requirements of the runs test are not met by this data. State the conclusion. Choose the correct answer below. OA. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs data are not in a random sequence. OB. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs median is equal to 2305.5. Do not raiart H Thara le insufficient avirlanca in conclude that the stock market nrica indav annual hinhe data are not in a random cananca 4√√ II, (0,0) ± More Print Done X

The accompanying data table contains the annual high values of a stock market price index for a recent sequence of years. Test for randomness below and above the median. Use the runs test with a significance level of 0.05. What does the result suggest about the stock market as an investment consideration? Note that all data are listed in chronological order by row. Click on the icon to view the data table. Click on the icon to view the table of critical values for the number of runs G. Click here to view the positive standard normal (2) distribution table Click here to view the negative standard normal (z) distribution table Identify the null and alternative hypotheses. Choose the correct answer below. A. Ho: The stock market price index annual highs are in a random sequence. H₁: The stock market price index annual highs are in a sequence that is not random. OB. Ho: The median of the stock price index annual highs is equal to 2305.5. H₁: The median of the stock price index annual highs is not equal to 2305.5. OC. Ho: The stock market price index annual highs are in a sequence that is not random. H₁: The stock market price index annual highs are in a random sequence. OD. The requirements of the runs test are not met by this data. Compute the test statistic. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. OA. G=(Round to two decimal places as needed.) B. z (Round to two decimal places as needed.) OC. The requirements of the runs test are not met by this data. Find the critical values. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. OA. G= (Round to two decimal places as needed. Use a comma to separate answers as needed.) Stock Price Index Annual Highs 4 1309 729 821 1071 611 500 1235 818 1674 350 1040 491 D 1568 1151 335 1695 1617 886 1783 2017 2594 1168 1513 3248 3810 4051 4047 3574 5124 1352 4673 7807 13666 10997 10279 18200 11348 7960 5614 9173 4341 7372 13995 4720 12672 4321 OB. 2= (Round to two decimal places as needed. Use a comma to separate answers as needed.) OC. The requirements of the runs test are not met by this data. State the conclusion. Choose the correct answer below. OA. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs data are not in a random sequence. OB. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs median is equal to 2305.5. Do not raiart H Thara le insufficient avirlanca in conclude that the stock market nrica indav annual hinhe data are not in a random cananca 4√√ II, (0,0) ± More Print Done X

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

J 1

Transcribed Image Text:The accompanying data table contains the annual high values of a stock market price index for a recent sequence of years. Test for randomness below and above the median. Use the runs test with a significance level of 0.05. What does the result suggest about the stock market

as an investment consideration? Note that all data are listed in chronological order by row.

Click on the icon to view the data table.

Click on the icon to view the table of critical values for the number of runs G.

Click here to view the positive standard normal (z) distribution table

Click here to view the negative standard normal (z) distribution table

Identify the null and alternative hypotheses. Choose the correct answer below.

ⒸA. Ho: The stock market price index annual highs are in a random sequence.

H₁: The stock market price index annual highs are in a sequence that is not random.

O B. Ho: The median of the stock price index annual highs is equal to 2305.5.

H₁: The median of the stock price index annual highs is not equal to 2305.5.

O C. Ho: The stock market price index annual highs are in a sequence that is not random.

H₁: The stock market price index annual highs are in a random sequence.

O D. The requirements of the runs test are not met by this data.

Compute the test statistic. Select the correct choice below and, if necessary, fill in the answer box to complete your choice.

OA. G=

(Round to two decimal places as needed.)

O B. Z=

(Round to two decimal places as needed.)

O C. The requirements of the runs test are not met by this data.

Find the critical values. Select the correct choice below and, if necessary, fill in the answer box to complete your choice.

O A. G=

(Round to two decimal places as needed. Use a comma to separate answers as needed.)

O B. z=

(Round to two decimal places as needed. Use a comma to separate answers as needed.)

O C. The requirements of the runs test are not met by this data.

State the conclusion. Choose the correct answer below.

O A. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs data are not in a random sequence.

OB. Reject Ho. There is sufficient evidence to conclude that the stock market price index annual highs median is equal to 2305.5.

Do not raiart H

=

Stock Price Index Annual Highs

There is incufficient evidence to conclude that the stock market price indlev annual hinhe data are not in a random contionco

C T |0| √i ✔

1309 729 821 1071 611 500 1235 818 1674 350 1040 491 Q

1568 1151 335 1695 1617 886 1783 2017 2594 1168 1513 3248

3810 4051 4047 3574 5124 1352 4673 7807 13666 10997 10279 18200

11348 7960 5614 9173 4341 7372 13995 4720 12672 4321

(4) ±

More

Print

Done

Next

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill