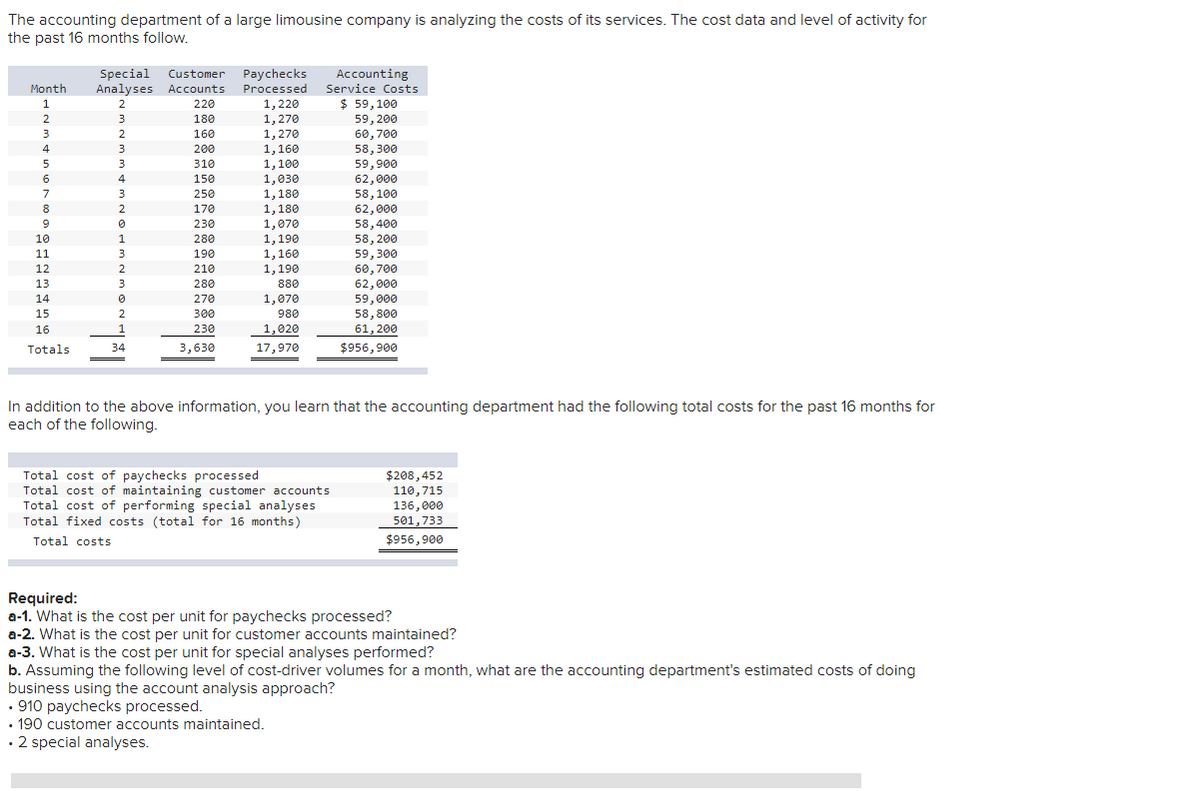

The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow. Accounting Analyses Accounts Processed Service Costs $ 59, 100 59, 200 60, 700 58, 300 59,900 62,000 58,100 62,000 58,400 58, 200 59,300 60, 700 62,000 59,000 58,800 61, 200 Special Customer Paychecks Month 1,220 1,270 1,270 1,160 1,100 1,030 1,180 2 220 2 3 180 3 2 160 4 200 310 150 250 5 6 4 3 8 2 170 1,180 230 1,070 1,190 1,160 1,190 880 10 280 190 11 12 2. 210 280 270 300 13 1,070 980 14 15 2 16 230 1,020 Totals 34 3,630 17,970 $956,900 In addition to the above information, you learn that the accounting department had the following total costs for the past 16 months for each of the following. Total cost of paychecks processed Total cost of maintaining customer accounts Total cost of performing special analyses Total fixed costs (total for 16 months) $208,452 110,715 136,000 501,733 Total costs $956,900 Required: a-1. What is the cost per unit for paychecks processed? a-2. What is the cost per unit for customer accounts maintained? a-3. What is the cost per unit for special analyses performed? b. Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of doing business using the account analysis approach? • 910 paychecks processed. • 190 customer accounts maintained. · 2 special analyses.

The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow. Accounting Analyses Accounts Processed Service Costs $ 59, 100 59, 200 60, 700 58, 300 59,900 62,000 58,100 62,000 58,400 58, 200 59,300 60, 700 62,000 59,000 58,800 61, 200 Special Customer Paychecks Month 1,220 1,270 1,270 1,160 1,100 1,030 1,180 2 220 2 3 180 3 2 160 4 200 310 150 250 5 6 4 3 8 2 170 1,180 230 1,070 1,190 1,160 1,190 880 10 280 190 11 12 2. 210 280 270 300 13 1,070 980 14 15 2 16 230 1,020 Totals 34 3,630 17,970 $956,900 In addition to the above information, you learn that the accounting department had the following total costs for the past 16 months for each of the following. Total cost of paychecks processed Total cost of maintaining customer accounts Total cost of performing special analyses Total fixed costs (total for 16 months) $208,452 110,715 136,000 501,733 Total costs $956,900 Required: a-1. What is the cost per unit for paychecks processed? a-2. What is the cost per unit for customer accounts maintained? a-3. What is the cost per unit for special analyses performed? b. Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of doing business using the account analysis approach? • 910 paychecks processed. • 190 customer accounts maintained. · 2 special analyses.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 30E: A company uses charging rates to allocate service department costs to the using departments. The...

Related questions

Question

The accounting department of a large limousine company is analyzing the costs of its services.

Need assistance with a1-a3

Transcribed Image Text:The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for

the past 16 months follow.

Customer Paychecks

Special

Analyses Accounts

Accounting

Processed Service Costs

$ 59,100

Month

1

2

220

1,220

1,270

1,270

1,160

1,100

1,030

1,180

1,180

1,070

1,190

1,160

1,190

2

3

180

59, 200

60, 700

58, 300

59,900

62,000

58, 100

3

2

160

4

3

200

5

3

310

6.

4

150

7

3

250

8

2

170

62,000

9

230

58,400

58, 200

59, 300

60, 700

62, 000

10

1

280

11

3

190

12

2

210

13

3

280

880

14

270

1,070

59,000

58, 800

61, 200

15

2

300

980

16

1

230

1,020

Totals

34

3,630

17,970

$956,900

In addition to the above information, you learn that the accounting department had the following total costs for the past 16 months for

each of the following.

Total cost of paychecks processed

Total cost of maintaining customer accounts

Total cost of performing special analyses

Total fixed costs (total for 16 months)

$208,452

110,715

136, 000

501,733

Total costs

$956,900

Required:

a-1. What is the cost per unit for paychecks processed?

a-2. What is the cost per unit for customer accounts maintained?

a-3. What is the cost per unit for special analyses performed?

b. Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of doing

business using the account analysis approach?

• 910 paychecks processed.

• 190 customer accounts maintained.

· 2 special analyses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning