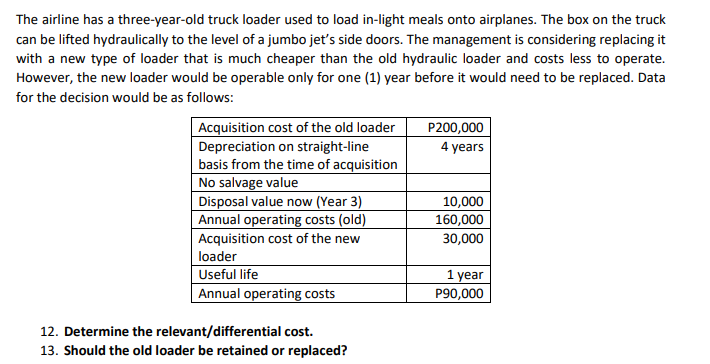

The airline has a three-year-old truck loader used to load in-light meals onto airplanes. The box on the truck can be lifted hydraulically to the level of a jumbo jeť's side doors. The management is considering replacing it with a new type of loader that is much cheaper than the old hydraulic loader and costs less to operate. However, the new loader would be operable only for one (1) year before it would need to be replaced. Data for the decision would be as follows: Acquisition cost of the old loader Depreciation on straight-line basis from the time of acquisition No salvage value Disposal value now (Year 3) Annual operating costs (old) P200,000 4 years 10,000 160,000 30,000 Acquisition cost of the new loader Useful life Annual operating costs 1 year P90,000 12. Determine the relevant/differential cost. 13. Should the old loader be retained or replaced?

The airline has a three-year-old truck loader used to load in-light meals onto airplanes. The box on the truck can be lifted hydraulically to the level of a jumbo jeť's side doors. The management is considering replacing it with a new type of loader that is much cheaper than the old hydraulic loader and costs less to operate. However, the new loader would be operable only for one (1) year before it would need to be replaced. Data for the decision would be as follows: Acquisition cost of the old loader Depreciation on straight-line basis from the time of acquisition No salvage value Disposal value now (Year 3) Annual operating costs (old) P200,000 4 years 10,000 160,000 30,000 Acquisition cost of the new loader Useful life Annual operating costs 1 year P90,000 12. Determine the relevant/differential cost. 13. Should the old loader be retained or replaced?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 30P: Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of...

Related questions

Question

Transcribed Image Text:The airline has a three-year-old truck loader used to load in-light meals onto airplanes. The box on the truck

can be lifted hydraulically to the level of a jumbo jet's side doors. The management is considering replacing it

with a new type of loader that is much cheaper than the old hydraulic loader and costs less to operate.

However, the new loader would be operable only for one (1) year before it would need to be replaced. Data

for the decision would be as follows:

Acquisition cost of the old loader

P200,000

4 years

Depreciation on straight-line

basis from the time of acquisition

No salvage value

Disposal value now (Year 3)

Annual operating costs (old)

Acquisition cost of the new

loader

10,000

160,000

30,000

Useful life

Annual operating costs

1 year

P90,000

12. Determine the relevant/differential cost.

13. Should the old loader be retained or replaced?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning