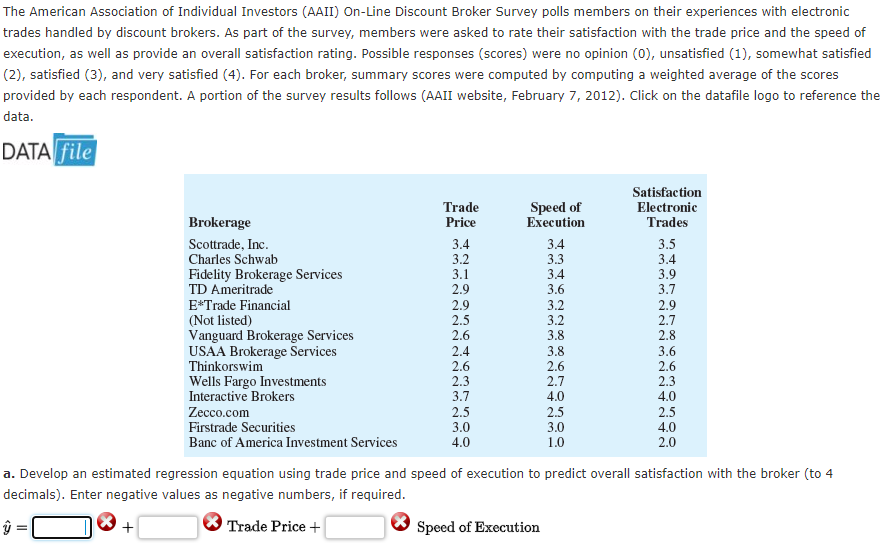

The American Association of Individual Investors (AAII) On-Line Discount Broker Survey polls members on their experiences with electronic trades handled by discount brokers. As part of the survey, members were asked to rate their satisfaction with the trade price and the speed of execution, as well as provide an overall satisfaction rating. Possible responses (scores) were no opinion (0), unsatisfied (1), somewhat satisfied (2), satisfied (3), and very satisfied (4). For each broker, summary scores were computed by computing a weighted average of the scores provided by each respondent. A portion of the survey results follows (AAII website, February 7, 2012). Click on the datafile logo to reference the data. DATA file Trade Price Speed of Еxecution Satisfaction Electronic Trades Brokerage Scottrade, Inc. Charles Schwab 3.4 3.2 3.1 2.9 2.9 2.5 2.6 2.4 2.6 2.3 3.7 2.5 3.0 4.0 3.4 3.3 3.4 3.6 3.2 3.2 3.8 3.8 2.6 2.7 4.0 2.5 3.0 1.0 3.5 3.4 3.9 3.7 2.9 2.7 2.8 3.6 2.6 2.3 4.0 2.5 4.0 2.0 Fidelity Brokerage Services TD Ameritrade E*Trade Financial (Not listed) Vanguard Brokerage Services USAA Brokerage Services Thinkorswim Wells Fargo Investments Interactive Brokers Zecco.com Firstrade Securities Banc of America Investment Services a. Develop an estimated regression equation using trade price and speed of execution to predict overall satisfaction with the broker (to 4 decimals). Enter negative values as negative numbers, if required. ® Trade Price + Speed of Execution 2222

The American Association of Individual Investors (AAII) On-Line Discount Broker Survey polls members on their experiences with electronic trades handled by discount brokers. As part of the survey, members were asked to rate their satisfaction with the trade price and the speed of execution, as well as provide an overall satisfaction rating. Possible responses (scores) were no opinion (0), unsatisfied (1), somewhat satisfied (2), satisfied (3), and very satisfied (4). For each broker, summary scores were computed by computing a weighted average of the scores provided by each respondent. A portion of the survey results follows (AAII website, February 7, 2012). Click on the datafile logo to reference the data. DATA file Trade Price Speed of Еxecution Satisfaction Electronic Trades Brokerage Scottrade, Inc. Charles Schwab 3.4 3.2 3.1 2.9 2.9 2.5 2.6 2.4 2.6 2.3 3.7 2.5 3.0 4.0 3.4 3.3 3.4 3.6 3.2 3.2 3.8 3.8 2.6 2.7 4.0 2.5 3.0 1.0 3.5 3.4 3.9 3.7 2.9 2.7 2.8 3.6 2.6 2.3 4.0 2.5 4.0 2.0 Fidelity Brokerage Services TD Ameritrade E*Trade Financial (Not listed) Vanguard Brokerage Services USAA Brokerage Services Thinkorswim Wells Fargo Investments Interactive Brokers Zecco.com Firstrade Securities Banc of America Investment Services a. Develop an estimated regression equation using trade price and speed of execution to predict overall satisfaction with the broker (to 4 decimals). Enter negative values as negative numbers, if required. ® Trade Price + Speed of Execution 2222

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter6: Ratio, Proportion, And Probability

Section: Chapter Questions

Problem 4CR

Related questions

Question

I need help with part A

Transcribed Image Text:The American Association of Individual Investors (AAII) On-Line Discount Broker Survey polls members on their experiences with electronic

trades handled by discount brokers. As part of the survey, members were asked to rate their satisfaction with the trade price and the speed of

execution, as well as provide an overall satisfaction rating. Possible responses (scores) were no opinion (0), unsatisfied (1), somewhat satisfied

(2), satisfied (3), and very satisfied (4). For each broker, summary scores were computed by computing a weighted average of the scores

provided by each respondent. A portion of the survey results follows (AAII website, February 7, 2012). Click on the datafile logo to reference the

data.

DATA file

Trade

Price

Speed of

Execution

Satisfaction

Electronic

Trades

Brokerage

Scottrade, Inc.

Charles Schwab

3.4

3.2

3.1

3.4

3.3

3.4

3.6

3.5

3.4

3.9

3.7

Fidelity Brokerage Services

TD Ameritrade

2.9

E*Trade Financial

2.9

2.5

2.6

3.2

3.2

3.8

2.9

2.7

2.8

(Not listed)

Vanguard Brokerage Services

USAA Brokerage Services

Thinkorswim

2.4

2.6

2.3

3.7

3.8

2.6

2.7

4.0

3.6

2.6

2.3

4.0

Wells Fargo Investments

Interactive Brokers

Zecco.com

Firstrade Securities

Banc of America Investment Services

2.5

3.0

4.0

2.5

3.0

1.0

2.5

4.0

2.0

a. Develop an estimated regression equation using trade price and speed of execution to predict overall satisfaction with the broker (to 4

decimals). Enter negative values as negative numbers, if required.

ŷ =

Trade Price +

Speed of Execution

هم

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL