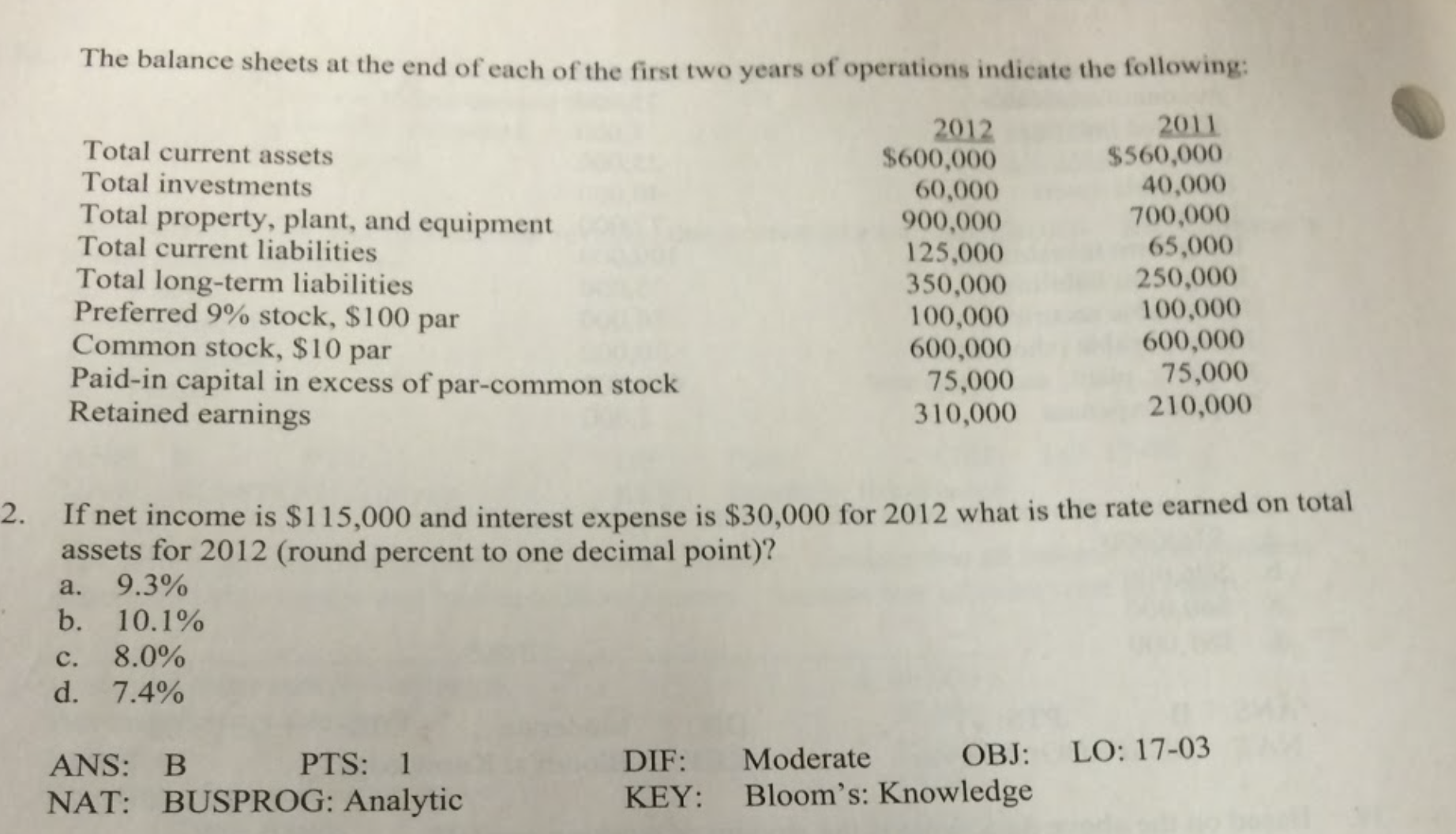

The balance sheets at the end of each of the first two years of operations indicate the following: 2011 $560,000 40,000 700,000 65,000 250,000 100,000 600,000 75,000 210,000 2012 $600,000 Total current assets Total investments 60,000 900,000 125,000 350,000 100,000 600,000 75,000 310,000 Total property, plant, and equipment Total current liabilities Total long-term liabilities Preferred 9% stock, $100 par Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings If net income is $115,000 and interest expense is $30,000 for 2012 what is the rate earned on total assets for 2012 (round percent to one decimal point)? 9.3% 2. a. b. 10.1% 8.0% c. d. 7.4% LO: 17-03 OBJ: Moderate DIF: ANS: B PTS: 1 Bloom's: Knowledge KEY: NAT: BUSPROG: Analytic

The balance sheets at the end of each of the first two years of operations indicate the following: 2011 $560,000 40,000 700,000 65,000 250,000 100,000 600,000 75,000 210,000 2012 $600,000 Total current assets Total investments 60,000 900,000 125,000 350,000 100,000 600,000 75,000 310,000 Total property, plant, and equipment Total current liabilities Total long-term liabilities Preferred 9% stock, $100 par Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings If net income is $115,000 and interest expense is $30,000 for 2012 what is the rate earned on total assets for 2012 (round percent to one decimal point)? 9.3% 2. a. b. 10.1% 8.0% c. d. 7.4% LO: 17-03 OBJ: Moderate DIF: ANS: B PTS: 1 Bloom's: Knowledge KEY: NAT: BUSPROG: Analytic

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 53P: Balance sheets for Brierwold Corporation follow: Additional transactions were as follows: a....

Related questions

Question

Transcribed Image Text:The balance sheets at the end of each of the first two years of operations indicate the following:

2011

$560,000

40,000

700,000

65,000

250,000

100,000

600,000

75,000

210,000

2012

$600,000

Total current assets

Total investments

60,000

900,000

125,000

350,000

100,000

600,000

75,000

310,000

Total property, plant, and equipment

Total current liabilities

Total long-term liabilities

Preferred 9% stock, $100 par

Common stock, $10 par

Paid-in capital in excess of par-common stock

Retained earnings

If net income is $115,000 and interest expense is $30,000 for 2012 what is the rate earned on total

assets for 2012 (round percent to one decimal point)?

9.3%

2.

a.

b. 10.1%

8.0%

c.

d. 7.4%

LO: 17-03

OBJ:

Moderate

DIF:

ANS: B

PTS: 1

Bloom's: Knowledge

KEY:

NAT: BUSPROG: Analytic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning