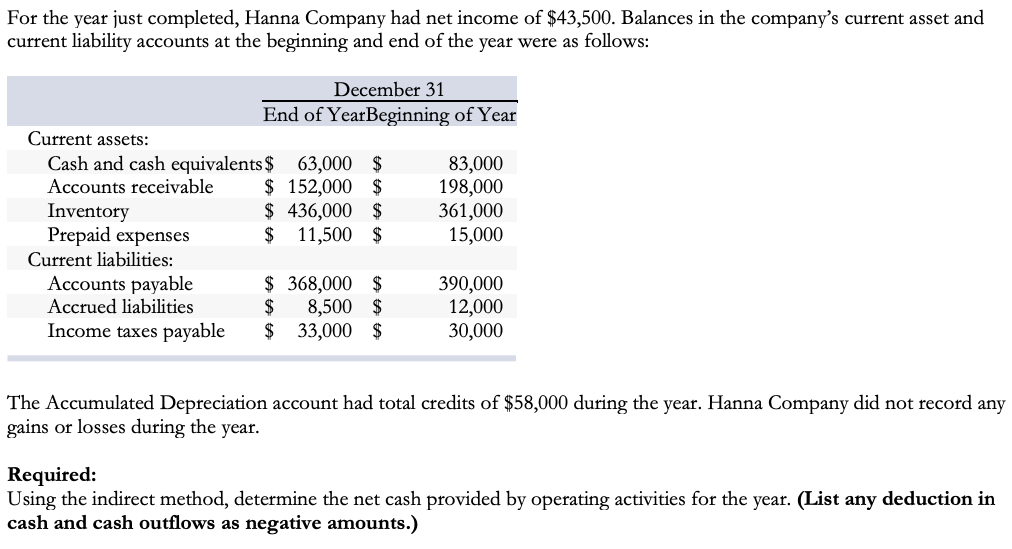

For the year just completed, Hanna Company had net income of $43,500. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of YearBeginning of Year Current assets: Cash and cash equivalents $ 63,000 $ $ 152,000 $ $ 436,000 $ $ 11,500 $ 83,000 198,000 361,000 15,000 Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 368,000 $ 390,000 12,000 30,000 $ 8,500 $ $ 33,000 $

For the year just completed, Hanna Company had net income of $43,500. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of YearBeginning of Year Current assets: Cash and cash equivalents $ 63,000 $ $ 152,000 $ $ 436,000 $ $ 11,500 $ 83,000 198,000 361,000 15,000 Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 368,000 $ 390,000 12,000 30,000 $ 8,500 $ $ 33,000 $

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.5E: Classification of Assets and Liabilities Indicate the appropriate classification of each of the...

Related questions

Question

What is the Required, otherwise meaning: the Operating Activities section of the Cash Flow Statement using the INDIRECT METHOD?

Transcribed Image Text:For the year just completed, Hanna Company had net income of $43,500. Balances in the company's current asset and

current liability accounts at the beginning and end of the year were as follows:

December 31

End of YearBeginning of Year

Current assets:

Cash and cash equivalents $ 63,000 $

$ 152,000 $

$ 436,000 $

$ 11,500 $

83,000

198,000

361,000

15,000

Accounts receivable

Inventory

Prepaid expenses

Current liabilities:

Accounts payable

$ 368,000 $

390,000

12,000

30,000

Accrued liabilities

$

8,500 $

Income taxes payable

$ 33,000 $

The Accumulated Depreciation account had total credits of $58,000 during the year. Hanna Company did not record any

gains or losses during the year.

Required:

Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in

cash and cash outflows as negative amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College