The Clarke Chemical Company produces a special kind of body oil that is widely used by professional sports trainers. The oil is produced in three processes: Refining, Blending, and Mixing. Raw oil materials are introduced at the beginning of the refining process. A "mountain-air scent" material is added in the blending process when processing is 50% completed. The following Work-in-Process account for the Refining Department is available for the month of July. The July 1 Work-in-Process Inventory contains $1,500 in material costs. The following Work-in-Process account for the Blending Department is available for the month of July. The July 1 Work-in-Process inventory contains $5,920 in material costs, and $1.56/unit in costs transferred in from the Refining Department. The Clarke Chemical Company uses first-in, first-out (FIFO) costing for the Refining Department and weighted-average costing for the Blending Department. Required (use 4 decimal places for computations): Part 1: Refining Department (a) Compute the equivalent units of production for July. (b) Compute the material cost per unit and the conversion cost per unit for July. (c) Compute the costs transferred to the Blending Department for July

The Clarke Chemical Company produces a special kind of body oil that is widely used by professional sports trainers. The oil is produced in three processes: Refining, Blending, and Mixing. Raw oil materials are introduced at the beginning of the refining process. A "mountain-air scent" material is added in the blending process when processing is 50% completed.

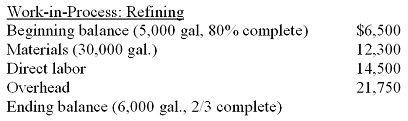

The following Work-in-Process account for the Refining Department is available for the month of July. The July 1 Work-in-Process Inventory contains $1,500 in material costs.

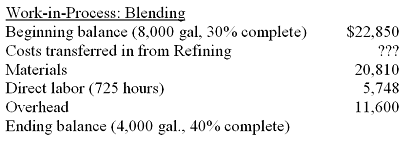

The following Work-in-Process account for the Blending Department is available for the month of July. The July 1 Work-in-Process inventory contains $5,920 in material costs, and $1.56/unit in costs transferred in from the Refining Department.

The Clarke Chemical Company uses first-in, first-out (FIFO) costing for the Refining Department and weighted-average costing for the Blending Department.

Required (use 4 decimal places for computations):

Part 1: Refining Department

(a) Compute the equivalent units of production for July.

(b) Compute the material cost per unit and the conversion cost per unit for July.

(c) Compute the costs transferred to the Blending Department for July.

(d) Compute the July 31 Work-in-Process Inventory balance.

Part 2: Blending Department

(e) Compute the equivalent units of production.

(f) Compute the unit costs in the Blending Department for the month of July. (HINT: There are three!!)

(g) Compute the costs transferred out for July.

(h) Compute the July 31 Work-in-Process Inventory balance.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps